Introduction Credit/Debit Cards

|

|

Visa Inc. is a public limited company and one of the two major companies for payment cards (credit cards, debit cards and credit cards) and employs around 20,500 people. Visa grants licenses to banks worldwide for issuing their cards (issuing licenses) and for billing contract companies (so-called acquiring licenses). In Europe, the London-Westminster-based subsidiary Visa Europe Services Inc. is responsible. Its sphere of influence also includes the non-European countries of Turkey and Israel. The tasks and rights of Visa are carried out in the individual countries by so-called Domestic Members. With a turnover of 25 billion US dollars (USD), EBITDA of 17.7 billion USD and 20,500 employees, Visa Inc. is ranked 122nd among the world's largest companies (as of mid-2021) according to the Forbes Global 2000. The company had a market capitalization of 501 billion USD at the end of 2020, making it the most expensive company from the financial sector worldwide. |

|

|

Mastercard Inc. is the second-largest payment-processing corporation worldwide. It offers a range of payment transaction processing and other related-payment services. Its headquarters are in Purchase, New York. Throughout the world, its principal business is to process payments between the banks of merchants and the card-issuing banks or credit unions of the purchasers who use the Mastercard-brand debit, credit and prepaid cards to make purchases. Mastercard has been publicly traded since 2006. |

|

|

American Express Company (Amex) is an American bank holding company and multinational financial services corporation that specializes in payment cards. It is headquartered at 200 Vesey Street, also known as American Express Tower, New York. Amex is the fourth largest card network globally based on purchase volume. |

|

|

JCB Co., Ltd., formerly Japan Credit Bureau, is a credit card company based in Tokyo, Japan. Its cards are accepted at JCB merchants, and has strategic alliances with Discover Network merchants in the United States, UnionPay merchants in China, American Express merchants in Canada, and RuPay merchants in India. With a turnover of 25 billion US dollars (USD), EBITDA of 17.7 billion USD and 20,500 employees, Visa Inc. is ranked 122nd among the world's largest companies (as of mid-2021) according to the Forbes Global 2000. The company had a market capitalization of 501 billion USD at the end of 2020, making it the most expensive company from the financial sector worldwide. |

|

|

Diners Club International (DCI), founded as Diners Club, is a charge card company owned by Discover Financial Services. Formed in 1950, it was the first independent payment card company in the world, successfully establishing the financial service of issuing travel and entertainment (T&E) credit cards as a viable business. Diners Club International and its franchises serve individuals from around the world with operations in 59 countries. |

|

|

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit. A subsequent innovation was "Cashback Bonus" on purchases. Discover is the third largest credit card brand in the U.S. based on the number of cards in circulation, behind Visa and Mastercard, with 57 million cardholders. |

|

|

UnionPay, also known as China UnionPay or by its abbreviation, CUP or UPI internationally, is a Chinese state-owned financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card scheme in mainland China. UnionPay offers mobile and online payments services. Founded on 26 March 2002, China UnionPay is an association for China's banking card industry, operating under the approval of the People's Bank of China. It is also an electronic funds transfer at point of sale (EFTPOS) network, and the only interbank network in China that links all the automatic teller machine (ATMs) of all banks throughout the country. UnionPay cards can be used in 181 countries and regions around the world. |

Overview

Recurring transactions credit card

|

You can find the Recuring all information about recurring transactions via credit card. We have listed there all information neccessary in order to successfully set up recurring credit card payments. |

Test Data

Integration

POST Request - creditcardcheck

The CreditCardCheck checks credit cards for plausibility in real-time.

Additionally, this request offers the possibility to store credit card data. In this case, the response submits what is known as a pseudo card number.

Account Parameters

|

request

required

|

Fixed Value: creditcardcheck

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

|

channel

required

|

Fixed Value: clientapi

|

|

channelDetail

required

|

Permitted Value: payoneHosted

|

Common Parameters

|

cardpan

required

|

Format NUMERIC(13..19)

Primary account number of credit card |

|

cardtype

optional

|

Format LIST

The Parameter “cardtype” can be dropped and then the PAYONE Platform will return the cardtype in the response depending on the given cardpan. This cardtype has then be passed for future requests (like “preauthorization” / “authorization”) BIN range for automatic card type detection |

|

cardexpiredate

required

|

Format NUMERIC(4), YYMM

Credit card expiry date YYMM |

|

cardcvc2

optional

|

Format NUMERIC(3..4)

Credit card security number For SAQ A compliance: PAYONE Frontend hosted iFrame must be used. This parameter must not be used. |

Response Parameters

|

status

|

Permitted Values

VALID

INVALID

ERROR

|

Response parameters (Valid)

|

pseudocardpan

optional

|

Format NUMERIC(16..19)

Pseudo primary account number for a credit card. This token is unique per merchant and cardpan/expiredate and can be used in any payment-request with credit cards to refer to an existing credit card in the PAYONE platform. |

|

truncatedcardpan

optional

|

Format CHAR(13..19)

Masked cardpan, i.e. 411111xxxxxx1111 (is returned if storecarddata=yes) |

|

cardtype

optional

|

Format LIST

Card type of credit card |

|

cardexpiredate

optional

|

Format NUMERIC(4), YYMM

Credit card expiry date YYMM |

Response parameters (INvalid) - card number invalid

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Response parameters (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

aid=52078

api_version=3.8

callback_method=PayoneGlobals.callback

cardexpiredate=2504

cardexpiremonth=4

cardexpireyear=2025

cardpan=411111xxxxxx1111

cardtype=V

channel=clientapi

channelDetail=payoneHosted

encoding=UTF-8

hash=f5aa284c7cef8dfb3e289290bc47d236

key=17031f73e2c6f9755788bddfff04169b

mid=14648

mode=test

portalid=2037267

request=creditcardcheck

responsetype=JSON

storecarddata=yes

RESPONSE

status=VALID

cardtype=V

pseudocardpan=9410010000038248746

truncatedcardpan=411111XXXXXX1111

cardexpiredate=2504

POST Request - Pre-/ Authorization

Account Parameters

|

request

required

|

Fixed Value: creditcardcheck

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

|

channel

required

|

Fixed Value: clientapi

|

|

channelDetail

required

|

Permitted Value: payoneHosted

|

PERSONAL DATA Parameters

|

customerid

optional

|

Format CHAR(1..20)

Permitted Symbols [0-9, a-z, A-Z, .,-,_,/]

Merchant's customer ID, defined by you / merchant to refer to the customer record. "customerid" can be used to identify a customer record. If "customerid" is used then stored customer data are loaded automatically.

|

|

userid

optional

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

|

salutation

optional

|

Format CHAR(1..10)

The customer's salutation |

|

title

optional

|

Format CHAR(1..20)

Samples

Dr. Prof. Dr.-Ing. Title of the customer |

|

firstname

optional

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

company

optional

|

Format CHAR(2..50)

Comany name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

street

optional

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

|

addressaddition

optional

|

Format CHAR(1..50)

Samples

7th floor c/o Maier Specifies an additional address line for the invoice address of the customer. |

|

zip

optional

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

|

city

optional

|

Format CHAR(2..50)

City of customer |

|

country

required

|

Format LIST

|

|

email

optional

|

Format CHAR(5..254)

Mandatory if "add_paydata[shopping_cart_type]=DIGITAL" Permitted Symbols RFC 5322 Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

|

telephonenumber

optional

|

Format CHAR(1..30)

Phone number of customer |

|

birthday

optional

|

Format DATE(8), YYYYMMDD

Samples

20190101 19991231 Date of birth of customer |

|

language

optional

|

Format LIST

Permitted values ISO 639-1 (Language)2-letter-codes

Language indicator (ISO 639) to specify the language that should be presented to the customer (e.g. for error messages, frontend display). If the language is not transferred, the browser language will be used. For a non-supported language English will be used. |

|

vatid

optional

|

Format CHAR(1..50)

VAT identification number. Used for b2b transactions to indicate VAT number of customer. |

|

gender

optional

|

Format LIST

Permitted values f / m / d

Gender of customer (female / male / diverse* ) * currently not in use |

|

personalid

optional

|

Format CHAR(1..32)

Permitted Symbols [0-9][A-Z][a-z][+-./()]

Person specific numbers or characters, e.g. number of passport / ID card |

|

ip

optional

|

Format CHAR(1..39)

Customer's IP-V4-address (123.123.123.123) or IP-V6-address |

Delivery data Parameters

|

shipping_firstname

required

|

Format CHAR(1..50)

First name of delivery address |

||||||

|

shipping_lastname

required

|

Format CHAR(1..50)

Surname of delivery address |

||||||

|

shipping_company

optional

|

Format CHAR(2..50)

Company name of delivery address |

||||||

|

shipping_street

optional

|

Format CHAR(2..50)

Street number and name of delivery address |

||||||

|

shipping_zip

required

|

Format CHAR(2..50)

Postcode of delivery address |

||||||

|

shipping_addressaddition

optional

|

Format CHAR(1..50)

Specifies an additional address line for the delivery address of the customer, e.g. "7th floor", "c/o Maier". |

||||||

|

shipping_country

optional

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state" |

||||||

|

shipping_state

optional

|

Format LIST

Permitted values ISO 3166-2 States (regions) 2-letter-codes

|

URL PARAMETERS

|

successurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path>

<scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "payment successful" |

|

errorurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path>

<scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "faulty payment" |

|

backurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path>

<scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "Back" or "Cancel" |

Article Parameters

|

it[n]

optional

|

Format LIST

|

||||||||||

|

id[n]

optional

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

|

pr[n]

optional

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent |

||||||||||

|

no[n]

optional

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400]

Quantity of this item |

||||||||||

|

de[n]

optional

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400]

Description of this item. Will be printed on documents to customer. |

||||||||||

|

va[n]

optional

|

Format NUMERIC(4)

Array elements [n] starting with [1]; serially numbered; max [400]

VAT rate (% or bp) |

Response Parameters

|

status

required

|

Permitted Values

APPROVED

REDIRECT

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

ReSponse Parameter (redirect)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

|

redirecturl

|

Redirect URL |

ReSponse Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

PAYLOAD

aid=52078

amount=46385

cardholder=frank tester

city=Neuss

clearingtype=cc

country=DE

currency=EUR

customer_is_present=yes

de[1]=Hauptartikel

de[2]=Standard Versand

email=test@payone.com

encoding=UTF-8

errorurl=https://yourdomain.dev/failure/appendSession/

firstname=Testperson-de

gender=m

id[1]=SW10001

id[2]=ship9

initial_payment=false

ip=172.19.0.34

it[1]=goods

it[2]=shipment

key=17031f73e2c6f9755788bddfff04169b

language=de

lastname=Approved

mid=14648

mode=test

no[1]=1

no[2]=1

param=session-1|1vlvoe60n8s794k8tcg201ffku|7c4f2ebba5d6c2c79a5c70b0da5bb560

portalid=2037267

pr[1]=45995

pr[2]=390

pseudocardpan=9410010000038248746

recurrence=oneclick

reference=1233900437

request=preauthorization

salutation=Herr

shipping_city=Neuss

shipping_country=DE

shipping_firstname=Testperson-de

shipping_lastname=Approved

shipping_street=Hellersbergstraße 99, 14

shipping_zip=41460

street=Hellersbergstraße 99, 14

successurl=https://yourdomain.dev/success/vxn9KEdltaIEUyLPyucOTga2IIDPLJZt/appendSession/

telephonenumber=+491522113356

va[1]=1900

va[2]=1900

zip=41460

RESPONSE

status=APPROVED

txid=911639945

userid=598465200

POST Request - Capture

common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

capturemode

required

|

Format LIST

Specifies whether this capture is the last one or whether there will be another one in future. |

||||||

|

sequencenumber

optional

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

|

settleaccount

optional

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

||||||

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

Article Parameters

|

it[n]

optional

|

Format LIST

|

||||||||||

|

id[n]

optional

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

|

pr[n]

optional

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent |

||||||||||

|

no[n]

optional

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400]

Quantity of this item |

||||||||||

|

de[n]

optional

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400]

Description of this item. Will be printed on documents to customer. |

||||||||||

|

va[n]

optional

|

Format NUMERIC(4)

Array elements [n] starting with [1]; serially numbered; max [400]

VAT rate (% or bp) |

Response Parameters

|

status

|

Permitted Values

APPROVED

PENDING

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response parameters (pending)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

Response parameters (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

amount=2389

capturemode=completed

currency=EUR

de[1]=Hauptartikel mit Eigenschaften S

de[2]=Standard Versand

encoding=UTF-8

id[1]=SW10007

id[2]=Standard Versand

it[1]=goods

it[2]=shipment

key=17031f73e2c6f9755788bddfff04169b

mid=14648

mode=test

no[1]=1

no[2]=1

portalid=2037267

pr[1]=1999

pr[2]=390

request=capture

sequencenumber=1

settleaccount=auto

txid=912162519

va[1]=1900

va[2]=1900

RESPONSE

status=APPROVED

txid=912162519

settleaccount=yes

POST Request - Debit

common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

sequencenumber

required

|

Format NUMERIC(1..3)

Permitted values 0..127 Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

|

currency

required

|

Format LIST

|

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

|

transaction_param

optional

|

Format CHAR(1..50)

Permitted Symbols [0-9][A-Z][a-z][.-_/]

Optional parameter for merchant information (per payment request) |

Article Parameters

|

it[n]

optional

|

Format LIST

|

||||||||||

|

id[n]

optional

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

|

pr[n]

optional

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent |

||||||||||

|

no[n]

optional

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400]

Quantity of this item |

||||||||||

|

de[n]

optional

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400]

Description of this item. Will be printed on documents to customer. |

||||||||||

|

va[n]

optional

|

Format NUMERIC(4)

Array elements [n] starting with [1]; serially numbered; max [400]

VAT rate (% or bp) |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response Parameter (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

https://api.pay1.de/post-gateway/

add_paydata[cancellation_reason]=false

amount=-2389

currency=EUR

de[1]=Hauptartikel mit Eigenschaften S

de[2]=Standard Versand

encoding=UTF-8

id[1]=SW10007

id[2]=Standard Versand

it[1]=goods

it[2]=shipment

key=17031f73e2c6f9755788bddfff04169b

mid=14648

mode=test

no[1]=1

no[2]=1

portalid=2037267

pr[1]=-1999

pr[2]=-390

request=debit

sequencenumber=2

txid=912162519

va[1]=1900

va[2]=1900

RESPONSE

status=APPROVED

txid=912162519

settleaccount=yes

Server API Error Messages

| ACCOUNTINFO Server API ErrorMessages | |

| CREDENTIALSONFILE ServerAPIErrorMessages | |

| CUSTOMERINFO ServerAPIErrorMessages | |

| MERCHANTRISKINDICATOR ServerAPIErrorMessages | |

| PRIORAUTHENTICATIONINFO ServerAPIErrorMessages | |

|

No. |

Signification |

| 2620 | Parameter {card_start_date} incorrect |

sequence diagrams

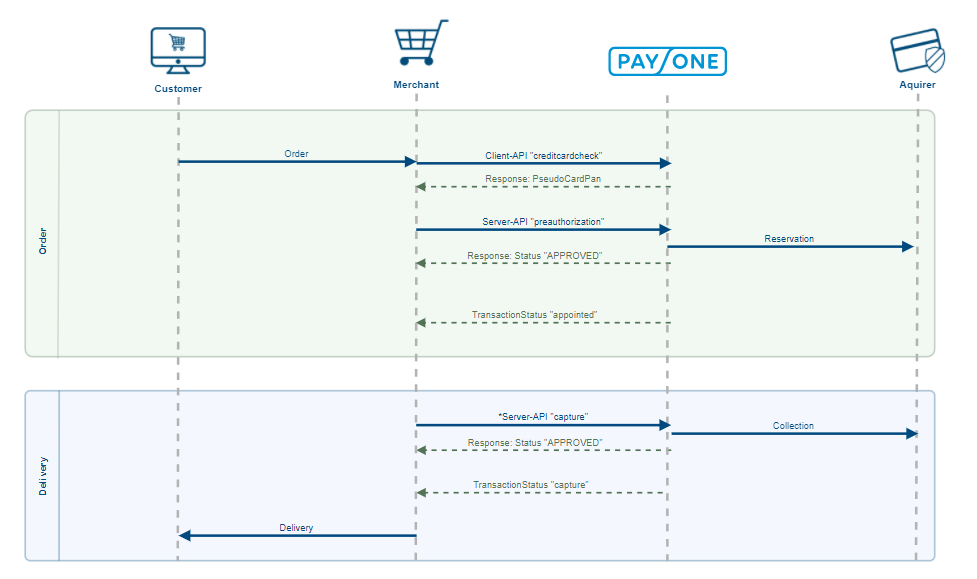

Credit Card flow - Preauthorization

Credit Card flow - authorization

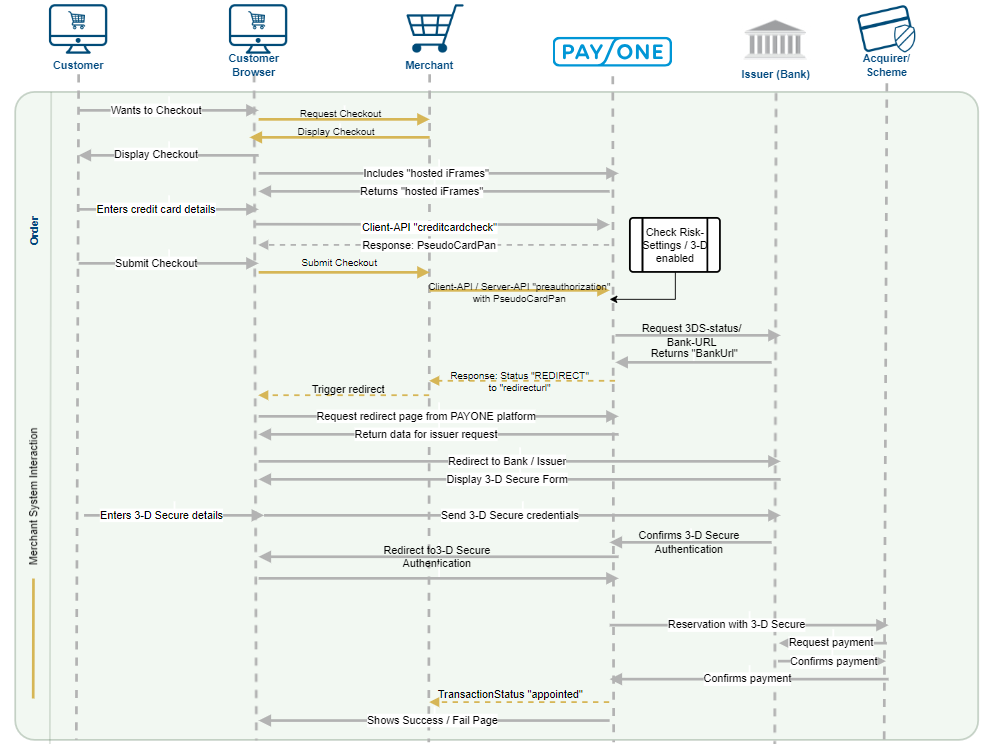

3-D Secure - overview

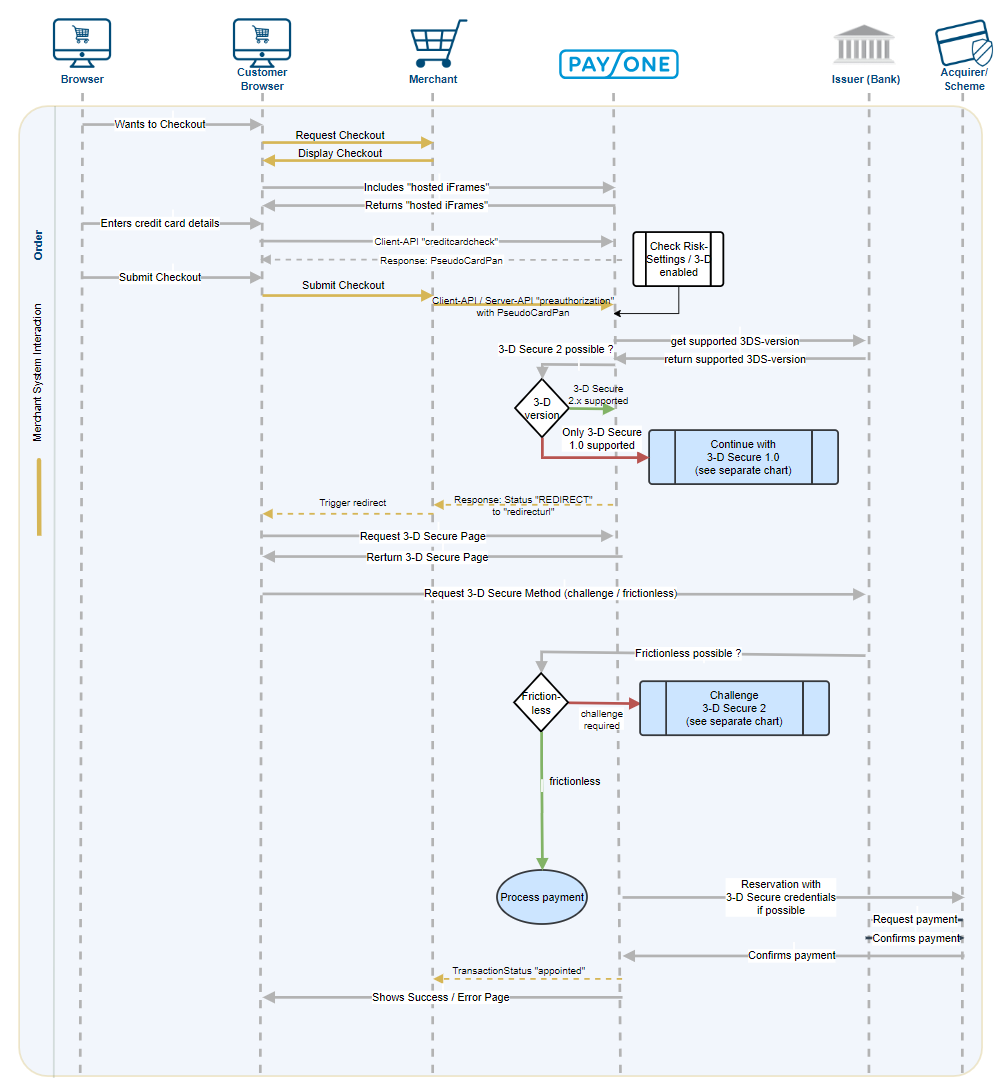

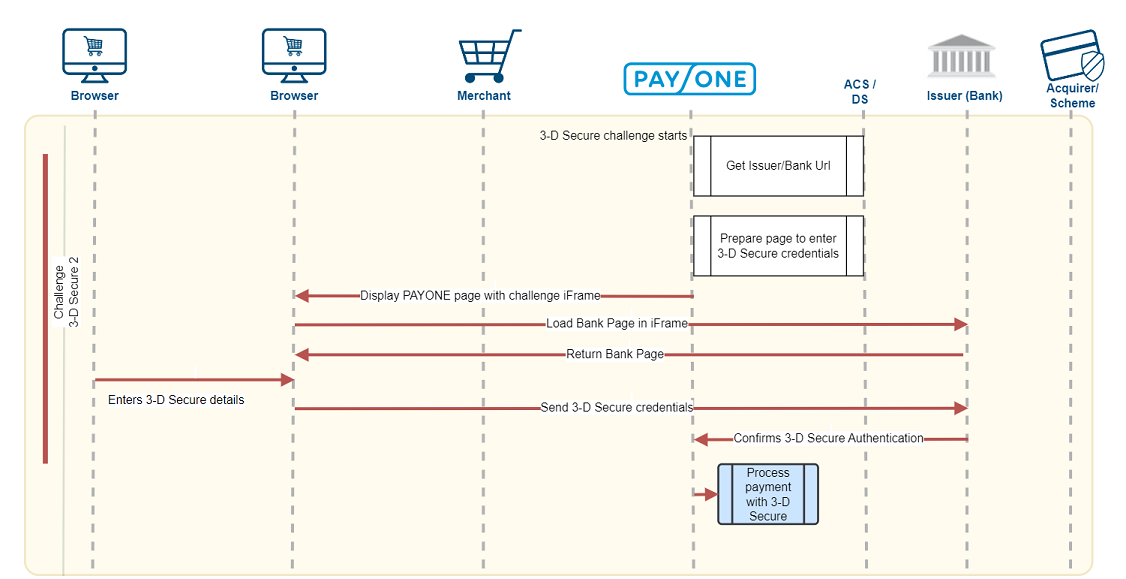

3-D Secure 2 - challenge

There are some handy examples in the examples folder. You're welcome to add more, if you feel like it!

If you want to try out our API with your own account credentials, please install our checkout demo app.

cardtype definition

Card type of credit card

|

Value |

Comment |

BIN-Range for automatic card type detection |

|---|---|---|

| Visa | ||

| MasterCard | ||

| American Express | ||

| Diners / Discover | ||

| JCB | ||

| Maestro International | ||

| China Union Pay | ||

| UATP / Airplus | ||

| girocard |

*girocard is currently only viable for e-commerce-payments via Apple Pay.

checktype TC - Definition

In addition to the "regular" creditcardcheck, the creditcardcheck with checktype=TC returns specific values for travel cards in the response.

Request

Parameters

| creditcardcheck required

|

Fixed Value: List

Permitted Values: TD

Extended check for travel cards with specific response data |

Response

Response Parameters

|

tcprovider

|

Fixed Value: List

Permitted Values: Airplus, Degussa, Amex

Currently supported Travel Cards |

|

tcdata

|

Fixed Value: List

Permitted Values: yes, no

|

|

tcinvoice

|

Fixed Value: List

Permitted Values: yes, no

|

Example

// request edited for clarity

cardpan=122000000000003

checktype=TC

request=creditcardcheck

storecarddata=yes

status=VALID

pseudocardpan=9122010000592458518

tcprovider=Airplus

tcinvoice=yes

cardtype=U

truncatedcardpan=122000XXXXX0003

tcdata=yesTest Cards

For mode=test, there is a range of test cards that can be used for creditcardchecks with checktype=TC

| PAN | Cardtype | tcprovider | tcdata | tcinvoice |

|---|---|---|---|---|

| 122000000000003 | U | Airplus | yes | yes |

| 192000100000007 | U | Airplus | yes | yes |

| 122018800000007 | U | Airplus | yes | no |

| 4864861000000002 | V | Airplus | yes | yes |

| 4277411000000007 | V | Degussa | yes | no |

| 4987441000000005 | V | Degussa | yes | yes |

| 5197841000000009 | M | Degussa | yes | yes |

| 5281591000000007 | M | Degussa | yes | yes |

| 370000100000001 | A | Amex | yes | yes |

Note Test Cards

- Only the above-mentioned cards can be used to return additional parameters for travel cards

- For cardexpiredate any date in the future can be used

- cardcvc2v can be any three or four digit sequence

- All other cards will return

tcdata=noand no additional parameters used for travel cards

Travel Card Check in Live Mode

Only if mode=live, the creditcardcheck with checktype=tc will actually look for the corresponding BIN-Range in the database and return additional parameters in case of a travel card.