Introduction

|

|

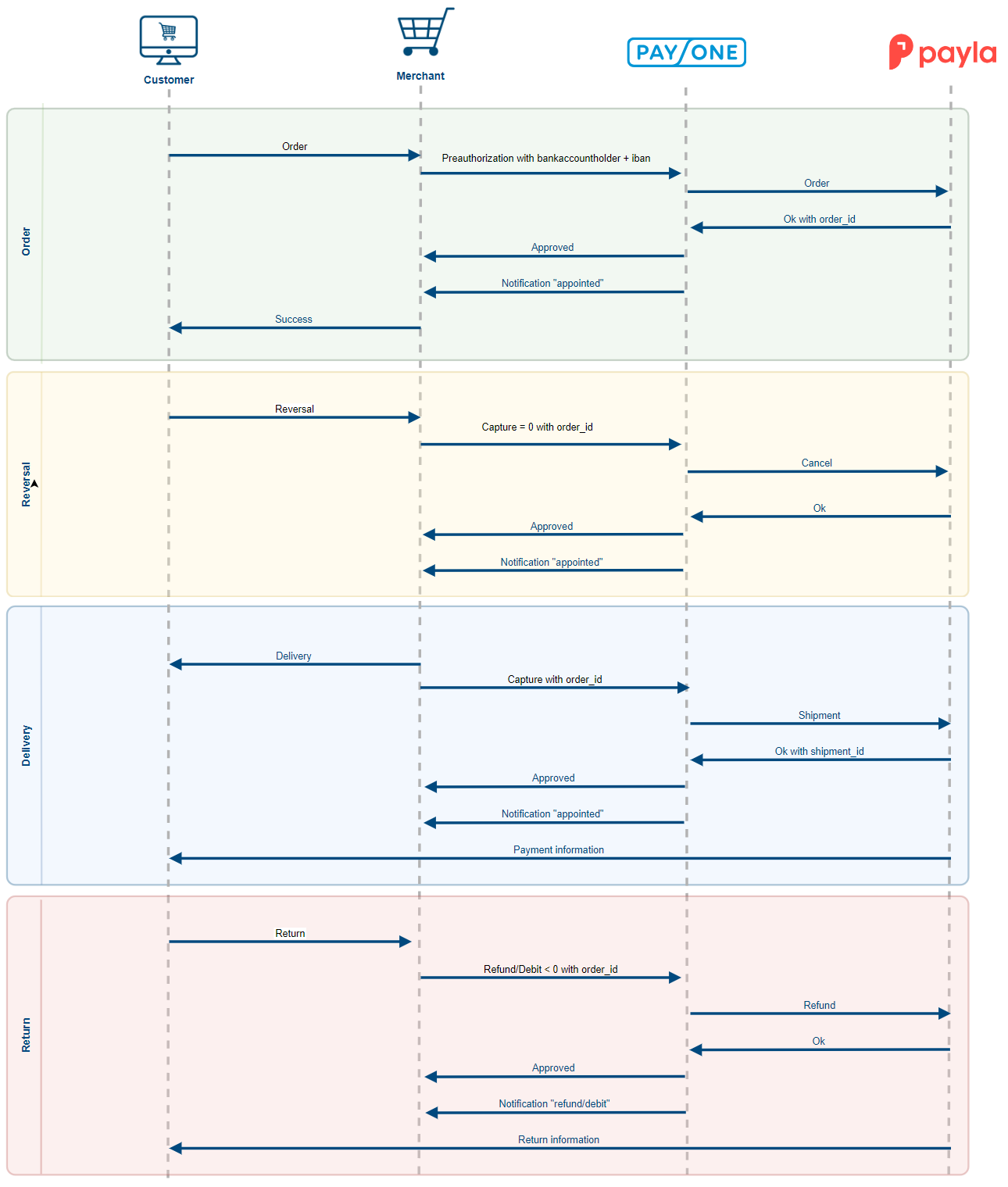

PAYONE Secured Direct Debit offers merchants in German-speaking countries the opportunity to integrate the "Buy Now, Pay Later" (BNPL) payment method direct debit as payment method in their online store. In doing so, our Partner Payla assumes the full fraud and default risk and supports merchants throughout the entire value chain from integration assistance to collection handover. |

General notes

In addition to the correct integration of the API request, the following points should be noted:

| Countries | Currency | Special | Limitations |

|---|---|---|---|

|

|

|

|

1. Device fingerprinting token

In order to detect and prevent fraud at an early stage for the secured payment methods, a device fingerprinting snippet has to be integrated during the checkout process. This snippet will generate a token in the format <partner_id>_<merchant_id>_<session_id>, which has to be sent via consumer parameter add_paydata[device_token] in the preauthorization/authorization request.

|

Snipped parameter explained:

| Parameter | Description | Comment |

|---|---|---|

|

environment |

Defines which environment the snippet is called for. During integration, t has to be used to point towards our test environment. Once the integration is finished and for every live processing merchant p has to be used to point towards our production environment. |

Set "t" for Test and "p" for Production |

|

payla_partner_id |

12-digit alphanumeric Identifier provided by Payla. It is fixed. The once assigned ID will not change and is identical for test and production environment. |

Fixed f.e. "e7yeryF2of8X" |

|

partner_merchant_id |

Identifier chosen and provided by PAYONE. It identifies the merchant and allows Payla to distinguish which merchant/shop the fingerprinting is done for. The ID is requested as part of Payla's onboarding. For testing without having a Merchant-ID, you can use "test-1" |

Set to your PAYONE Merchant-ID |

|

snippet_token |

For Payla, the most important requirement is the snippet - token being unique per API call. If a consumer calls the snippet multiple times during the checkout process but is in the same session, this token can be used. Once an actual order or risk check has been performed with the snippet_token, Payla expect a new snippet_token for a new API call. The main reason for this is customers switching devices between orders. |

e.g. xyz123abc456_test-1_randomOrSessionadh9029381923 |

2. Mandatory checkout implementation

In order to offer end customers maximum transparency regarding the function of the payment methods and the use of personal data during the ordering process, it is necessary to use the following note. The links listed must be included in the text of the note accordingly.

Checkout note:

| Language | Text |

|---|---|

| German | Mit Abschluss dieser Bestellung erkläre ich mich mit den ergänzenden Zahlungsbedingungen (Link) und der Durchführung einer Risikoprüfung für die ausgewählte Zahlungsart einverstanden. Den ergänzenden Datenschutzhinweis (Link) habe ich zur Kenntnis genommen. |

| English | By placing this order, I agree to the supplementary payment terms (link) and the performance of a risk assessment for the selected payment method. I am aware of the supplementary data protection notice (link). |

Links:

| Document | Language | Description | URL |

|---|---|---|---|

| Terms of payment | German | Framework for the use of the mentioned payment methods | https://legal.paylater.payone.com/de/terms-of-payment.html |

| Data protection notice | German | Describes, among other things, the use of the personal data | https://legal.paylater.payone.com/de/data-protection-payments.html |

| Terms of payment | English | Framework for the use of the mentioned payment methods | https://legal.paylater.payone.com/en/terms-of-payment.html |

| Data protection notice | English | Describes, among other things, the use of the personal data | https://legal.paylater.payone.com/en/data-protection-payments.html |

Integrations

POST Request - Pre-/ Authorization

During the preauthorization a risk check for the customer is performed. Depending on the result the customer qualifies or disqualifies from using this payment method. When the risk of payment default is deemed too high the transaction can’t be insured and the customer is denied, yielding an error message and the status “ERROR”.

Generally, the more customer data you send, the better the risk check can decide to give an insurance or not. Nonetheless, there following table contains flags, if a parameter is optional or not.

If the preauthorization is successful the response will contain the status “APPROVED”.

Using the Preauthorization request does NOT finalize the claim. In order to start the dunning process the transactions need to be captured first.

Please bear in mind, that a preauthorization is valid for 28 days. You need to make sure, that you capture this preauthorization in this period. Otherwise, if you know that you won’t capture the amount, please send a cancel (capture with amount=0), to free the reserved guarantee.

Account Parameters

|

request

required

|

Fixed Value: preauthorization / authorization

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

clearingtype

required

|

Fixed Value: fnc

FNC: Financing |

|

financingtype

required

|

Fixed Value: PDD

PAYONE Secured Direct Debit |

|

mode

required

|

Fixed Value: test/live

Can be either test environment (test) or live environment (live) |

|

reference

optional

|

Format CHAR(2..255)

A unique ID that will be displayed in your shop backend and for the customer |

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro. The amount must be less than or equal to the amount of the corresponding booking. |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

|

param

optional

|

Format CHAR(1..255)

Individual parameter (per payment process) |

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

|

customer_is_present

optional

|

Format LIST

Permitted Values yes / no

Indicates whether customer is “present” and can enter their data in the shop (=yes). Or customer is not present and can not enter any data (=no). |

PERSONAL DATA Parameters

|

customerid

optional

|

Format CHAR(1..20)

Permitted Symbols [0-9, a-z, A-Z, .,-,_,/]

Merchant's customer ID, defined by you / merchant to refer to the customer record. "customerid" can be used to identify a customer record.

If "customerid" is used then stored customer data are loaded automatically. |

||||||

|

userid

optional

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

||||||

|

businessrelation

optional

|

Format LIST

Value specifies business relation between merchant and customer |

||||||

|

salutation

optional

|

Format CHAR(1..10)

The customer's salutation |

||||||

|

title

optional

|

Format CHAR(1..20)

Samples

Dr Prof. Dr.-Ing. Title of the customer |

||||||

|

firstname

required

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

||||||

|

lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

||||||

|

company

optional

|

Format CHAR(2..50)

Comany name of customer (required if businessrelation is set to b2b)

|

||||||

|

street

required

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

||||||

|

addressaddition

optional

|

Format CHAR(1..50)

Samples

7th floor c/o Maier Specifies an additional address line for the invoice address of the customer. |

||||||

|

zip

required

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

||||||

|

city

required

|

Format CHAR(2..50)

City of customer |

||||||

|

country

required

|

Fixed Value DE, AT

|

||||||

|

email

required

|

Format CHAR(5..254)

Permitted Symbols RFC 5322 Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

||||||

|

telephonenumber

required

|

Format CHAR(1..30)

Phone number of customer |

||||||

|

birthday

required

|

Format DATE(8), YYYYMMDD

Samples

20190101 19991231 Date of birth of customer |

||||||

|

language

optional

|

Format LIST

Permitted values ISO 639-1 (Language)2-letter-codes

Language indicator (ISO 639) to specify the language that should be presented to the customer (e.g. for error messages, frontend display). If the language is not transferred, the browser language will be used. For a non-supported language English will be used. |

||||||

|

vatid

optional

|

Format CHAR(1..50)

VAT identification number. Used for b2b transactions to indicate VAT number of customer. |

||||||

|

gender

optional

|

Format LIST

Permitted values f/ m/ d*

Gender of customer (female / male / diverse* ) *currently not in use |

||||||

|

personalid

optional

|

Format CHAR(1..32)

Permitted Symbols [0-9][A-Z][a-z][+-./()]

Person specific numbers or characters, e.g. number of passport / ID card |

||||||

|

ip

optional

|

Format CHAR(1..39)

Customer's IP-V4-address (123.123.123.123) or IP-V6-address |

||||||

|

bankaccountholder

required

|

Format CHAR(1..39)

Account holder |

||||||

|

iban

required

|

Format CHAR(10..34)

Permitted Symbols [0-9][A-Z]

IBAN to be used for payment or to be checked |

Delivery data Parameters

|

shipping_firstname

optional

|

Format CHAR(1..50)

First name of delivery address |

||||||

|

shipping_lastname

optional

|

Format CHAR(1..50)

Surname of delivery address |

||||||

|

shipping_company

optional

|

Format CHAR(2..50)

Company name of delivery address |

||||||

|

shipping_street

optional

|

Format CHAR(2..50)

Street number and name of delivery address |

||||||

|

shipping_zip

optional

|

Format CHAR(2..50)

Postcode of delivery address |

||||||

|

shipping_addressaddition

optional

|

Format CHAR(1..50)

Specifies an additional address line for the delivery address of the customer, e.g. "7th floor", "c/o Maier". |

||||||

|

shipping_country

optional

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state" |

||||||

| shipping_state optional

|

Format LIST

Permitted values ISO 3166-2 States (regions) 2-letter-codes

|

Article Parameters

|

it[n]

required

|

|

||||||||||

|

id[n]

required

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

Permitted Symbols [0-9][a-z][A-Z], .,-,_,/

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

|

pr[n]

required

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent |

||||||||||

|

no[n]

required

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400] Quantity of this item |

||||||||||

|

de[n]

required

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400] Description of this item. Will be printed on documents to customer. |

||||||||||

|

va[n]

optional

|

Format NUMERIC(4)

Array elements [n] starting with [1]; serially numbered; max [400]

VAT rate (% or bp) |

Paydata Parameters

|

add_paydata[device_token]

required

|

FORMAT: AN(255)

Device fingerprinting token (details in general notes) |

|

add_paydata[customer_registration_date]

optional

|

FORMAT YYYY-MM-DDThh:mm:ssZ

The registration date of the consumer at the merchant`s shop |

Response Parameters

|

status

required

|

Permitted Values

APPROVED

ERROR

|

ReSponse Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

workorderid

|

Format CHAR(1..50)

The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). |

|

userid

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

|

clearing_reference

|

Format AN(..50)

Payment reference of an order. To be used when communicating payment instructions with the consumer (e.g. on the invoice). |

ReSponse Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

request=preauthorization mid=54321 aid=12345 portalid=12345123 key=abcdefghijklmn123456789 clearingtype=fnc financingtype=PDD mode=test reference=jv-1668434776 amount=20000 currency=EUR param=individualParameter narrative_text=messageoralternativetext customer_is_present=yes businessrelation=b2c firstname=Max lastname=Mustermann street=Musterweg 1 city=Musterstadt zip=12345 country=DE telephonenumber=491731234567 email=max@mustermann.de birthday=19820324 bankaccountholder=Max Mustermann iban=DE12345678910111213141 ip=123.123.123.123 add_paydata[device_token]=abcdefghijklmn123456789 it[1]=goods it[2]=shipment id[1]=1001001 id[2]=1001002 de[1]=Testartikel 1 de[2]=Transport no[1]=1 no[2]=1 pr[1]=1000 pr[2]=100 va[1]=19 va[2]=19

successurl=http://www.your-success.url errorurl=http://www.your-error.url backurl=http://www.your-back.url

RESPONSE

status=APPROVED

txid=753359579

workorderid=PP2ADYUBK1MZ27W8

userid=483104612

clearing_reference=1174-61833-4181

POST Request - Capture

Account Parameters

|

request

required

|

Fixed Value: capture

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

mode

required

|

Format fixed: Test/live

Environment in which the transaction is captured |

||||||

|

capturemode

optional

|

Format LIST

Specifies whether this capture is the last one or whether there will be another one in future. |

||||||

|

sequencenumber

optional

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro. The amount must be less than or equal to the amount of the corresponding booking. |

||||||

|

currency

required

|

Fixed Value EUR

|

||||||

|

settleaccount

optional

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

add_paydata Parameters

|

add_paydata[cancellation_reason]

optional

|

Format: LIST

Note: Mandatory for Capture=0 and capturemode=completed if the capture amount is lower than the reservation amount.

|

Response Parameters

|

status

|

Permitted Values

APPROVED

PENDING ERROR |

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

workorderid

|

Format CHAR(1..50)

The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). |

||||||

|

add_paydata[capture_id]

|

Format CHAR(16)

The capture ID can be used for multiple captures and refunds, to connect a specific refund to a specific capture. |

||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

||||||

|

clearing_bankaccountholder

|

Format AN(..35)

Recipient bank account holder |

||||||

|

clearing_bankiban

|

Format AN(..35)

Recipient IBAN |

||||||

|

clearing_bankbic

|

Format AN(..11)

Recipient BIC |

||||||

|

clearing_duedate

|

Format N(..8)

Payment due date |

||||||

|

clearing_reference

|

Format AN(..50)

Payment reference of an order. To be used when communicating payment instructions with the consumer (e.g. on the invoice). |

||||||

|

add_paydata[external_status]

|

Format LIST

External status for the payment process. Status will be "open" for the capture. |

Response parameters (pending)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

Request Body schema: application/json

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

request=capture mid=54321 aid=12345 portalid=12345123 key=abcdefghijklmn123456789 txid=753359579 mode=test capturemode=completed sequencenumber=1 amount=20000 currency=EUR settleaccount=auto it[1]=goods it[2]=shipment id[1]=1001001 id[2]=1001002 de[1]=Testartikel 1 de[2]=Transport no[1]=1 no[2]=1 pr[1]=10000 pr[2]=10000 va[1]=19 va[2]=19

RESPONSE

status=APPROVED

txid=753359579

workorderid=PP2ADYUBK1MZ27W8

add_paydata[capture_id]=TX2AAYUAPB2DKRZA

settleaccount=yes

clearing_bankaccountholder=Company

clearing_bankiban=DE02701500000000594937

clearing_bankbic=SSKMDEMM

clearing_duedate=20250324

clearing_reference=1174-61833-4181-1

add_paydata[external_status]=open

POST Request - Debit

Account Parameters

|

request

required

|

Fixed Value: debit

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

add_paydata Parameters

|

add_paydata[cancellation_reason]

optional

|

Format: LIST

Note: Mandatory for Capture=0 and capturemode=completed if the capture amount is lower than the reservation amount.

|

Common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

mode

required

|

Format fixed: test/live

Environment in which the transaction is refunded |

||||||

|

sequencenumber

required

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. -19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro. The amount must be less than or equal to the amount of the corresponding booking. Amount must be negativ.

|

||||||

|

currency

required

|

Fixed Value EUR

|

||||||

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

||||||

|

clearingtype

optional

|

Fixed Value wlt

|

||||||

|

use_customerdata

optional

|

Format LIST

Use account details from debtor's master data |

||||||

|

transaction_param

optional

|

Format CHAR(1..50)

Permitted Symbols [0-9][A-Z][a-z][.-_/]

Optional parameter for merchant information (per payment request) |

Article Parameters

|

it[n]

required

|

|

||||||||||

|

id[n]

required

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

Permitted Symbols [0-9][a-z][A-Z], .,-,_,/

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

|

pr[n]

required

|

Format NUMERIC(10) max. -19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent. Amount must be negativ.

|

||||||||||

|

no[n]

required

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400] Quantity of this item |

||||||||||

|

de[n]

required

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400]

Description of this item. Will be printed on documents to customer. |

||||||||||

|

va[n]

optional

|

Format NUMERIC(4)

VAT rate (% or bp) Array elements [n] starting with [1]; serially numbered; max [400] |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response Parameter (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

mid=23456

aid=12345

amount=-20000

currency=EUR

key=abcdefghijklmn123456789

mode=test

portalid=12345123

request=refund

sequencenumber=2

txid=753359579

RESPONSE

status=APPROVED

txid=753359579