PayPal V1 Integrations

|

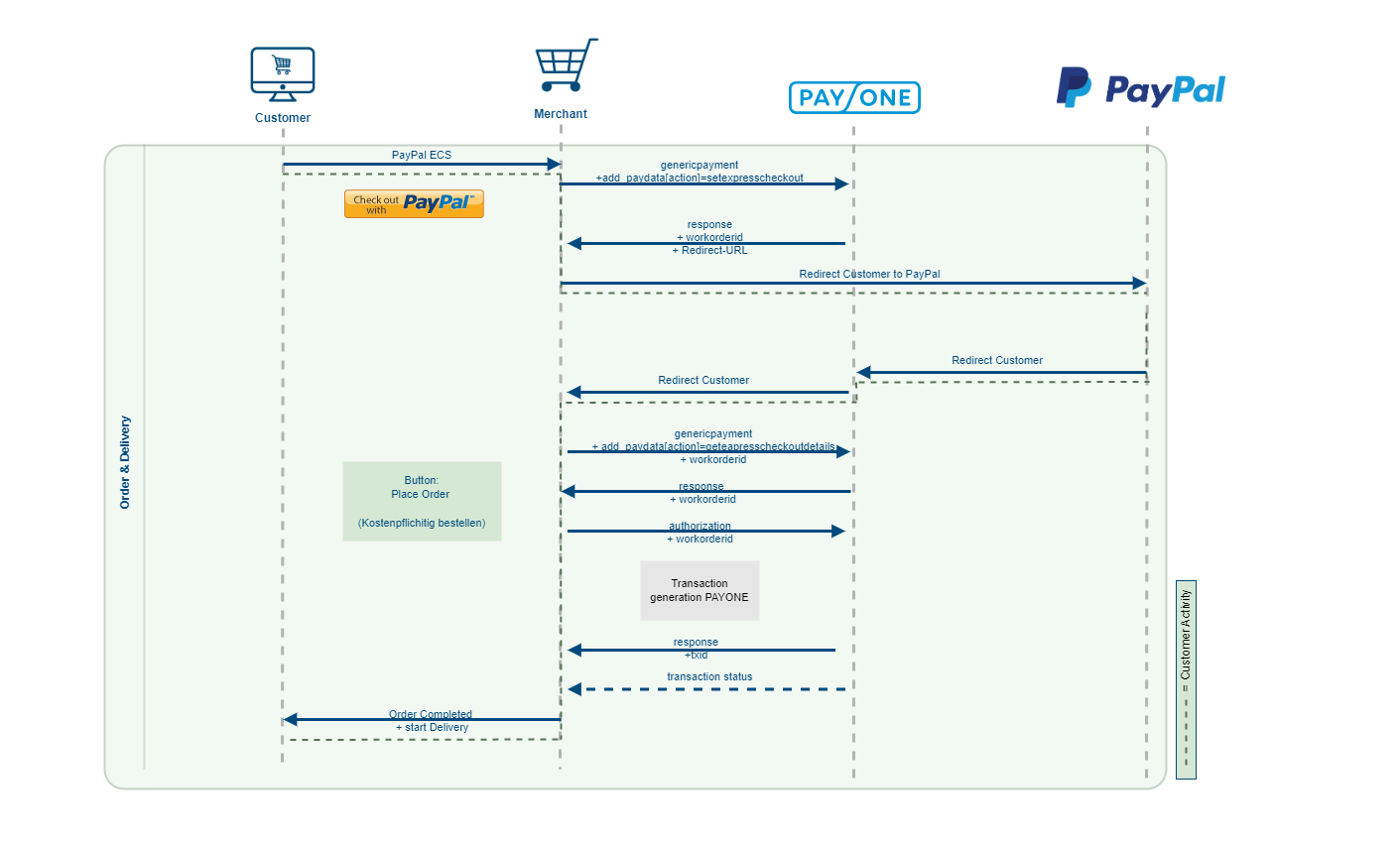

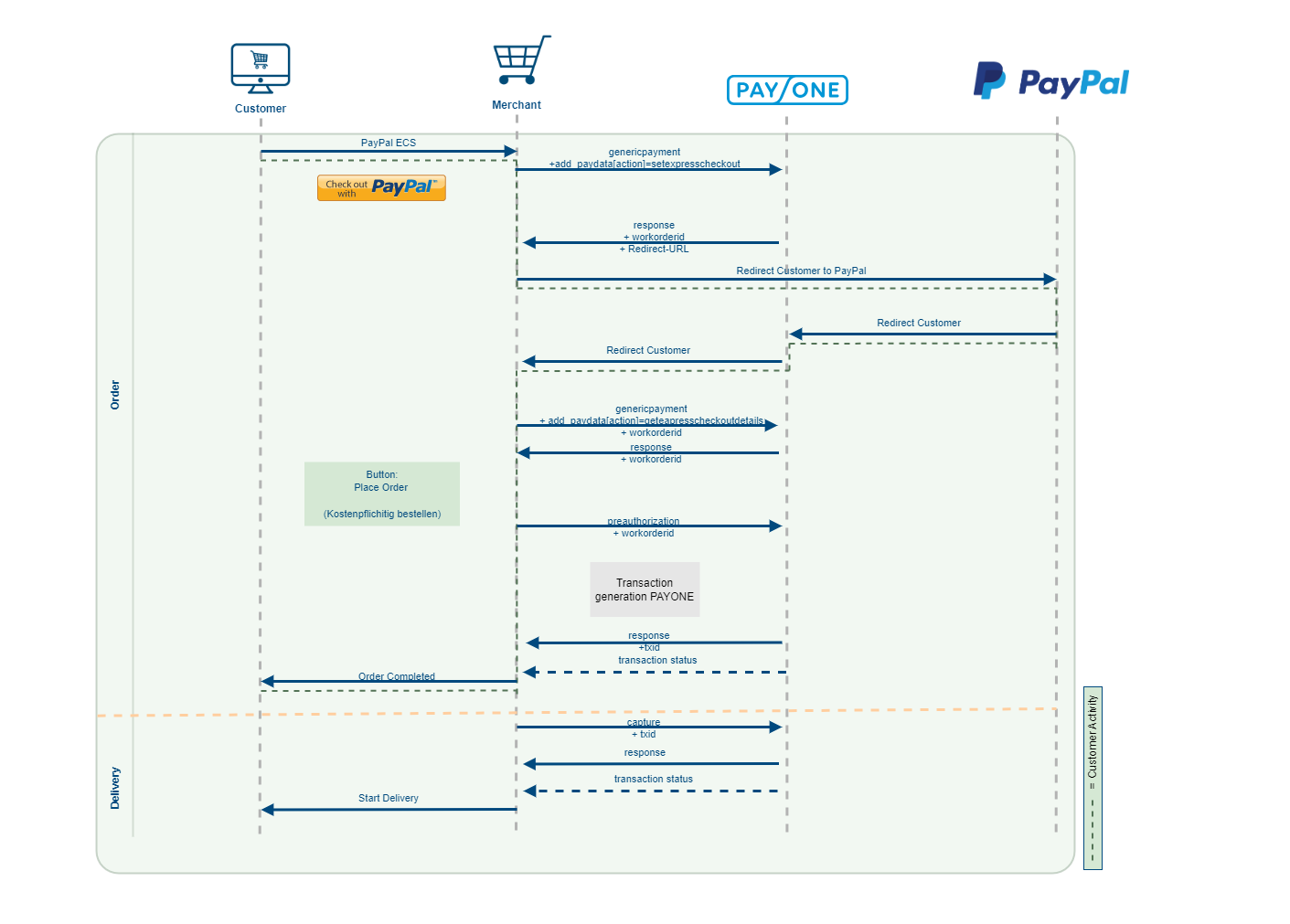

Currently PayPal Express is using the NVP integrations. You can choose between Express Checkout Shortcut (ECS) or Express Checkout Mark (ECM) as integration options. It is mandatory to send the shipping address in the “authorization” or “preauthorization” request. Otherwise you don’t have the PayPal sellers-protection. Use shipping address also as billing address. Your customer should have an option to change billing address while checking out. If you want to use multi partial capture, you need to set settleaccount to yes or auto, to be able to send another capture afterwards. Do not use settleaccount=no. PAYONE platform must be allowed to use your PayPal-account. Please find here how this is configured within PayPal administration: How to Configure Your PayPal Account for Processing over the Payone Platform |

Test Data

|

Test data is created individual in a Sandbox Account which is connected to your PayPal account. Under https://developer.paypal.com you can login to the dashboard and create your own various Sandbox test accounts with different scenarios (buyer, seller, countries, currencies, account types, payment methods etc. ) You can now test payment through your e-commerce application (for example your shop). You will need to mark the "mode" parameter with the value "test" (mode=test). Use the buyer test account that you have just created as the test customer. |

|

If you want to make End-to-End Tests with PayPal, you'll also need a Sandbox Merchant Account. Please contact our Merchant Service so we can store the Sandbox Merchant Account deails in your PAYONE Account. |

POST Request - Pre-/ Authorization

For PayPal as a standard payment method in your checkout:

Account Parameters

| request

required

|

Fixed Value: preauthorisation/authorization

|

| mid

required

|

your merchant ID, 5-digit numeric

|

| aid

required

|

your subaccount ID, 5-digit numeric

|

| portalId

required

|

your Portal ID, 7-digit numeric

|

| key

required

|

your key value, alpha-numeric

|

common Parameters

| clearingtype

required

|

Fixed Value: wtl

|

| mode

required

|

Fixed Value: test/live

Can be either test environment (test) or live environment (live) |

| reference

optional

|

Format CHAR(2..255)

A unique ID that will be displayed in your shop backend and for the customer |

| amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro. The amount must be less than or equal to the amount of the corresponding booking. |

| currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

| param optional

|

Format CHAR(1..255)

Individual parameter (per payment process) |

| narrative_text optional

|

Format CHAR(1..81)

Dynamic text element on account statements. (3 lines with 27 characters each) and credit card statements. |

| customer_is_present optional

|

Format LIST

Permitted Values

yes no Indicates whether customer is “present” and can enter their data in the shop (=yes). Or customer is not present and can not enter any data (=no). |

PERSONAL DATA Parameters

| customerid optional

|

Format CHAR(1..20)

Permitted Symbols [0-9, a-z, A-Z, .,-,_,/] Merchant's customer ID, defined by you / merchant to refer to the customer record. "customerid" can be used to identify a customer record.

If "customerid" is used then stored customer data are loaded automatically. |

| userid optional

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

| salutation optional

|

Format CHAR(1..10)

The customer's salutation |

| title optional

|

Format CHAR(1..20)

Samples

Dr Prof. Dr.-Ing. Title of the customer |

| firstname optional

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

| lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

| company optional

|

Format CHAR(2..50)

Comany name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

| street optional

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

| addressaddition optional

|

Format CHAR(1..50)

Samples

7th floor c/o Maier Specifies an additional address line for the invoice address of the customer. |

| zip optional

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

| city optional

|

Format CHAR(2..50)

City of customer |

| country

required

|

Fixed Value DE

|

| email optional

|

Format CHAR(5..254)

Mandatory if "add_paydata[shopping_cart_type]=DIGITAL" Permitted Symbols RFC 5322 Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

| telephonenumber optional

|

Format CHAR(1..30)

Phone number of customer |

| birthday optional

|

Format DATE(8), YYYYMMDD

Samples

20190101 19991231 Date of birth of customer |

| language optional

|

Format LIST

Permitted values ISO 639-1 (Language)2-letter-codes

Language indicator (ISO 639) to specify the language that should be presented to the customer (e.g. for error messages, frontend display). If the language is not transferred, the browser language will be used. For a non-supported language English will be used. |

| vatid optional

|

Format CHAR(1..50)

VAT identification number. Used for b2b transactions to indicate VAT number of customer. |

| gender optional

|

Format LIST

Permitted values

f m d Gender of customer (female / male / diverse* ) * currently not in use |

| personalid optional

|

Format CHAR(1..32)

Permitted Symbols [0-9][A-Z][a-z][+-./()]

Person specific numbers or characters, e.g. number of passport / ID card |

| ip optional

|

Format CHAR(1..39)

Customer's IP-V4-address (123.123.123.123) or IP-V6-address |

Delivery data Parameters

| shipping_firstname required

|

Format CHAR(1..50)

First name of delivery address |

||||||||

| shipping_lastname required

|

Format CHAR(1..50)

Surname of delivery address |

||||||||

| shipping_company optional

|

Format CHAR(2..50)

Company name of delivery address |

||||||||

| shipping_street optional

|

Format CHAR(2..50)

Street number and name of delivery address |

||||||||

| shipping_zip required

|

Format CHAR(2..50)

Postcode of delivery address |

||||||||

| shipping_addressaddition optional

|

Format CHAR(1..50)

Specifies an additional address line for the delivery address of the customer, e.g. "7th floor", "c/o Maier". |

||||||||

| shipping_country optional

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state" |

||||||||

| shipping_state optional

|

Format LIST

Permitted values ISO 3166-2 States (regions) 2-letter-codes

|

Wallet PARAMETERS

| wallettype required

|

Fixed Value PPE

|

| successurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "payment successful" |

| errorurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "faulty payment" |

| backurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "Back" or "Cancel" |

Article Parameters

| it[n] optional

|

|

||||||||||

| id[n] optional

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

Required for physical goods in order to ensure PayPal seller protection International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

| pr[n] optional

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Required for physical goods in order to ensure PayPal seller protection Unit gross price of the item in smallest unit! e.g. cent |

||||||||||

| no[n] optional

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400]

Required for physical goods in order to ensure PayPal seller protection Quantity of this item |

||||||||||

| de[n] optional

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400] Required for physical goods in order to ensure PayPal seller protection Description of this item. Will be printed on documents to customer. |

||||||||||

| va[n] optional

|

Format NUMERIC(4)

VAT rate (% or bp) Array elements [n] starting with [1]; serially numbered; max [400] |

Response Parameters

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

| txid |

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

Response Parameter (Error)

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

aid=52078

amount=100

api_version=3.10

clearingtype=wlt

country=DE

currency=EUR

encoding=UTF-8

firstname=Test

key=19539eb4b369b29f314b51368076475a

lastname=Test

mid=14648

mode=test

portalid=2037267

reference=TESTPO-5694966661501

request=preauthorization

successurl=https://www.payone.com

wallettype=PPE

RESPONSE

status=REDIRECT

txid=1036710580

userid=696218018

redirecturl=https://www.sandbox.paypal.com/webscr?useraction=commit&cmd=_express-checkout&token=EC-4EH96765J9760104C

add_paydata[token]=EC-4EH96765J9760104C

POST Request - Capture

common Parameters

| txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

| capturemode

required

|

Format LIST

Specifies whether this capture is the last one or whether there will be another one in future. |

||||||

| sequencenumber optional

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

| amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||

| currency

required

|

Fixed Value EUR

|

||||||

| narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements |

Response Parameters

|

Permitted Values

APPROVED

PENDING

ERROR

|

Response Parameter (approved)

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|||||||

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response parameters (pending)

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

Response parameters (error)

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

mid=23456 portalid=12345123 key=abcdefghijklmn123456789 api_version=3.10 mode=test request=capture encoding=UTF-8 txid=345678901 amount=300 currency=EUR

RESPONSE

status=APPROVED txid=345678901 settleaccount=no

POST Request - Debit

Common Parameters

| txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

| sequencenumber

required

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

| amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||

| currency

required

|

Fixed Value EUR

|

||||||

| narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

||||||

| clearingtype

optional

|

Fixed Value wlt

|

||||||

| use_customerdata

optional

|

Format LIST

Use account details from debtor's master data |

||||||

| transaction_param

optional

|

Format CHAR(1..50)

Permitted Symbols [0-9][A-Z][a-z][.-_/] Optional parameter for merchant information (per payment request) |

Response Parameters

| status |

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

| txid |

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

| settleaccount |

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response Parameter (error)

| errorcode |

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

| errormessage |

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

| customermessage |

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

mid=23456 portalid=12345123 key=abcdefghijklmn123456789 api_version=3.10 mode=test request=capture encoding=UTF-8 txid=345678901 sequencenumber=1 amount=1000 currency=EUR

RESPONSE

status=APPROVED txid=345678901 settleaccount=no

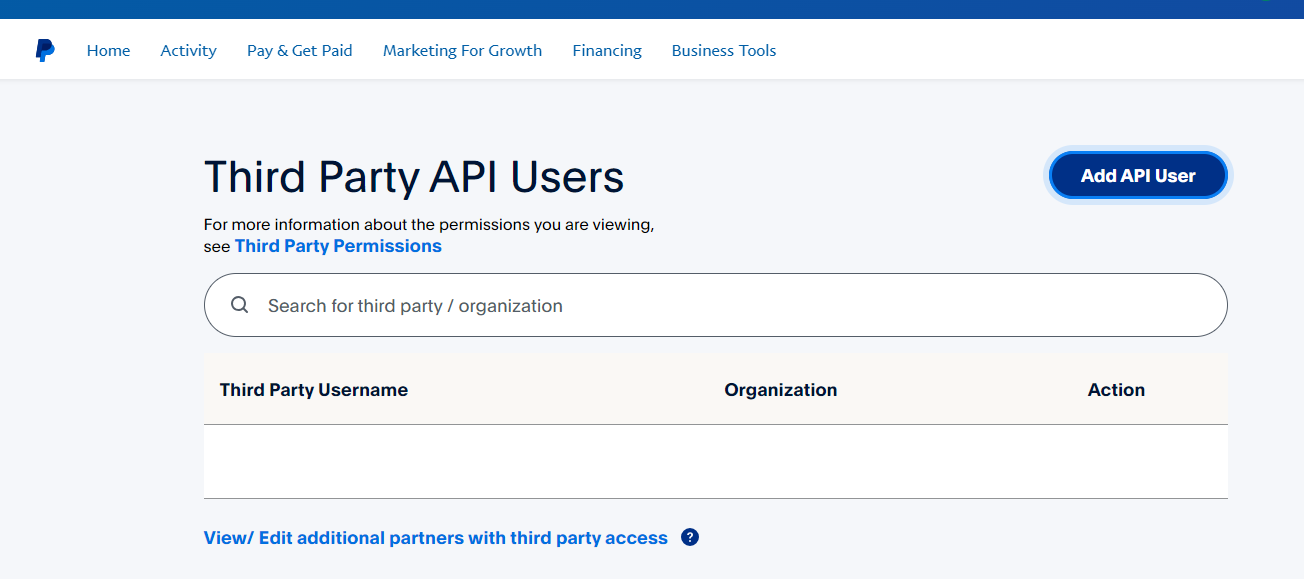

Granting PAYONE access to your PayPal account

|

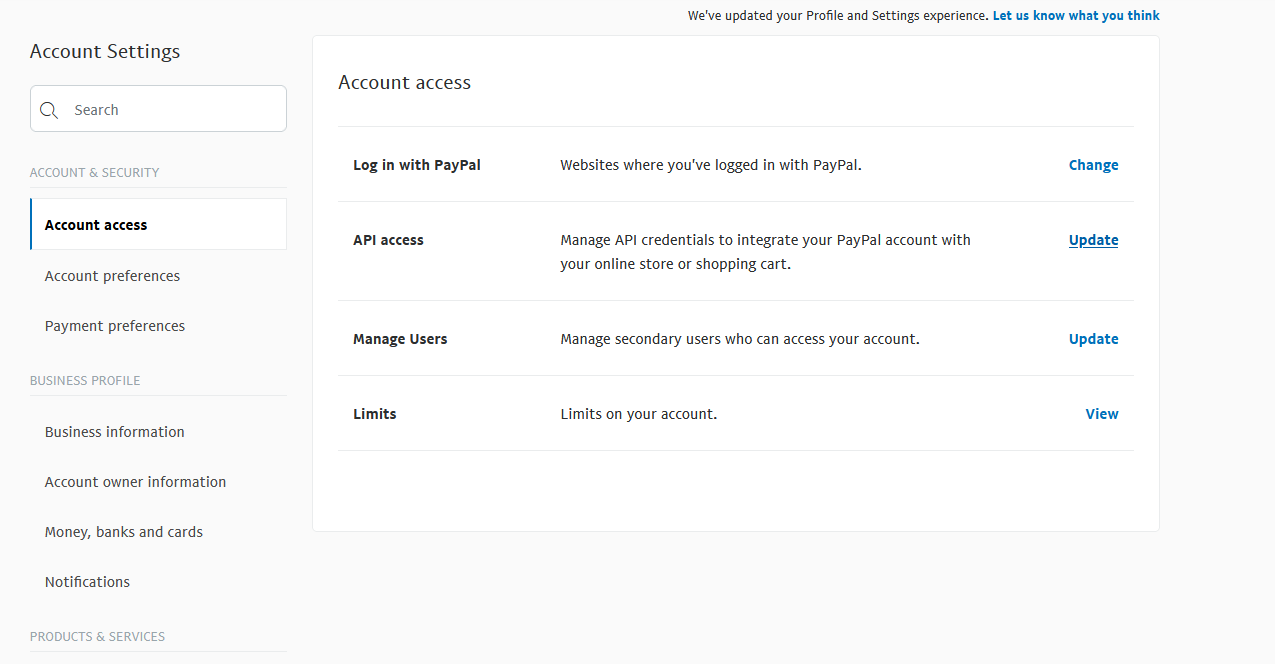

You need to authorise PAYONE to manage your PayPal account before PAYONE can process PayPal payments for you. To do so, please follow the instructions below. |

|

In your PayPal account, click on „Profile" and then on „Account Settings"

|

|

Under "API Access" click on API Access - "Update" |

|

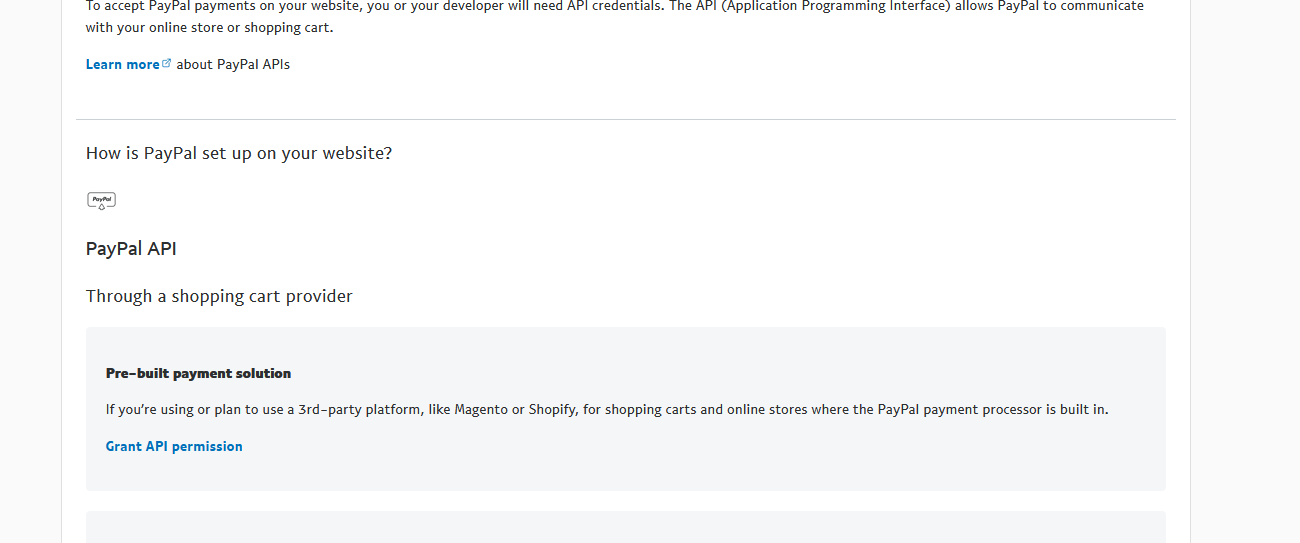

Choose Pre-build payment solution |

|

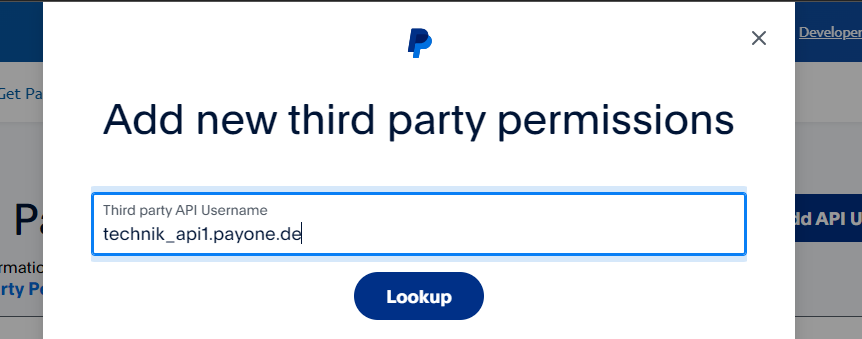

Adding a new api user |

|

|

For live Business Accounts: technik_api1.payone.de For sandbox Business Accounts: api_1217604614_biz_api1.payone.de If you want to use your own sandbox business account, please contact our support and tell us the corresponding email address of your sandbox business account. We'll need this to link payments made through our platform to your sandbox business account. |

|

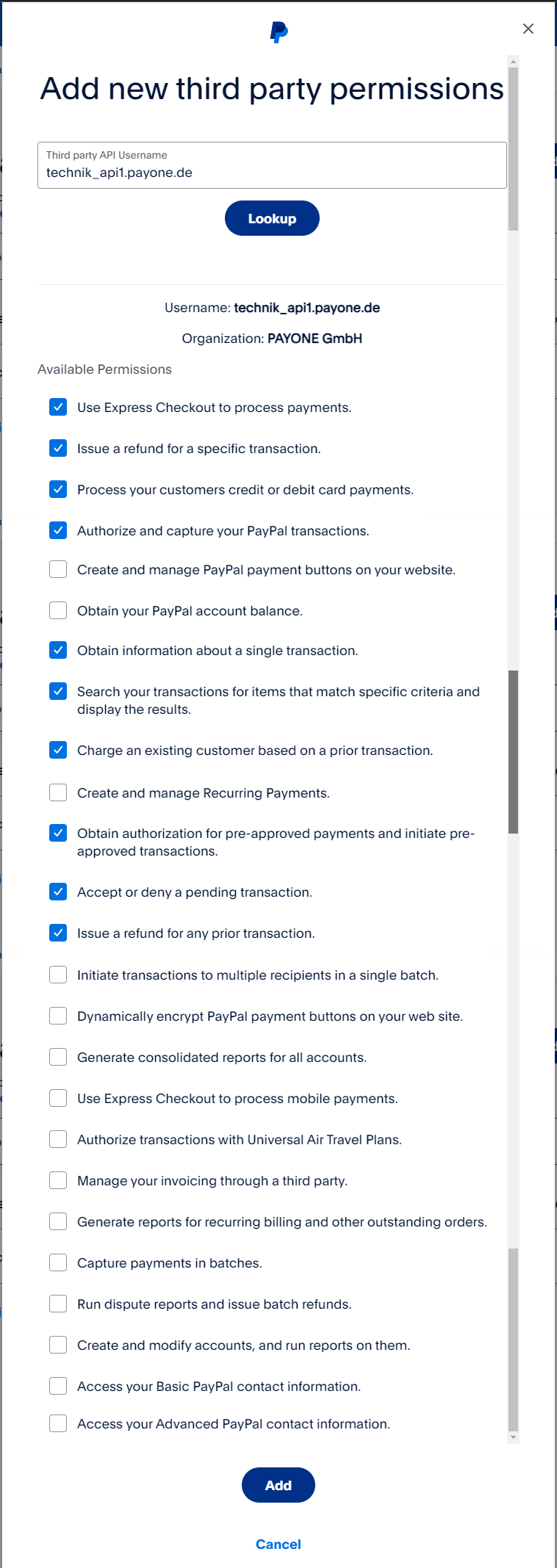

Enter API Username and search with button „Lookup" |

|

Activate the necessary permissions (see screenshot – Add new third party permissions) |

|

Select authorization as follows:

|

Enabling Digital GoodsIf you use PayPal's "Digital Goods" feature, please note:

|