Introduction

|

|

Unzer's services include transaction processing and acting as an acquirer. The Unzer Group includes numerous companies, including Heidelberger Payment and Universum Group, mPAY24, StarTec, Avanti, Alpha Cash, ec-Plus, POSeidon digital, Pay Later (acquired by Paysafe), Paydiscount. Kulam and Lavego. Unzer also acquired Berlin-based fintech Tillhub in April 2022. |

Integrations

POST Request - Pre-/ Authorization

Currently there are some technical limitations regarding the “fulfillment_delay” and “refund_announcement”. If you plan on using them you have to implement the “preauthorization” instead of “authorization”also always use API version 3.10 when using Unzer Pay Later™.

path Parameters

|

api_version

required

|

Has to be at least "3.10"

|

|

clearingtype

required

|

Fixed Value fnc

|

|

financingtype

required

|

Fixed Values PYV, PYM, PYS, PYD

PYV: Unzer Rechnungskauf PYM: Unzer - Monthly PYS: Unzer Ratenkauf PYD: Unzer Lastschrift |

|

reference

required

|

Format CHAR(1..20)

Permitted Symbols [0-9][a-z][A-Z], .,-,_,/

Merchant reference number for the payment process (case insensitive) |

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99 Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro. The amount must be less than or equal to the amount of the corresponding booking. |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

|

workorderid

optional

|

Format CHAR(1..50)

Required for Preauth/Auth of Unzer Ratenkauf / references the preceding calculation request The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). The workorderid is used for the genericpayment request. |

PERSONAL DATA Parameters

|

firstname

required

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

company

optional

|

Format CHAR(2..50)

Company name, required for B2B transactions (if add_paydata[b2b] = “yes”) |

|

street

required

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

|

zip

required

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

|

city

required

|

Format CHAR(2..50)

City of customer |

|

country

required

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state"

|

|

email

required

|

Format CHAR(5..254

Permitted Symbols RFC 5322

Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

|

birthday

required

|

Format DATE(8), YYYYMMDD

Samples

20190101 19991231 Date of birth of customer |

|

ip

required

|

Format CHAR(1..39)

Customer's IP-V4-address (123.123.123.123) or IP-V6-address |

Bank TRANSFER PARAMETERS

|

bankcountry

optional

|

Format LIST

Account type/ country for use with BBAN (i.e. bankcode, bankaccount): DE DE: Mandatory with bankcode, bankaccount, optional with IBAN For other countries than DE please use IBAN or IBAN/BIC |

|

bankaccount

optional

|

Numeric (1..10)

Account number (BBAN) DE: bankcountry, bankcode and bankaccount may be used. Then IBAN will be generated by PAYONE platform and used for SEPA transactions. Not DE: Please use IBAN or IBAN/ BIC. |

|

bankcode

optional

|

Numeric (1..8)

Sort code (BBAN) (only in DE) DE: bankcountry, bankcode and bankaccount may be used. Then IBAN will be generated by PAYONE platform and used for SEPA transactions. Not DE: Please use IBAN or IBAN/ BIC. |

|

iban

optional

|

Format CHAR(8 or 11) Only capital letters and digits, no spaces

Permitted Symbols [0-9][A-Z]

Bank Identifier Code to be used for payment or to be checked |

|

bic

optional

|

Format CHAR(8 or 11) Only capital letters and digits, no spaces

Permitted Symbols [0-9][A-Z]

BIC is optional for all Bank transfers within SEPA. For Accounts from Banks outside of SEPA, BIC is still required. |

ARTicle Parameters

|

it[n]

optional

|

Note: handling and voucher are not supported and will be mapped to goods

|

||||||

|

id[n]

optional

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

Symbols [0-9][a-z][A-Z], .,-,_,/

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||

|

pr[n]

optional

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent |

||||||

|

no[n]

optional

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400]

Quantity of this item |

||||||

|

de[n]

optional

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400]

Description of this item. Will be printed on documents to customer. |

add_paydata PARAMETERS

| add_paydata[installment_duration]

optional

|

Required for Unzer Ratenkauf, value has to be the result of a preceding generic calculation request |

| add_paydata[company_trade_registry_number]

optional

|

Trade registry number for B2B transactions |

|

add_paydata[b2b]

optional

|

Optional, defaults to “no”

Set “yes” for B2B transactions B2B transactions only available for PYV transactions. |

|

add_paydata[company_uid]

optional

|

VAT identification number, recommended for better acceptance rates with b2b transactions |

|

add_paydata[company_register_key]

optional

|

ID of other company register than trade registry or UID |

|

add_paydata[mobile]

optional

|

Optional mobile phone number |

|

add_paydata[analysis_transportation_<suffix>]

optional

|

<suffix> is one of: company - DHL, UPS tracking - delivery tracking package id return_tracking - for tracking id of returns You can use these parameters on authorization and capture requests |

|

add_paydata[analysis_customer_<suffix>]

optional

|

<suffix> is one of: group - customer group confirmed_orders - recently confirmed orders confirmed_amount - recently confirmed amount internal_score - internal risk score of the merchant |

|

add_paydata[analysis_item_category_<n>]

optional

|

Item category Replace <n> with the shopping item id you want to categorize |

|

add_paydata[analysis_webshop_url]

optional

|

Webshop URL |

|

add_paydata[payolution_session_id]

optional

|

see Chapter "Fraud Prevention" for more details |

ReSponse Parameters

|

status

required

|

Permitted Values

APPROVED

ERROR

|

ReSponse Parameter (APPRoved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

workorderid

|

Format NUMERIC(6..12)

Used to reference a preceding calculation or pre-check request |

|

add_paydata[clearing_reference

|

Format CHAR(2..1024)

Accounting number, used to print on the invoice |

ReSponse Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

aid=52078

amount=49595

api_version=3.10

birthday=19711110

city=Frankfurt am Main

clearingtype=fnc

country=DE

currency=EUR

email=test@example.com

encoding=UTF-8

financingtype=PYV

firstname=Manuel

hash=d9e909f9004dae0c838b142e48505fb388b2d26f979e96a805dc602fec0babc6c585cc1036c78e94ffcf8b90dd95adb0

ip=89.245.17.41

key=19539eb4b369b29f314b51368076475a

language=de

lastname=Weißmann

mid=14648

mode=test

portalid=2037267

reference=1240501003

request=preauthorization

salutation=Herr

shipping_city=Frankfurt am Main

shipping_country=DE

shipping_firstname=Manuel

shipping_lastname=Weißmann

shipping_street=Hugo-Junckers-Straße 3

shipping_zip=60386

street=Hugo-Junckers-Straße 3

zip=60386

RESPONSE

status=APPROVED

add_paydata[PaymentDetails_1_Duration]=1

add_paydata[PaymentDetails_1_Installment_1_Amount]=495.95

add_paydata[PaymentDetails_1_Installment_1_DueInDays]=14

add_paydata[txid]=TX1B1DC6WU4019L0

add_paydata[PaymentDetails_1_MinimumInstallmentFee]=0

add_paydata[PaymentDetails_1_Currency]=EUR

add_paydata[PaymentDetails_1_Installment_1_Due]=2024-02-22

add_paydata[PaymentDetails_1_TotalAmount]=495.95

add_paydata[PaymentDetails_1_OriginalAmount]=495.95

add_paydata[workorderid]=WX1B1DC6WUUKFC6H

add_paydata[clearing_reference]=XGBG-FBSM-GKTN

add_paydata[PaymentDetails_1_Usage]=Calculated by calculation service

txid=995802748

userid=663754411

POST Request Capture

The capture request is used to finalize a preauthorized transaction.

If you use preauth/Capture with installment transactions, the capture request has to be sent right after the preauthorization

common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

clearingtype

required

|

Fixed Value fnc

|

||||||

|

financingtype

required

|

Fixed Value PYV, PYM, PYS, PYD

PYV: Unzer Rechnungskauf PYM: Unzer - Monthly PYS: Unzer Ratenkauf PYD: Unzer Lastschrift |

||||||

|

capturemode

required

|

Format LIST

Specifies whether this capture is the last one or whether there will be another one in future. |

||||||

|

sequencenumber

optional

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro The amount must be less than or equal to the amount of the corresponding booking. |

||||||

|

currency

required

|

Fixed Value EUR

|

||||||

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

add_paydata PARAMETERS

|

add_paydata[b2b]

optional

|

Optional, defaults to “no”

Set “yes” for B2B transactions B2B transactions only available for PYV transactions. |

|

add_paydata[analysis_customer_<suffix>]

optional

|

<suffix> is one of: group - customer group confirmed_orders - recently confirmed orders confirmed_amount - recently confirmed amount internal_score - internal risk score of the merchant |

|

add_paydata[analysis_invoice_id]

optional

|

Additional field for an invoice ID that the merchant can use for his own purposes |

|

add_paydata[analysis_order_id]

optional

|

Additional field for an order ID that the merchant can use for his own purposes |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

add_paydata[clearing_reference]

|

Accounting number, used to print on the invoice (only for API version >3.10) |

Response parameters (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

POST Request Debit

Only Unzer specific parameters are described here. Refer to the Payone API description

ADd_Paydata Parameters

|

add_paydata[analysis_invoice_id

optional

|

Additional field for an invoice ID that the merchant can use for his own purposes |

|

add_paydata[analysis_order_id]

optional

|

Additional field for an order ID that the merchant can use for his own purposes |

|

add_paydata[b2b]

optional

|

Optional, defaults to “no”

Set “yes” for B2B transactions B2B transactions only available for PYV transactions. |

genericpayment – Requests

POST Request genericpayment – add_paydata[action] = calculation

The calculation request is used, whenever you need to retrieve financing plans for the payment type “Unzer-Installment”. It accepts the amount of the transaction as an input parameter and returns all possible payment plans.

The calculation request has to be referenced in an installment preauthorization/authorization. add_paydata[installment_duration] is used to specify the desired duration for the payment plan in months.

common Parameters

|

clearingtype

required

|

Fixed Value fnc

|

|

financingtype

required

|

Fixed Values PYV, PYM, PYS, PYD

PYV: Unzer Rechnungskauf PYM: Unzer - Monthly PYS: Unzer Ratenkauf PYD: Unzer Lastschrift |

|

amount

optional

|

Required for action=pre_check and action=calculation |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

add_paydata PARAMETERS

|

add_paydata[action]

required

|

Fixed Value calculation

|

|

add_paydata[analysis_merchant_comment]

optional

|

Comment field for the merchant |

|

add_paydata[company_uid]

optional

|

Only for action=pre_check

VAT identification number, recommended for better acceptance rates with b2b transactions |

Response Parameter

|

status

|

Permitted Values

OK

ERROR

|

|

add_paydata[PaymentDetails _<n>_Currency ]

|

Currency |

| add_paydata[PaymentDetails_<n>_StandardCreditInformationUrl ] |

A URL to the EU Standard Credit Information hosted by Unzer

|

|

add_paydata[PaymentDetails_<n>_Usage ]

|

A human readable description of the reason for the payment Replace n with natural number |

|

add_paydata[PaymentDetails_<n>_Duration]

|

Defines how many installments are used to perform the payment Replace n with natural number |

|

add_paydata[PaymentDetails_<n>_EffectiveInterestRate]

|

The effective interest rate p.a. in percent |

|

add_paydata[PaymentDetails_<n>_InterestRate]

|

The interest rate p.a. in percent

|

|

add_paydata[PaymentDetails_<n>_MinimumInstallmentFee ]

|

The minimum fee for the installment payment, which will be charged even if the interest would be lower than that (e.g. because of partial refunds |

|

add_paydata[PaymentDetails_<n>_OriginalAmount]

|

The original transaction amount as transmitted by the merchant

|

|

add_paydata[PaymentDetails_<n>_TotalAmount]

|

The total transaction amount as transmitted by the merchant |

|

add_paydata[PaymentDetails_<n>_Installment_<m>_amount]

|

Amount of installment number m

|

|

add_paydata[PaymentDetails_<n>_Installment_<m>_due]

|

Due date of installment number m |

|

add_paydata[PaymentDetails_<n>_Installment_<m>_dueInDays]

|

Number of days until installment number m is due |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

add_paydata[action]=calculation

aid=52078

amount=49595

api_version=3.10

birthday=19710110

city=Frankfurt am Main

clearingtype=fnc

country=DE

currency=EUR

email=test@example.com

encoding=UTF-8

financingtype=PYS

firstname=Manuel

hash=7f015290822476e1e062f9ef9f77a537cdde4fe533cfba2cf0afa6d7e6610fb71fd39c0357398451adfc911304a8ce0e

ip=89.245.17.41

key=19539eb4b369b29f314b51368076475a

language=de

lastname=Weißmann

mid=14648

mode=test

portalid=2037267

request=genericpayment

salutation=Herr

street=Hugo-Junckers-Straße 3

workorderid=WX1B0DC6153HQN3A

zip=60386

RESPONSE

status=OK

add_paydata[PaymentDetails_1_Duration]=3

add_paydata[PaymentDetails_6_EffectiveInterestRate]=16.01

add_paydata[PaymentDetails_5_Installment_2_Due]=2024-04-05

add_paydata[PaymentDetails_5_Installment_3_Amount]=44.69

add_paydata[PaymentDetails_5_Installment_4_Amount]=44.69

add_paydata[PaymentDetails_5_Installment_7_Amount]=44.69

add_paydata[PaymentDetails_6_Installment_4_Due]=2024-06-05

add_paydata[PaymentDetails_6_Installment_17_Due]=2025-07-05

add_paydata[PaymentDetails_5_Installment_9_Amount]=44.69

add_paydata[PaymentDetails_5_Installment_1_Amount]=44.69

add_paydata[PaymentDetails_5_Installment_2_Amount]=44.69

add_paydata[PaymentDetails_5_Installment_5_Amount]=44.69

add_paydata[PaymentDetails_5_Installment_6_Amount]=44.69

add_paydata[PaymentDetails_1_MinimumInstallmentFee]=0

add_paydata[PaymentDetails_5_Installment_8_Amount]=44.69

add_paydata[PaymentDetails_6_Installment_7_Amount]=24.00

add_paydata[PaymentDetails_6_Installment_8_Amount]=24.00

add_paydata[PaymentDetails_6_Installment_9_Amount]=24.00

add_paydata[PaymentDetails_6_Installment_2_Due]=2024-04-05

add_paydata[PaymentDetails_4_Installment_9_Due]=2024-11-05

add_paydata[PaymentDetails_5_EffectiveInterestRate]=16.02

add_paydata[PaymentDetails_4_Installment_6_Amount]=58.51

add_paydata[PaymentDetails_6_Installment_1_Amount]=24.00

add_paydata[PaymentDetails_6_Installment_6_Due]=2024-08-05

[...]

add_paydata[PaymentDetails_6_Installment_21_Amount]=24.00

add_paydata[PaymentDetails_4_Installment_6_Due]=2024-08-05

add_paydata[PaymentDetails_4_Currency]=EUR

add_paydata[PaymentDetails_6_Installment_10_Amount]=24.00

add_paydata[PaymentDetails_6_Installment_14_Amount]=24.00

add_paydata[PaymentDetails_5_Installment_12_Due]=2025-02-05

add_paydata[PaymentDetails_4_StandardCreditInformationUrl]=https://test-payment.paylater.unzer.com/payolution-payment/rest/query/customerinfo/pdf?trxId=Tx-dxsxfzfkn7z&duration=9

add_paydata[PaymentDetails_3_Installment_5_Due]=2024-07-05

add_paydata[PaymentDetails_6_Usage]=Calculated by calculation service

add_paydata[PaymentDetails_2_Installment_2_Amount]=127.66

workorderid=WX1B0DC6153HQN3A

POST Request genericpayment – add_paydata[action] = pre_check

This can be used to perform a preliminary risk check.

common Parameters

|

clearingtype

required

|

Fixed Value fnc

|

|

financingtype

required

|

Fixed Value PYV, PYM, PYS, PYD

PYV: Unzer Rechnungskauf PYM: Unzer - Monthly PYS: Unzer Ratenkauf PYD: Unzer Lastschrift |

|

ip

required

|

Customer's IP-V4-address (123.123.123.123) or IP-V6-address |

|

email

required

|

Customers e-mail address |

|

amount

required

|

Required for action=pre_check and action=calculation |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

|

company

optional

|

Company name, required for B2B transactions (if add_paydata[b2b] = “yes”) |

|

birthday

required

|

Date of birth (YYYYMMDD) |

|

firstname

optional

|

First name |

|

lastname

required

|

Surname |

|

street

optional

|

Street name and number |

|

zip

required

|

Postcode |

|

city

optional

|

City |

|

country

required

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state"

|

add_paydata PARAMETERS

|

add_paydata[action]

required

|

Fixed Value pre_check

|

|

add_paydata[payment_type]

required

|

Format LIST

Permitted values Payolution-Invoicing, Payolution-Installment, Payolution-Monthly, Payolution-Debit

|

|

add_paydata[b2b]

optional

|

Optional, defaults to “no”

Set “yes” for B2B transactions B2B transactions only available for PYV transactions. |

| add_paydata[company_trade_registry_number]

optional

|

Trade registry number for B2B transactions |

|

add_paydata[company_register_key]

optional

|

ID of other company register than trade registry or UID |

|

add_paydata[mobile]

optional

|

Only for action=pre_check Optional mobile phone number |

|

add_paydata[payolution_session_id]

optional

|

see Chapter "Fraud Prevention" for more details

|

Response Parameters

|

status

|

Permitted Values

OK

ERROR

|

Response Parameter (OK)

|

workorderid

|

Format CHAR(1..50)

The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). The workorderid is used for the genericpayment request. |

Response Parameter (ERRor)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

https://api.pay1.de/post-gateway/

add_paydata[action]=pre_check

add_paydata[payment_type]=Payolution-Installment

aid=52078

amount=10000

api_version=3.10

birthday=19900505

city=Test

clearingtype=fnc

country=DE

currency=EUR

email=test@example.com

encoding=UTF-8

financingtype=PYS

firstname=Test

hash=fe6469c3fae568d427ea33a5ab5822ca966634d37f4e527e100b139a511cd0922f47ac554615587c27b0ad286efaabf1

ip=127.0.0.1

key=19539eb4b369b29f314b51368076475a

lastname=Test

mid=14648

mode=test

portalid=2037267

reference=TESTPO-7119981132236

request=genericpayment

street=teststreet 2

zip=12345

RESPONSE

status=OK

workorderid=WX1A6DC65EFPX83F

POST Request genericpayment – add_paydata[action] = refund_announcement

If a customer announces a return to the customer support it is possible to send a “refund_announcement” request in order to stop the dunning process.

common parameters

|

clearingtype

required

|

Fixed Value fnc |

|

financingtype

required

|

Fixed Value PYV, PYM, PYS, PYD

PYV: Unzer Rechnungskauf PYM: Unzer - Monthly PYS: Unzer Ratenkauf PYD: Unzer Lastschrift |

|

amount

required

|

Required for action=pre_check and action=calculation |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

|

workorderid

required

|

The “workorderid” of the corresponding preauth/auth request. It is only returned for preauthorizations using API version 3.10 |

add_paydata PARAMETERS

|

add_paydata[action]

required

|

Fixed Value refund_announcement

|

|

add_paydata[txid]

required

|

Not the regular TXID that is returned by all preauth/auth requests. This txid is returned as “add_paydata[txid]” for preauthorizations using API version 3.10 |

Response Parameters

|

status

|

Permitted Values

OK

ERROR

|

Response Parameter (ok)

|

workorderid

|

Format CHAR(1..50)

The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). The workorderid is used for the genericpayment request. |

Response Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

POST Request genericpayment – add_paydata[action] = fulfillment_delay

If the merchant can’t abide by his commited fulfillment date, it is possible to send a “fulfillment_delay” request in order to delay the dunning process until a specified date.

common parameters

|

amount

required

|

Required for action=pre_check and action=calculation |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

|

workorderid

required

|

The “workorderid” of the corresponding preauth/auth request. It is only returned for preauthorizations using API version 3.10 |

add_paydata PARAMETERS

|

add_paydata[action]

required

|

Fixed Value fulfillment_delay

|

|

add_paydata[txid]

required

|

Not the regular TXID that is returned by all preauth/auth requests. This txid is returned as “add_paydata[txid]” for preauthorizations using API version 3.10 |

|

add_paydata[analysis_expected_fulfillment_date]

required

|

Format YYYY-MM-DD

New expected fulfillment date. |

Response Parameters

|

status

|

Permitted Values

OK

ERROR

|

Response Parameter (OK)

|

workorderid

|

Format CHAR(1..50)

The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). The workorderid is used for the genericpayment request. |

Response Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Referencing preliminary requests by “workorderid”

Unzer offers a couple of preliminary requests (“calculation” and “pre_check”) that need to be referenced during the preauthorization/auothorization of a transaction. The “pre_check” request can be used to perform a preliminary risk check. This request is optional.

The “calculation” request is required for installment transactions. If you decide to use the pre_check in your implementation, make sure that you pass the workorderid returned by the “pre_check” on to following requests.

Example

If you try to perform an installment payment with a preceding “pre_check” you need to reference the “pre_check”’s workorderid in both the “calculation” and “preauthorization”/”authorization” requests. In this particular case, you don’t need to reference the workorderid of the “calculation” request.

If you try to perform an installment payment without a preceding “pre_check” you need to reference the workorderid of the preceding “calculation” request. If you try to perform an invoice payment with a preceding “pre_check” you need to reference the workorderid of the “pre_check”

Fraud Prevention

Unzer offers the possibility to send a session_id, referencing a complete customer session. This is to make sure, that all requests sent by the merchant, belong to the same customer session. This helps Unzer to make sure, that there are no fraudulent requests sent by a third party. For each checkout process, a session ID has to be created and transmitted to Unzer in two ways:

When loading the fraud prevention JS, and 2. during API requests.

The add_paydata[analysis_session_id] is a temporary identifier that is unique to the visitor’s session and per event/order. It can be up to 128 bytes long and must only consist of the following characters:

upper and lowercase English letters([az], [A-Z])

digits (0-9)

underscore (_)

hyphen(-)

|

Recommendations for creation of add_paydata[analysis_session_id]:

Use a merchant identifier (URL without domain additions), append an existing session identifier from a cookie, append the date and time in milliseconds to the end of the identifier and then applying a hexadecimal hash to the concatenated value to produce a completely unique Session ID.

Use a merchant identifier (URL without domain additions), append an existing session identifier from the web application and applying a hexadecimal hash to the value to obfuscate the identifier.

Define a session ID. Unzer recommends to concatenate the merchant name, an existing session identifier and a timestamp in milliseconds, then apply a hexadecimal hash function. The session ID must be retained through the checkout process.

Load the fraud prevention JavaScript, be sure to replace the [SessionID] placeholder. 363t8kgq is a static value:

|

You are free to use any asynchronous loading mechanism. We strongly recommend to load the JS only when the customer hits the acceptance checkbox of the privacy statement to avoid GDPR issues.

The session ID must be added to all pre_check and authorization/preauthorization requests in the paramter add_paydata[analysis_session_id].

B2B Transactions

Unzer supports B2B transactions for (monthly) Invoice and Debit transactions. If you want your transaction to be flagged as B2B, you need to set the parameter “add_paydata[b2b]” to “yes” for all requests regarding this transaction.

B2B transactions are only available for Unzer Rechnungskauf.

Unzer HTTP Authentication

As part of the calculation request response a document URL is returned as well (StandardCreditInformationUrl). In order to access the referenced document HTTP authentication is required. The user credentials are the channelname and password provided by Unzer.

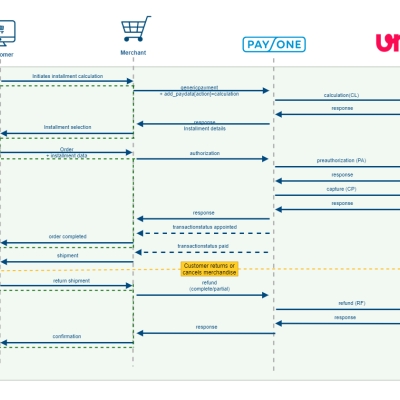

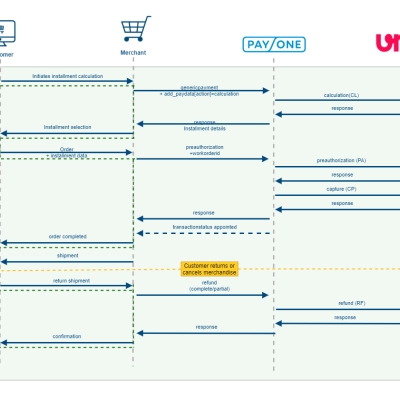

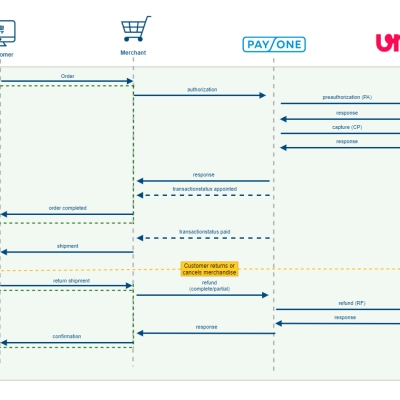

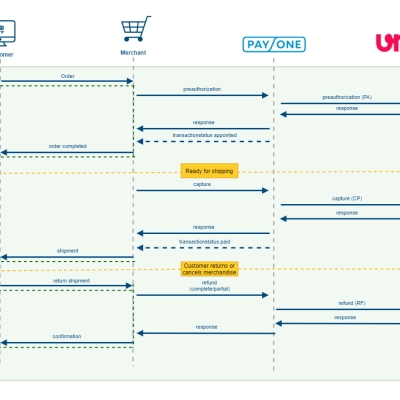

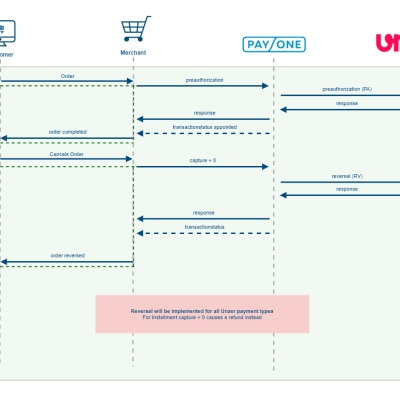

Sequence Diagrams

|

Installment Authorization and Refund |

Installment Preauthorization and Refund |

Invoice Sale Authorization and Refund |

|

Invoice Preauthorization and Refund |

Reversal |

Testdata

Please refer to the Unzer documentation for specific test data: https://docs.unzer.com/reference/test-data/