Introduction

|

|

Postfinance (proper spelling PostFinance) is a subsidiary of the state-owned Swiss Post, which is active in private customer business and business customer business and as such is one of the largest Swiss financial institutions. The main area of activity is national and international payment transactions. In addition, it also offers products and services in the areas of savings, investments, retirement planning and financing. Since the end of June 2013, Postfinance has held a banking license and is under the supervision of the Swiss Financial Market Supervisory Authority (FINMA). In 2015, Postfinance was classified as systemically important domestically by the Swiss National Bank and must comply with special rules on equity and liquidity and submit an emergency plan. With e-finance, the online banking service from PostFinance, you can easily manage your finances anywhere and at any time via computer or smartphone. You can connect e-finance with selected payment transaction and accounting software and simplify your processes. |

POST Request - genericpayment – add_paydata[action] = register_alias

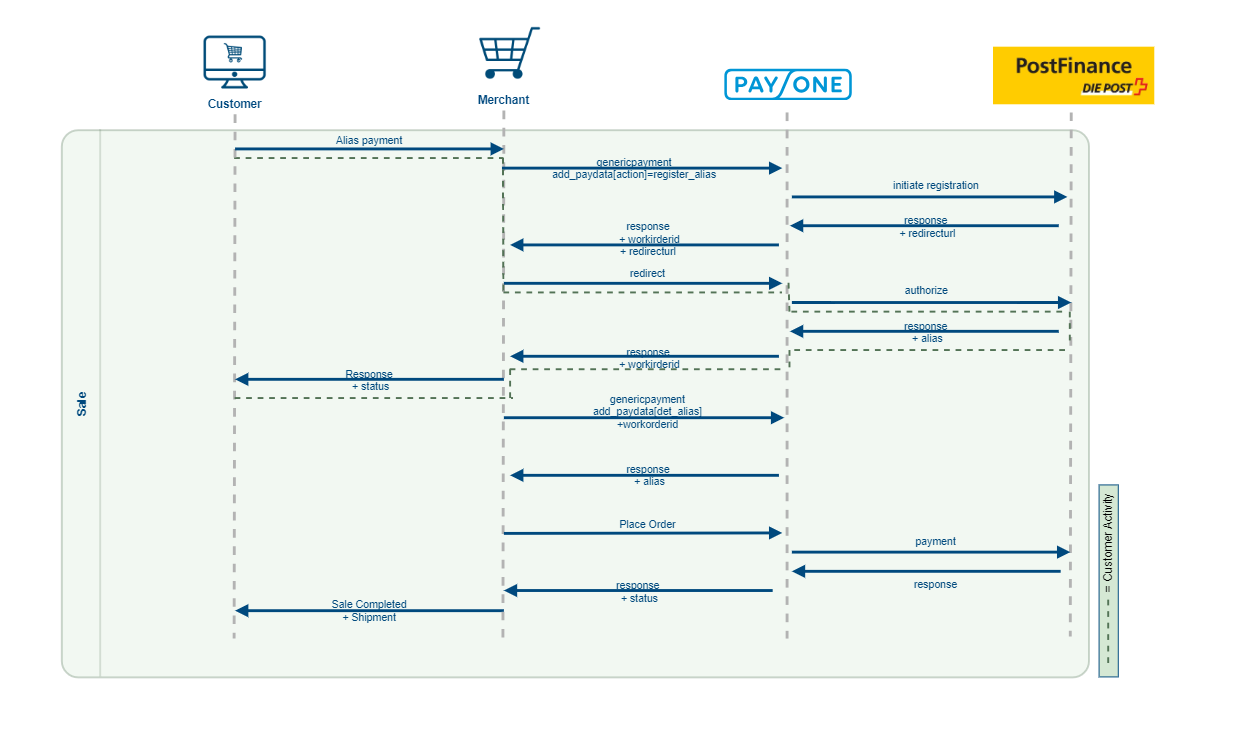

To register a Postfinance alias, there are 3 steps to take:

- Initiate Alias Registration

To start the alias registration you need to send a generic payment request with action “register_alias” to our server api. - Request Alias

The customer will be redirected to the postfinance alias registration page. After authorization, the customer will be redirected to your shop. When the customer has arrived, you can call the generic payment request with action “get_alias” to receive the registered alias. Save the alias in the customer’s profile, to use it for future authorizations. You will always use the same registered alias for this customer for every future authorization. - Request Payment with Alias

When the registration is finished, you can send an authorization request to our server api and send the alias in the request. When we receive an alias in the authorization, we will process an alias payment to postfinance. When you don’t send the alias, we will try to process a “normal” authorization to postfinance including a redirect of the customer.

Account Parameters

|

request

required

|

Fixed Value: genericpayment

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

clearingtype

required

|

Permitted Value sb

|

|

onlinebanktransfertype

required

|

Permitted Value PFF

PFF = Postfinance E-Finance |

|

mode

required

|

Fixed Value: test/live

|

|

amount

required

|

Fixed Value: 0

As only the configuration is requested, the amount is set to zero |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

|

bankcountry

required

|

Format LIST

Permitted Value CH

|

|

country

required

|

Format LIST

Permitted value CH

|

|

successurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "payment successful" |

|

errorurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "faulty payment" |

|

backurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "Back" or "Cancel" |

add_paydata Parameters

|

add_paydata[action]

required

|

AN..255

Set to "register_alias" |

Response Parameters

|

status

|

Permitted Values

REDIRECT

ERROR

|

Response Parameter (REDIRECT)

|

redirecturl

|

Format CHAR(2..2000)

URL to redirect the customer. The customer needs to authenticate the alias_registration at postfinance. Redirect URL → zMerchant system has to redirect customer to this URL to complete payment |

|

workorderid

|

Format CHAR(1..50)

The ID is unique. The returned workorderid is mandatory for the following requests of Postfinance Checkout. The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). The workorderid is used for the genericpayment request. |

Response parameters (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

add_paydata[action]=register_alias aid=12345 mid=23456 portalid=12345123 key=abcdefghijklmn123456789 clearingtype=sb currency=CHF country=CH bankcountry=CH mode=test request=genericpayment onlinebanktransfertype=PFF

RESPONSE

status=REDIRECT redirecturl=http://www.aliasregistrationpage.com workorderid=WORKORDERID12345

POST Request - genericpayment – add_paydata[action] = get_alias

Account Parameters

|

request

required

|

Fixed Value: genericpayment

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

workorderid

required

|

Format CHAR(1..50)

With the first genericpayment the workorderid will be generated from the PAYONE platform and will be sent to you in the response. The ID is unique. The returned workorderid is mandatory for the following requests. |

|

clearingtype

required

|

Permitted Value sb

|

|

onlinebanktransfertype

required

|

Fixed Value PFF

PFF = Postfinance E-Finance |

|

currency

required

|

Format LIST

Permitted Value CHF

|

|

bankcountry

required

|

Format LIST

Permitted Value CH

|

|

country

required

|

Format LIST

Permitted value CH

|

add_paydata Parameters

|

add_paydata[action]

required

|

AN..255

Set to "get_alias" |

Response Parameters

|

status

|

Permitted Values

OK

ERROR

|

Response Parameter (OK)

|

workorderid

|

Format CHAR(1..50)

The ID is unique. The returned workorderid is mandatory for the following requests of Postfinance Checkout. The workorderid is a technical id returned from the PAYONE platform to identify a workorder. A workorder is a part of a payment process (identified by a txid). The workorderid is used for the genericpayment request. |

|

add_paydata[alias]

|

Alias of the buyer |

Response parameters (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

add_paydata[action]=get_alias aid=12345 mid=23456 portalid=12345123 key=abcdefghijklmn123456789 clearingtype=sb bankcountry=CH currency=EUR mode=test request=genericpayment onlinebanktransfertype=PFF workorderid=WORKORDERID12345

RESPONSE

status=OK add_paydata[alias]=yourcustomeralias workorderid=WORKORDERID12345

POST Request Pre- /Authorization

Account Parameters

|

request

required

|

Fixed Value: preauthorisation/authorization

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

clearingtype

required

|

Fixed Value: sb

|

|

onlinebanktransfertype

required

|

Permitted Value PFF

PFF = Postfinance E-Finance |

|

mode

required

|

Fixed Value: test/live

Can be either test environment (test) or live environment (live) |

|

reference

optional

|

Format CHAR(2..255)

A unique ID that will be displayed in your shop backend and for the customer |

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99 Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro. The amount must be less than or equal to the amount of the corresponding booking. |

|

currency

required

|

Format LIST

Permitted values ISO 4217 (currencies) 3-letter-codes

Samples

EUR USD GBP |

|

bankcountry

required

|

Fixed Value CH

|

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

|

successurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "payment successful" |

|

errorurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "faulty payment" |

|

backurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "Back" or "Cancel" |

PERSONAL DATA Parameters

|

customerid

optional

|

Format CHAR(1..20)

Permitted Symbols [0-9, a-z, A-Z, .,-,_,/]

Merchant's customer ID, defined by you / merchant to refer to the customer record. "customerid" can be used to identify a customer record. If "customerid" is used then stored customer data are loaded automatically.

|

||||||

|

userid

optional

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

||||||

|

businessrelation

optional

|

Format LIST

Value specifies business relation between merchant and customer |

||||||

|

salutation

optional

|

Format CHAR(1..10)

The customer's salutation |

||||||

|

title

optional

|

Format CHAR(1..20)

Samples

Dr Prof. Dr.-Ing. Title of the customer |

||||||

|

firstname

optional

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

||||||

|

lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

||||||

|

company

optional

|

Format CHAR(2..50)

Comany name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

||||||

|

street

optional

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

||||||

|

addressaddition

optional

|

Format CHAR(1..50)

Samples

7th floor c/o Maier Specifies an additional address line for the invoice address of the customer. |

||||||

|

zip

optional

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

||||||

|

city

optional

|

Format CHAR(2..50)

City of customer |

||||||

|

country

required

|

Fixed Value DE

|

||||||

|

email

optional

|

Format CHAR(5..254)

Mandatory if "add_paydata[shopping_cart_type]=DIGITAL" Permitted Symbols RFC 5322 Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

||||||

|

telephonenumber

optional

|

Format CHAR(1..30)

Phone number of customer |

||||||

|

birthday

optional

|

Format DATE(8), YYYYMMDD

Samples

20190101 19991231 Date of birth of customer |

||||||

|

language

optional

|

Format LIST

Permitted values ISO 639-1 (Language)2-letter-codes

Language indicator (ISO 639) to specify the language that should be presented to the customer (e.g. for error messages, frontend display). If the language is not transferred, the browser language will be used. For a non-supported language English will be used. |

||||||

|

vatid

optional

|

Format CHAR(1..50)

VAT identification number. Used for b2b transactions to indicate VAT number of customer. |

||||||

|

gender

optional

|

Format LIST

Permitted values f/ m/ d

Gender of customer (female / male / diverse* ) * currently not in use |

||||||

|

ip

optional

|

Format CHAR(1..39)

Customer's IP-V4-address (123.123.123.123) or IP-V6-address |

Delivery data Parameters

|

shipping_firstname

required

|

Format CHAR(1..50)

First name of delivery address |

||||||

|

shipping_lastname

required

|

Format CHAR(1..50)

Surname of delivery address |

||||||

|

shipping_company

optional

|

Format CHAR(2..50)

Company name of delivery address |

||||||

|

shipping_street

optional

|

Format CHAR(2..50)

Street number and name of delivery address |

||||||

|

shipping_zip

required

|

Format CHAR(2..50)

Postcode of delivery address |

||||||

|

shipping_addition

optional

|

Format CHAR(1..50)

Specifies an additional address line for the delivery address of the customer, e.g. "7th floor", "c/o Maier". |

||||||

|

shipping_country

optional

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state" |

||||||

|

shipping_state

required (in CN)

|

Format LIST

Permitted values ISO 3166-2 States (regions) 2-letter-codes

|

Article Parameters

|

it[n]

optional

|

|

||||||||||

|

id[n]

optional

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

Permitted Symbols [0-9][a-z][A-Z], .,-,_,/

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

|

pr[n]

optional

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent |

||||||||||

|

no[n]

optional

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400] Quantity of this item |

||||||||||

|

de[n]

optional

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400]

Description of this item. Will be printed on documents to customer. |

||||||||||

|

va[n]

optional

|

Format NUMERIC(4)

Array elements [n] starting with [1]; serially numbered; max [400]

VAT rate (% or bp) |

Paydata Parameters

|

add_paydata[alias]

optional

|

FORMAT CHAR(255)

Alias for postfinance alias payment |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

ReSponse Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

aid=12345 mid=23456 portalid=12345123 key=abcdefghijklmn123456789 clearingtype=sb amount=6413 onlinebanktransfertype=PFF currency=CHF lastname=Master reference=youranyreference mode=test request=authorization country=CH bankcountry=CH add_paydata[alias]=youralias123456

RESPONSE

status=APPROVED txid=12345678 userid=789654

POST Request - Capture

Account Parameters

|

request

required

|

Fixed Value: capture

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

capturemode

required

|

Format LIST

Specifies whether this capture is the last one or whether there will be another one in future. |

||||||

|

sequencenumber

optional

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||

|

currency

required

|

Fixed Value EUR

|

||||||

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|||||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response parameters (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

| errormessage |

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

mid=23456 portalid=12345123 key=abcdefghijklmn123456789 mode=test request=capture txid=345678901 amount=300 currency=CHF

RESPONSE

status=APPROVED txid=345678901 settleaccount=no

POST Request - Debit

Account Parameters

|

request

required

|

Fixed Value: debit

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||||

|

settleaccount

|

Format LIST

Carry out settlement of outstanding balances. The request is booked and the resulting balance is settled by means of a collection, e.g. a refund. |

||||||||

|

sequencenumber

optional

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||||

|

currency

required

|

Fixed Value EUR

|

||||||||

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

||||||||

|

transaction_param

optional

|

Format CHAR(1..50)

Permitted Symbols [0-9][A-Z][a-z][.-_/]

Optional parameter for merchant information (per payment request) |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response Parameter (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

mid=23456 portalid=12345123 key=abcdefghijklmn123456789 api_version=3.10 mode=test request=debit txid=345678901 sequencenumber=2 amount=1000 currency=CHF

RESPONSE

status=APPROVED txid=345678901 settleaccount=no