Introduction

|

|

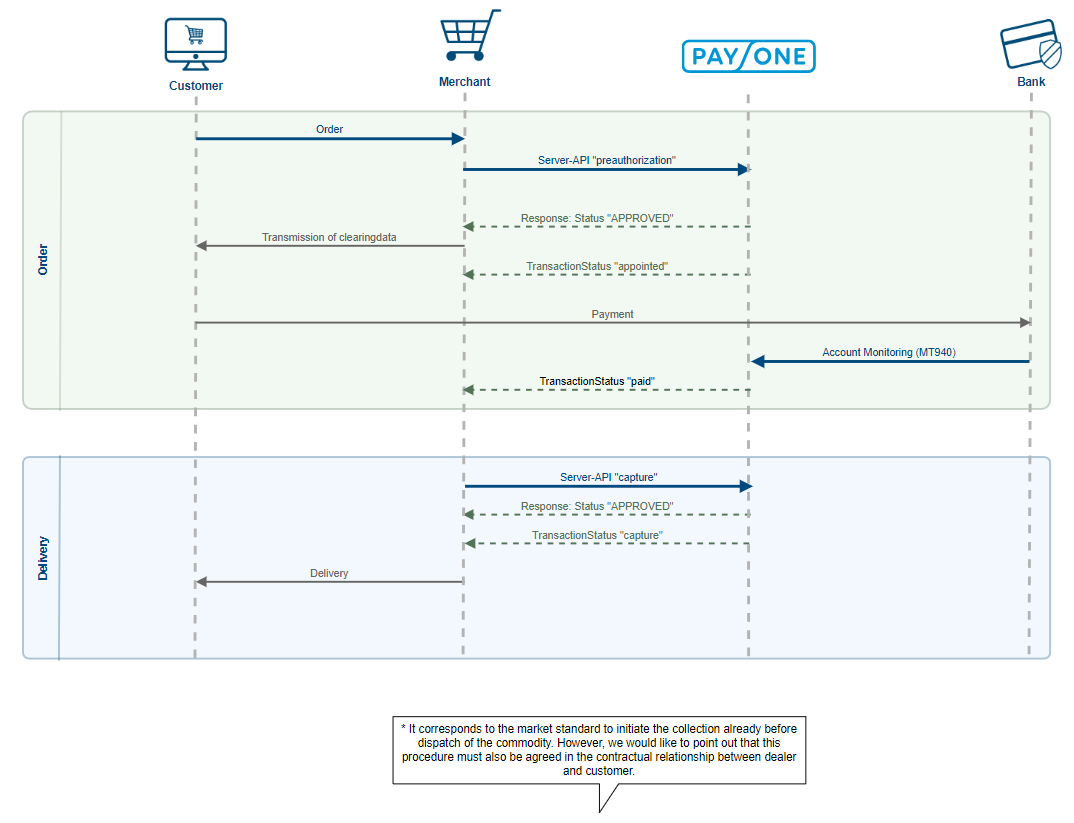

When paying in advance (Prepayment), the goods will be shipped only after receipt of payment. When paying with Prepayment, customers must transfer the money for the ordered goods in advance. Only after the invoice amount has been received by the merchant, the goods will be shipped. |

Test Data

Payone has specific testdata for the prepayment tests:

| Usecase | lastname | Behavior |

|---|---|---|

| Full payment | Payer | Simulation for a full payment of the requested amount |

| Underpayment | Underpayer | An incoming payment for 95% of the requested amount is simulated. |

| Overpayment | Overpayer | An incoming payment for 105% of the requested amount is simulated. |

| Split Payment | Splitpayer | An incoming payment for 95% of the requested amount is simulated first. Then shortly after a second incoming payment is simulated completing the requested amount. |

Integrations

POST Request - Pre-/ Authorization

Account Parameters

|

request

required

|

Fixed Value: preauthorization / authorization

|

| mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

PERSONAL DATA Parameters

|

customerid

optional

|

Format CHAR(1..20)

Permitted Symbols [0-9, a-z, A-Z, .,-,_,/]

Merchant's customer ID, defined by you / merchant to refer to the customer record. "customerid" can be used to identify a customer record.

If "customerid" is used then stored customer data are loaded automatically. |

|

userid

optional

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

|

salutation

optional

|

Format CHAR(1..10)

The customer's salutation |

|

title

optional

|

Format CHAR(1..20)

Samples

Dr Prof. Dr.-Ing. Title of the customer |

|

firstname

optional

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

company

optional

|

Format CHAR(2..50)

Comany name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

street

optional

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

|

addressaddition

optional

|

Format CHAR(1..50)

Samples

7th floor c/o Maier Specifies an additional address line for the invoice address of the customer. |

|

zip

optional

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

|

city

optional

|

Format CHAR(2..50)

City of customer |

|

country

required

|

Fixed Value DE

|

|

email

optional

|

Format CHAR(5..254)

Mandatory if "add_paydata[shopping_cart_type]=DIGITAL" Permitted Symbols RFC 5322 Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

|

telephonenumber

optional

|

Format CHAR(1..30)

Phone number of customer |

|

birthday

optional

|

Format DATE(8), YYYYMMDD

Samples

20190101 19991231 Date of birth of customer |

|

language

optional

|

Format LIST

Permitted values ISO 639-1 (Language)2-letter-codes

Language indicator (ISO 639) to specify the language that should be presented to the customer (e.g. for error messages, frontend display). If the language is not transferred, the browser language will be used. For a non-supported language English will be used. |

|

vatid

optional

|

Format CHAR(1..50)

VAT identification number. Used for b2b transactions to indicate VAT number of customer. |

|

gender

optional

|

Format LIST

Permitted values f / m / d

Gender of customer (female / male / diverse* ) * currently not in use |

|

personalid

optional

|

Format CHAR(1..32)

Permitted Symbols [0-9][A-Z][a-z][+-./()]

Person specific numbers or characters, e.g. number of passport / ID card |

|

ip

optional

|

Format CHAR(1..39)

Customer's IP-V4-address (123.123.123.123) or IP-V6-address |

|

clearingtype

required

|

Fixed Value VOR

|

Delivery data Parameters

|

shipping_firstname

required

|

Format CHAR(1..50)

First name of delivery address |

||||||

|

shipping_lastname

required

|

Format CHAR(1..50)

Surname of delivery address |

||||||

|

shipping_company

optional

|

Format CHAR(2..50)

Company name of delivery address |

||||||

|

shipping_street

optional

|

Format CHAR(2..50)

Street number and name of delivery address |

||||||

|

shipping_zip

required

|

Format CHAR(2..50)

Postcode of delivery address |

||||||

|

shipping_addressaddition

optional

|

Format CHAR(1..50)

Specifies an additional address line for the delivery address of the customer, e.g. "7th floor", "c/o Maier". |

||||||

|

shipping_country

optional

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state" |

||||||

|

shipping_state

optional

|

Format LIST

Permitted values ISO 3166-2 States (regions) 2-letter-code.

|

Article Parameters

|

it[n]

optional

|

Format List

|

||||||||||

|

id[n]

optional

|

Format CHAR(1..32)

Array elements [n] starting with [1]; serially numbered; max [400]

Permitted Symbols [0-9][a-z][A-Z], .,-,_,/

International Article Number (EAN bzw. GTIN) Product number, SKU, etc. of this item |

||||||||||

|

pr[n]

optional

|

Format NUMERIC(10) max. 19 999 999 99

Array elements [n] starting with [1]; serially numbered; max [400]

Unit gross price of the item in smallest unit! e.g. cent |

||||||||||

|

no[n]

optional

|

Format NUMERIC(6)

Array elements [n] starting with [1]; serially numbered; max [400]

Quantity of this item |

||||||||||

|

de[n]

optional

|

Format CHAR(1..255)

Array elements [n] starting with [1]; serially numbered; max [400]

Description of this item. Will be printed on documents to customer. |

||||||||||

|

va[n]

optional

|

Format NUMERIC(4)

Array elements [n] starting with [1]; serially numbered; max [400]

VAT rate (% or bp) |

Response Parameters

|

status

required

|

Permitted Values

Approved

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

||||||

|

userid

|

Format NUMERIC(9..12)

PAYONE User ID, defined by PAYONE |

||||||

|

|

Format AN..26

Merchants account number |

||||||

|

|

Format AN..11

Merchants sort code |

||||||

|

clearing_bankcountry

|

Format LIST

Merchants account type/ country (e.g. DE, AT, etc.) |

||||||

|

clearing_bankname

|

Format AN..50

Merchants bank name |

||||||

|

clearing_bankaccountholder

|

Format AN..35

Recipient bank account holder |

||||||

|

clearing_bankcity

|

Format AN..50

Recipient city or bank |

||||||

|

clearing_bankiban

|

Format CHAR(10..34)

Permitted Symbols [0-9][A-Z]

Recipient IBAN |

||||||

|

clearing_bankbic

|

Format CHAR(8 or 11) Only capital letters and digits, no spaces

Permitted Symbols [0-9][A-Z]

Recipient BIC |

Response Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

aid=54400

amount=2000

api_version=3.10

city=Dresden

clearingtype=vor

country=DE

currency=EUR

email=test@payone.com

encoding=UTF-8

firstname=Maximillian

hash=your hashed value

key=abcdefghijklmn123456789

language=de

lastname=Testerei

mid=23456

mode=test

portalid=12345123

reference=123456789

request=preauthorization

salutation=Frau

street=Wegeweg 25

zip=01099

RESPONSE

status=APPROVED

txid=988072239

userid=657644990

clearing_bankaccount=0001772359

clearing_bankcode=30050000

clearing_bankcountry=DE

clearing_bankname=Landesbank Hessen-Thüringen

clearing_bankaccountholder=PAYONE GmbH

clearing_bankcity=Duesseldorf

clearing_bankiban=DE81300500000001772359

clearing_bankbic=WELADEDDXXX

POST Request - Capture

Account Parameters

|

request

required

|

Fixed Value: capture

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

capturemode

required

|

Format LIST

Specifies whether this capture is the last one or whether there will be another one in future. |

||||||

|

sequencenumber

optional

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||

|

currency

required

|

Fixed Value EUR

|

||||||

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

Response Parameters

|

status

|

Permitted Values

APPROVED

PENDING

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response parameters (pending)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(6..12)

PAYONE User ID, defined by PAYONE |

Request Body schema: application/json

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

mid=23456

portalid=12345123

key=abcdefghijklmn123456789

api_version=3.10

mode=test

request=capture

encoding=UTF-8

txid=345678901

amount=300

currency=EUR

RESPONSE

status=APPROVED

txid=345678901

settleaccount=no

POST Request - Debit

Account Parameters

|

request

required

|

Fixed Value: debit

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

Common Parameters

|

txid

required

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

sequencenumber

required

|

Format NUMERIC(1..3)

Permitted values 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

|

amount

required

|

Format NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||

|

currency

required

|

Fixed Value EUR

|

||||||

|

narrative_text

optional

|

Format CHAR(1..81)

Dynamic text element on account statements (3 lines with 27 characters each) and credit card statements. |

||||||

|

clearingtype

optional

|

Fixed Value vor

|

||||||

|

use_customerdata

optional

|

Format LIST

Use account details from debtor's master data |

||||||

|

transaction_param

optional

|

Format CHAR(1..50)

Permitted Symbols [0-9][A-Z][a-z][.-_/]

Optional parameter for merchant information (per payment request) |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

|

settleaccount

|

Format LIST

Provides information about whether a settlement of balances has been carried out. |

Response Parameter (error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de

Content-Type: application/x-www-form-urlencoded

Payload

mid=23456

portalid=12345123

key=abcdefghijklmn123456789

api_version=3.10

mode=test

request=capture

encoding=UTF-8

txid=345678901

sequencenumber=1

amount=1000

currency=EUR

RESPONSE

status=APPROVED

txid=345678901

settleaccount=no