Introduction

|

|

Google Pay™ offers a fast, simple and secure way for customers to handle payments both online and in store using their digital wallet. Integrating Google Pay™ helps merchants deliver a seamless checkout experience, increasing user satisfaction and encouraging repeat business. Merchants need to place a Google Pay™ button in their online shops or mobile apps. Customers are then presented with a payment sheet displaying saved payment methods from their Google Account, along with other optional data like shipping addresses. Google Pay™ allows merchants to customize the payment button's appearance to match the merchant's UI design, while adhering to Google Pay™ branding guidelines. |

Overview

Google Pay™ is now available worldwide, however some Google Pay™ and Google Wallet™ payments features are only available in certain countries and on certain devices. For more details, please check with Google Pay™ feature availability.

All currencies that Google Pay™ supports are currently also supported by the PAYONE platform.

Supported Payment methods:

- Visa

- Mastercard

Google Pay™ may use cards or network tokens. Card based payloads consisting of PAN require PCI DSS compliance and 3D-Secure processing. To avoid the software on your server to come in contact with credit card data, PAYONE gets the complexity away from you via our Google Pay™ implementation in combination with the existing 3D Secure and SCA handling available in our gateway.

Test Data

You can use Google’s sample cards or PAYONE's test cards to perform test transactions.

Google’s sample cards

Payone test cards

When testing the Google Pay™ integration with PAYONE, you can utilize PAYONE test cards, which also support the 3DS flow, providing a comprehensive end-to-end testing experience. The account you use for testing with PAYONE test cards must be added to the Google Pay test card suite group.

LIABILITY SHIFT

Google Pay™ supports liability shift to issuers for qualified transactions using Mastercard and Visa Android device tokens (CRYPTOGRAM_3DS). Meanwhile, Google Pay™ PAN-based transactions follow the same liability shift rules based on the results of 3D Secure and corresponding card scheme rules.

The liability shift features are part of Visa and Mastercard programs with Google Pay™ and are subject to card scheme rules. For Visa, merchants can opt-in for "Fraud Liability Protection for Visa device tokens" at the Google Pay™ & Wallet Console.

---end

Details about liability shift for Google Pay™ can be found in the Google Pay™ - Shift liability to issuer and Google Pay™ - Enabling liability shift for eligible Visa device token transactions globally.

Integrations

POST Request Pre- /Authorization

Account Parameters

| request

required

|

Fixed Value: preauthorisation/authorization

|

| mid

required

|

your merchant ID, 5-digit numeric

|

| aid

required

|

your subaccount ID, 5-digit numeric

|

| portalId

required

|

your Portal ID, 7-digit numeric

|

| key

required

|

your key value, alpha-numeric

|

PERSONAL DATA Parameters

| firstname optional

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

| lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

| company optional

|

Format CHAR(2..50)

Company name, required for B2B transactions (if add_paydata[b2b] = “yes”) |

| street optional

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

| zip optional

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

| city optional

|

Format CHAR(2..50)

City of customer |

| country

required

|

Format List

Permitted values ISO 3166 2-letter-codes Samples DE / GB/ US Specifies country of address for the customer. Some countries require additional information in parameter "state"

|

| email optional

|

Format CHAR(5..254)

Permitted Symbols RFC 5322 Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

| birthday optional

|

Format DATE(8), YYYYMMDD

Samples 20190101 / 19991231 Date of birth of customer |

| telephonenumber optional

|

Telephone number |

Wallet PARAMETERS

|

wallettype

required

|

Fixed Value: GGP

GGP: Google Pay

|

|

successurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "payment successful" |

|

errorurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "faulty payment" |

|

backurl

required

|

Format CHAR(2..255)

Scheme <scheme>://<host>/<path> <scheme>://<host>/<path>?<query> scheme-pattern: [a-zA-Z]{1}[a-zA-Z0-9]{1,9}

URL for "Back" or "Cancel" |

add_paydata PARAMETERS

|

add_paydata

required

|

Sample rhHAQUrR118u[...]cwDw Google Pay encrypted token, Base64 encoded |

Response Parameters

|

Permitted Values APPROVED

REDIRECT

ERROR |

Response Parameter (Approved)

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

| userid |

Format NUMERIC(9..12)

PAYONE User ID, defined by PAYONE |

Response Parameter (Error)

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

add_paydata[paymentmethod_token_data]=FpFyA6zSGkZC[...]xi8xeXCNbpGBpvlNXfcang==

aid=12345

amount=1000

api_version=3.11

clearingtype=wlt

country=DE

currency=EUR

encoding=UTF-8

firstname=Demo

key=123456789abcdefghij

lastname=Dude

mid=12345

mode=test

portalid=123456

reference=013265464564654

request=preauthorization

wallettype=GGP

RESPONSE

status=APPROVED

txid=123456789

userid=987654321

POST Request Capture

The capture request is used to finalize a preauthorized transaction.

Account Parameters

| request

required

|

Fixed Value: capture

|

| mid

required

|

your merchant ID, 5-digit numeric

|

| aid

required

|

your subaccount ID, 5-digit numeric

|

| portalId

required

|

your Portal ID, 7-digit numeric

|

| key

required

|

your key value, alpha-numeric

|

common Parameters

| txid

required

|

Format: NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

| clearingtype

optional

|

Fixed Value: wlt

|

||||||

| wallettype

optional

|

Fixed Value: GGP

GGP: Google Pay |

||||||

| capturemode

required

|

Format: LIST

Specifies whether this capture is the last one or whether there will be another one in future. |

||||||

| sequencenumber

optional

|

Format: NUMERIC(1..3)

Permitted values: 0..127

Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||

| amount

required

|

Format: NUMERIC(1..10)

Permitted values: max. +/- 19 999 999 99

Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro The amount must be less than or equal to the amount of the corresponding booking. |

||||||

| currency

required

|

Fixed Value: EUR

|

||||||

| narrative_text

optional

|

Format: CHAR(1..81)

Dynamic text element on account statements |

Response Parameters

|

Permitted Values

APPROVED

ERROR |

Response Parameter (approved)

|

Format: NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|||||||||

| settleaccount |

Format: LIST

Carry out settlement of outstanding balances. The request is booked and the resulting balance is settled by means of a collection, e.g. a refund. |

Response parameters (error)

|

Format: NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

|

Format: CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

| customermessage |

Format: CHAR(1..1024)

The customer message is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

POST Request Debit

Account Parameters

| request

required

|

Fixed Value: debit

|

| mid

required

|

your merchant ID, 5-digit numeric

|

| aid

required

|

your subaccount ID, 5-digit numeric

|

| portalId

required

|

your Portal ID, 7-digit numeric

|

| key

required

|

your key value, alpha-numeric

|

common Parameters

| txid

required

|

Format: NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||||

| sequencenumber

required

|

Format: NUMERIC(1..3)

Permitted values 0..127 Sequence number for this transaction within the payment process (1..n), e.g. PreAuthorization: 0, 1. Capture: 1, 2. Capture: 2 Required for multi partial capture (starting with the 2nd capture) |

||||||||

| amount

required

|

Format: NUMERIC(1..10)

Permitted values max. +/- 19 999 999 99 Specifies the total gross amount of a payment transaction. Value is given in smallest currency unit, e.g. Cent of Euro; Pence of Pound sterling; Öre of Swedish krona. The amount must be less than or equal to the amount of the corresponding booking. |

||||||||

| currency

required

|

Fixed Value: EUR

|

||||||||

| settleaccount

optional

|

Format: LIST

Carry out settlement of outstanding balances. The request is booked and the resulting balance is settled by means of a collection, e.g. a refund. |

Response Parameters

|

Permitted Values

APPROVED

ERROR |

Response Parameter (approved)

| txid |

Format: NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

||||||

| settleaccount |

Format: LIST

Provides information about whether a settlement of balances has been carried out. |

Response Parameter (error)

| errorcode |

Format: NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

| errormessage |

Format: CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

| customermessage |

Format: CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

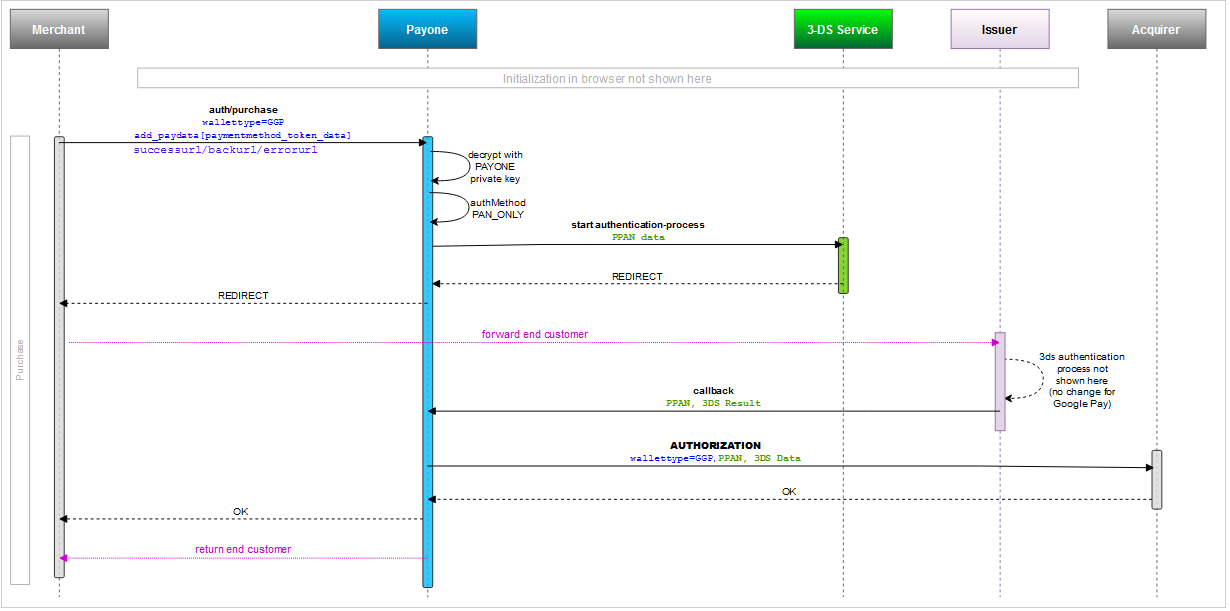

Sequence Diagram

Please ensure that you only offer payment methods through Google Pay™ that are included in your contract with us.

Prerequisites

Onboarding

Merchants with an existing account on our platform who wish to provide Google Pay™ must follow these preparatory steps:

Activate Google Pay™ payment method with us

Please contact PAYONE Merchant Services

register and obtain Google account

To integrate Google Pay™ in your online shop or Android app, you must first register with Google and obtain a Google account. Please follow the checklists below:

accept Google Pay™ Terms of service and acceptable use policy

Before your production access you should read and accept Google Pay™ Terms of Service and adehere to Google Pay™ and Wallet APIs Acceptable Use Policy

meet the Google pay™ API requirements

Check the criteria for Google Pay™ API as described in Setup section of the Google documentation

payone is your gateway

PAYONE handles PCI DSS and alleviates the burden from you when using and integrating Google Pay™. You will receive the encrypted payload (payment token data) from Google Pay™ with the PAYONE Public Key. Use the type: "PAYMENT_GATEWAY" to facilitate integration via the PAYONE Gateway and to avoid receiving PAN data on your end..

You should specify PAYONE as your GatewayId:

- GatewayId: payonegmbh

- Gateway Merchant ID: <your merchant id with PAYONE>

Google Pay™ on Your Website

How Google Pay™ Works

The Google Pay™ API offers a streamlined checkout process, allowing customers to make purchases using payment methods saved to their Google Accounts. This not only simplifies the checkout process but also enhances security, as customer payment data is encrypted from Google's servers to the payment processor. With easy integration, you can implement Google Pay™ with minimal coding, potentially leading to a significant increase in unique users and sales volume.

Checkout the Google Pay - checkout experience pages for more buyer's experience with Google Pay.

source: Google Developers

1. Google Pay™ brand guideline for web

Make sure to follow the Google Pay™ brand guidelines before adding Google Pay™ payment button on your online shop.

2. Integrate Google Pay™ api

Integrate Google Pay™ API in your online shop. For detailed instructions please use the Google Pay™ API web integration guide and Google Pay™ API web integration checklist

---end

You should use the following values for the payment gateway, in accordance with the Tokenization Specifications illustrated below:

- type: "PAYMENT_GATEWAY"

- GatewayId: payonegmbh

- Gateway Merchant ID: <your merchant id with PAYONE>

const tokenizationSpecification = {

type: “PAYMENT_GATEWAY”,

parameters: {

'gateway': 'payonegmbh',

'gatewayMerchantId': 'yourPayoneMerchantID'

}---end

You should configure your online shop to accept only the card schemes that your merchant account supports:

const allowedCardNetworks = ["MASTERCARD", "VISA"];

---end

The Google Pay™ API may return payment cards stored on file with the customer's Google Account (PAN_ONLY) and/or a device token on an Android device. This includes payment data with a cryptogram (CRYPTOGRAM_3DS) generated on the device.

"allowedAuthMethods": ["PAN_ONLY", "CRYPTOGRAM_3DS"]

The PAN_ONLY will automatically follow the 3DS process to obtain liability shift to the issuer.

|

---end

After the customer has completed the payment sheet and authenticated themselves, you as the merchant, will receive a response object with the PaymentMethodTokenizationData from GoolgePay.

|

To process the actual payment, you will need make an API Pre- /Authorization request to PAYONE including the payment token received from Google as Base64 encoded.

---end

|

---end

Google Pay™ in App (android)

How Google Pay™ Works

The Google Pay™ API provides a streamlined checkout process for native Android applications, enabling customers to make purchases using payment methods saved to their Google Accounts within an app. When the customer clicks the Google Pay button in the app, the payment sheet appears, displaying all their saved payment methods and optional fields for shipping address data.

Integration steps with PAYONE are similar to those for the web. However, the integration of the Google Pay API in an online shop or Android app differs.

source: Google Developers

1. Google Pay™ brand guideline for Android

Make sure to follow the Google Pay™ brand guidelines before adding Google Pay™ payment button on Android application.

2. Integrate Google Pay™ api

Integrate Google Pay™ API in your Android application. For detailed instructions please use the Google Pay™ API Android integration guide and Google Pay™ API Android integration checklist

---end

You should use below values for the payment gateway as part of Tokenization Specifications as illustrated below:

- type: "PAYMENT_GATEWAY"

- GatewayId: payonegmbh

- Gateway Merchant ID: <your merchant id with PAYONE>

"tokenizationSpecification": {

"type": "PAYMENT_GATEWAY",

"parameters": {

"gateway": "payonegmbh",

"gatewayMerchantId": "yourPayoneMerchantId"

}---end

You should configure your Android app to accept only the card schemes supported by PAYONE for Google Pay and card schemes that your merchant account supports:

const allowedCardNetworks = ["MASTERCARD", "VISA"];

---end

The Google Pay™ API may return payment cards stored on file with the customer's Google Account (PAN_ONLY) and/or a device token on an Android device, which includes in payment data a cryptogram (CRYPTOGRAM_3DS) generated on the device.

"allowedAuthMethods": ["PAN_ONLY", "CRYPTOGRAM_3DS"]

The PAN_ONLY will automatically follow the 3DS process to obtain liability shift to the issuer.

|

---end

After the customer has completed the payment sheet and authenticated themselves, you as the merchant, will receive a response object with the PaymentMethodTokenizationData from GoolgePay.

To process the actual payment, you will need make an API Pre- /Authorization request to PAYONE including payment token received from Google as Base64 encoded.

---end

|

---end

Google Pay™ Specific Error Messages

| Error | Description | Suggested Activity |

|---|---|---|

| 2702 |

Error decrypting Apple Pay / Google Pay token |

Check the environment settings for GooglePay and mode for PAYONE to match either for Test or for Live. |

| 2703 |

Certificate service declined request because of validation errors. |

Failure to decrypt or validate the Google Pay payment token due to incorrect encoding or malformed json |