payone secured installment

General notes

For every PAYONE Buy Now Pay Later payment method there are general requirements that should be considered for a successful integration:

| Countries | Currency | Special Parameters | Limitations |

|---|---|---|---|

|

Euro |

|

|

Mandatory parameters

The following parameters are mandatory for every PAYONE Buy Now Pay Later payment method:

| Parameter | Description |

|---|---|

| Customer | |

|

customer.businessRelation |

Business relation to the customer. Possible values: B2C or B2B. If B2B is provided, company customer.companyInformation is a mandatory field. |

|

customer.personalInformation.name.firstName |

Given name(s) or first name(s) of the customer |

|

customer.personalInformation.name.surname |

Surname(s) or last name(s) of the customer |

|

customer.personalInformation.dateOfBirth |

The date of birth of the customer |

| Contact Information | |

|

customer.contactDetails.emailAddress |

Email address of the customer |

|

customer.contactDetails.phoneNumber |

Phone number of the customer |

| Billing address | |

|

customer.billingAddress.street |

Street name |

|

customer.billingAddress.zip |

Zip code |

|

customer.billingAddress.city |

City |

|

customer.billingAddress.countryCode |

ISO 3166-1 alpha-2 country code |

| Information about customer's device | |

|

paymentMethodSpecificInput.customerDevice.ipAddress |

The IP address of the customer |

|

paymentMethodSpecificInput.customerDevice.deviceToken |

Tokenized representation of the customer's device (details see below) |

| Shopping cart | |

|

shoppingCart.items.invoiceData.description |

Shopping cart item description. The description will also be displayed in the portal as the product name. |

|

shoppingCart.items.orderLineDetails.productCode |

Product Code |

|

shoppingCart.items.orderLineDetails.productPrice |

The price of one unit of the product |

|

shoppingCart.items.orderLineDetails.quantity |

Quantity of the units being purchased |

|

shoppingCart.items.orderLineDetails.productType |

Enum to classify items that are purchased

|

Device fingerprinting token

|

Snippet parameter explained:

| Parameter | Description | Content |

|---|---|---|

|

environment |

Defines which environment the snippet is called for. During integration, t has to be used to point towards our test environment. Once the integration is finished and for every live processing merchant p has to be used to point towards our production environment. |

Set "t" for Test and "p" for Production |

|

payla_partner_id |

12-digit alphanumeric Identifier provided by Payla. It is fixed. The once assigned ID will not change and is identical for test and production environment. |

Set "e7yeryF2of8X" |

|

partner_merchant_id |

Identifier chosen and provided by PAYONE. It identifies the merchant and allows Payla to distinguish which merchant/shop the fingerprinting is done for. The ID is requested as part of Payla's onboarding. For testing without having a Merchant-ID, you can use "test-1" |

Set your PAYONE Merchant-ID |

|

snippet_token |

For Payla, the most important requirement is the snippet - token being unique per API call. If a consumer calls the snippet multiple times during the checkout process but is in the same session, this token can be used. Once an actual order or risk check has been performed with the snippet_token, Payla expects a new snippet_token for a new API call. The main reason for this is customers switching devices between orders. |

e.g. xyz123abc456_test-1_randomOrSessionadh9029381923 |

Mandatory checkout implementation

Checkout note:

| Language | Text |

|---|---|

|

German |

Mit Abschluss dieser Bestellung erkläre ich mich mit den ergänzenden Zahlungsbedingungen (Link) und der Durchführung einer Risikoprüfung für die ausgewählte Zahlungsart einverstanden. Den ergänzenden Datenschutzhinweis (Link) habe ich zur Kenntnis genommen. |

|

English |

By placing this order, I agree to the supplementary payment terms (link) and the performance of a risk assessment for the selected payment method. I am aware of the supplementary data protection notice (link). |

Links:

| Document | Language | Description | URL |

|---|---|---|---|

|

Terms of payment |

German |

Framework for the use of the mentioned payment methods |

https://legal.paylater.payone.com/de/terms-of-payment.html |

|

Data protection notice |

German |

Describes, among other things, the use of the personal data |

https://legal.paylater.payone.com/de/data-protection-payments.html |

|

Terms of payment |

English |

Framework for the use of the mentioned payment methods |

https://legal.paylater.payone.com/en/terms-of-payment.html |

|

Data protection notice |

English |

Describes, among other things, the use of the personal data |

https://legal.paylater.payone.com/en/data-protection-payments.html |

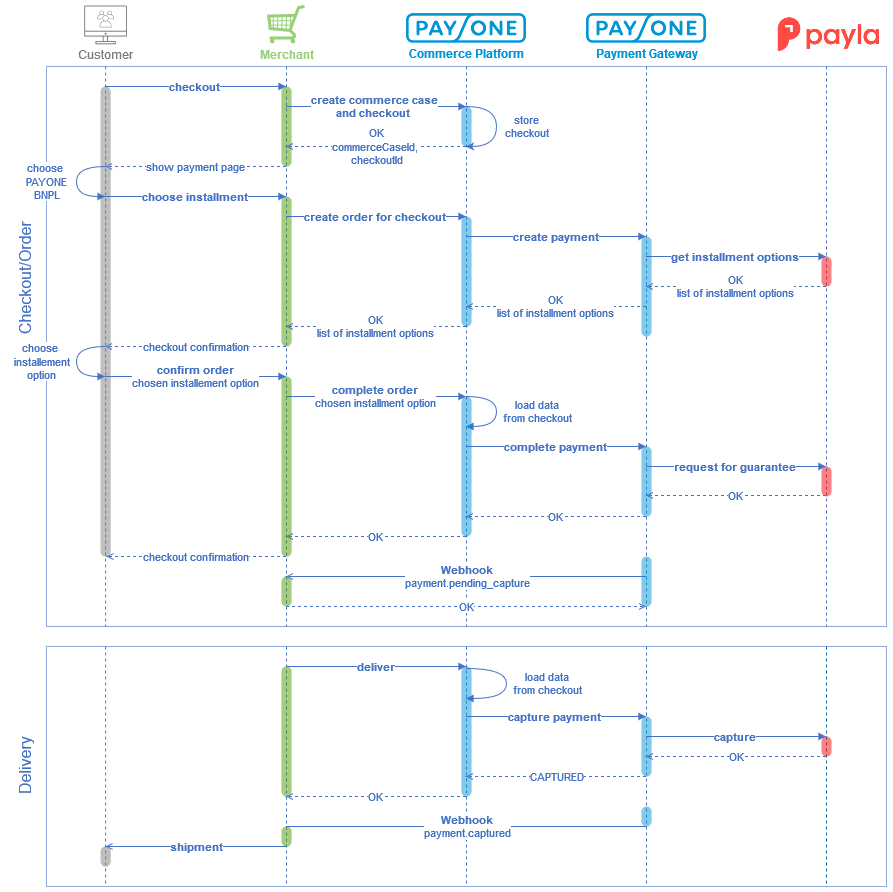

Specific Parameters for PAYONE Secured Installment Payments

PAYONE Secured Installment requires a two-step approach for a successful payment:

- With the initial order request the available installment options will be returned in the response (Note: no personal data of your customer will be provided to the external BNPL provider in this step)

- With the complete-order request the selected installment option has to be provided to finalize the order and to request the guarantee

Structure of financingPaymentMethodSpecificInput for order request:

| Parameter | Description |

|---|---|

|

paymentProductId |

3391 |

Structure of financingPaymentMethodSpecificInput for complete-order request:

| Parameter | Description |

|---|---|

|

paymentProductId |

3391 |

|

requiresApproval |

boolean

|

|

paymentProduct3391SpecificInput.installmentOptionId |

ID of the selected installment option |

|

paymentProduct3391SpecificInput.bankAccountInformation.iban |

IBAN of the customer's bank account. |

|

paymentProduct3391SpecificInput.bankAccountInformation.accountHolder |

Account holder of the bank account with the given IBAN. Does not necessarily have to be the customer (e.g. joint accounts). |

Example

Simple example for a PAYONE Secured Installment payment via Commerce Platform:

- Creating a Checkout (in the example in one step, the creation is also possible in multiple steps)

- Creating an Order for the entire checkout (partial orders are also possible)

- The response will contain the available installment options

- Complete the order with the selected installment option

- Create a Deliver to capture of order amount (partial deliver also possible)

Process flow