Introduction

|

|

Customers with iOS devices or Macs can use Apple Pay to make payments using their stored payment methods. To enable eligible customers to use Apple Pay, merchants should display an Apple Pay button. Upon selection, customers are presented with a payment sheet or a QR code for an easy review of the order and payment details. Apple Pay on the Web can now be used via Payone without the need to have your own Apple developer account, making the integration process simpler and removing additional maintenance and registration with the Apple Pay developer program. |

Disclaimer

At the moment Session initiation request is only available in mode live.

Test mode support will be available at a later time. We apologize for the inconvinience.

---end

Overview

Apple Pay is currently not supported in all countries, please check with Apple Pay if it is available in your country/region. This specific version is not supported in Mainland China.

All currencies that Apple Pay supports are currently also supported by the PAYONE platform.

Supported Payment methods:

- Visa

- Mastercard

- girocard

The Apple Pay token serves as a pseudo card PAN, resembling a credit card number, allowing third-party systems to utilize it without needing to adhere to PCI DSS requirements for storing card data. However This information is not available for the Merchant using Apple Pay without own developer account and can be accessed only by Payment Service Provider responsible for the Payment.

Clearingtype / Clearingsubtype

| clearingtype | wallettype |

| wlt | APL |

Test Data

The test data that can be used is documented on the developer page of Apple Pay

LIABILITY SHIFT

Apple Pay supports liability shift globally for all the major Schemes, except for Visa.

The liability shift rules for Visa are defined as following:

- For devices running iOS 16.2 and above, there is global support for all countries.

- For devices running on versions below iOS 16.2, support is only available for cards issued in Europe region (as defined by Visa).

Liability shift applies only to the Customer-Initiated Transactions (CITs).

It is not available for Merchant-Initiated Transactions (MITs) since the cardholder is not present in-session for biometrics authentication.

However in certain scenarios the liability can stay with a Merchant if it was indicated in the Apple Pay payload by providing a specific ECI value.

Please make sure you only make payment methods available for Apple Pay which are part of your contract with us.

Sequence Diagram

Significantly simplified sequence diagram in order to present the implementation with Payone Server API showing a sample positive scenario of a Authorization request.

Apple Pay implementation is done on the Merchant side and is presented simplified with a focus on a Session retrieval and payment requests being sent.

Compared to a regular credit card payment there is no 3ds flow and no redirect needed.

Prerequisites

Opposed to the Apple pay integration with your own Apple Pay Developer Accounts, there is no need to create or have a Developer Account with Apple, but there are other requirements which should be followed.

In order to begin processing with Apple Pay you should contact our customer support, however first ensure that you have completed the Domain verification steps described below.

Domain Verification and server Setup

Prior to requesting the Apple Pay without Developer account with our Merchant Services team , prepare your website for registration (please follow steps described below) with Apple pay. Please see the same process should be completed each time you change any URL`s or would like to enable a new Merchant ID (MID) or Portal.

Step 1 - Put the following file to your web page to the dedicated URL defined below.

This step to be done by you before requesting Apple Pay with payone.

Please use the following file that have to be hosted on your webpage

Download domain verification file

The Domain verification file (apple-developer-merchantid-domain-association) should be available via following URL :

First, create a folder named .well_known/ in your system's web root directory. Then, copy the domain verification file into the folder you just created. After that, the above URL should work.

Your web server may be configured to block access to this address. Depending on your system configuration, you might be able to make changes to an .htaccess file. In this case, you could add a rewrite rule at the beginning to allow access.---end

|

---end

Step 2 - Setup your Server and Web Page

Follow Apple guidelines for Server Setup. You should specifically allow Apple IP Addresses for Domain Verification and payment processing.

Please ensure that domain has a valid SSL certificate. For future it is crucial to update the certificate not later than 7 days prior to it`s expiration to keep Apple Pay functional. If not done in the mentioned time, contact our merchant service team to onboard you to Apple Pay again.

Step 3 - Requesting a Merchant Identifier

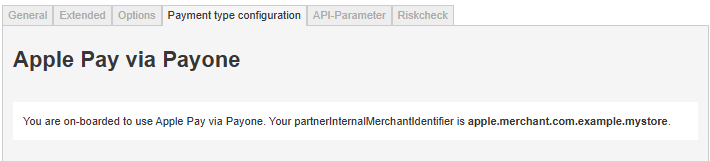

Once all prerequisites are done, contact our Merchant Services team in order to be on-boarded and receive merchantIdentifier. You will need this identifier in order to begin payment processing with Apple Pay on the Web.

You will be able to see your merchantIdentifier in the PMI for the onboarded Portal once the registration is completed. This can be found at the following path : CONFIGURATION/PAYMENT PORTALS - choose an onboarded Portal and go to Payment type configuration tab.

Apple Pay on Your Website

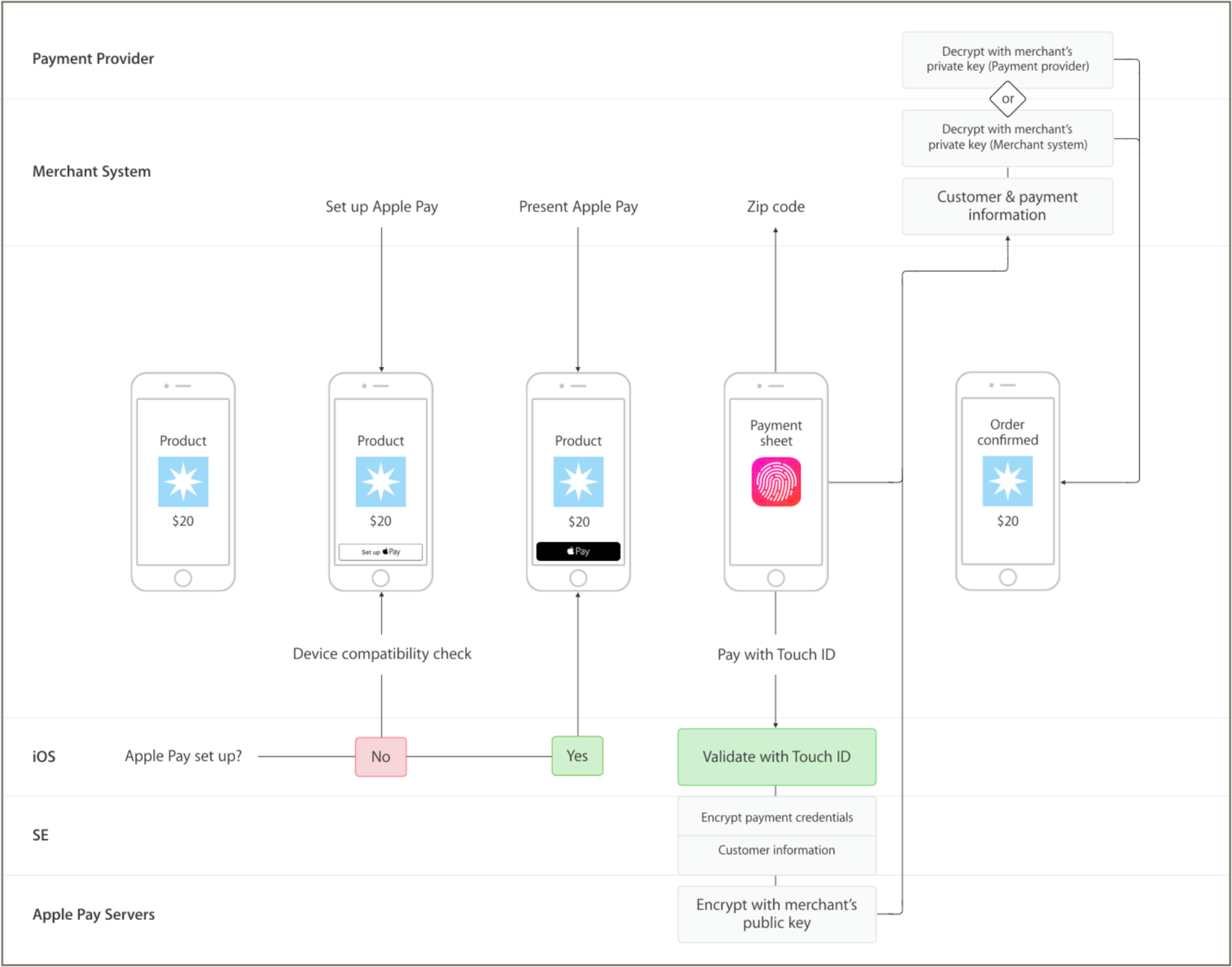

How Apple Pay Works

Similar to other payment buttons, Apple Pay is designed to bypass the typical checkout steps by displaying a comprehensive payment sheet to the customer.

source: Apple

Initiating The Payment Session

Apple Pay on the Web

Apple Pay on the Web utilizes JavaScript APIs integrated into Safari on both Mac and mobile devices.

In order to be able to process the transaction with Apple Pay without developer account, you will need to implement a session retrieval process for the onvalidatemerchant event, which would be done against Payone Endpoint using a generic request.

New Apple Pay on the web without a developer account special parameters

| API PARAMETER | REQUIRED | Definition |

| add_paydata[action]="init_applepay_session" | YES | Generic action |

| add_paydata[display_name]="testStore" | YES | Merchant Display Name |

| add_paydata[domain_name]="aTestDomain"' | YES |

Merchant Domain Name |

Sample Session initiation request

Please use the following generic request to retrieve a session against Payone Server API

request="genericpayment"

mid="1234"

aid="1235"

portalid="2013224"

key="123456789abcdefghij"

mode="live"

clearingtype="wlt"

wallettype="APL"

currency: "EUR"

add_paydata[action]="init_applepay_session"

add_paydata[display_name]="testStore"

add_paydata[domain_name]="aTestDomain"Sample Session initiation Response

"status": "OK",

"workorderid": "PP2AADH3T16XW53W",

"add_paydata[applepay_payment_session]": "BASE64_encoded_STRING"You will have to decode the session data from BASE64 and use it `as is` to identify yourself with Apple Pay

Apple Pay Button display

"For information on displaying the buttons and initiating the payment session, please refer to the Apple documentation: https://developer.apple.com/documentation/apple_pay_on_the_web/displaying_apple_pay_buttons and https://developer.apple.com/documentation/apple_pay_on_the_web/apple_pay_js_api/creating_an_apple_pay_session

Visit https://applepaydemo.apple.com for a comprehensive overview and some demo code.

Ensure that your payment request is configured correctly to align with your merchant account capabilities. For instance, a basic request for a merchant who can process Mastercard, Visa, and girocard in live mode might look like this:

{

"countryCode": "DE",

"currencyCode": "EUR",

"merchantCapabilities": [

"supports3DS" // mandatory

],

"supportedNetworks": [

"visa",

"masterCard",

"girocard"

],

"total": {

"label": "Demo (Card is not charged)",

"type": "final",

"amount": "1.99"

}

}Handling of Co-Badged Cards

Starting with iOS 15.4, the Apple Pay APIs will honor the order in which the supportedNetworks array is listed. If both networks of a co-badged card are supported by the merchant and the customer’s default card is co-badged, the pre-selected network will be chosen based on the listed order of the networks. This preference affects only the user’s default card (if it’s co-badged), as merchants cannot change the default card selection. However the customer can choose what network he will use.

For Mastercard co-badged Girocards, you can specify the preferred network order like this:

|

|

Apple Pay In-App

Apple Pay in the App is not supported without Developer Account as this a limitation from Apple. You will need to have your own developer account and implement the regular version of the Apple Pay available from Payone.

Forwarding the Token Data to the Payone API

After the customer completes the payment sheet and authenticates using biometric methods (such as Touch ID or Face ID), you'll receive an Apple Pay object like this:

|

Many contents of this object can be mapped to existing Server API parameters.

|

Apple Pay Object

|

⇨ |

PAYONE Server API

|

However, the payment component of the object is encrypted and must be sent to the PAYONE API using specific parameters.

Please note that the token generated by Apple has a limited lifespan of 5 minutes. In live mode (mode=live), PAYONE is required to reject expired tokens.

Apple Pay Specific Error Messages

| Error | Description | Suggested Activity |

|---|---|---|

|

apple-pay-technical-error |

Your domain is no longer activated. This could have happened due to the loss of registration with Apple. Main reason for it is a failure to update the SSL certificate on time. Contact our Merchant services team to enable yourself again with Apple Pay |

|

|

validation-error - missing-domain-name |

Provide the domain name in the API Request |

|

|

validation-error - missing-display-name |

Provide the display name in the API Request |

|

| 2700 |

Request amount differs from apple pay token amount. |

Make sure to use the same amount as in your Apple Pay payment sheet |

| 2701 |

Request currency differs from apple pay token amount. |

Make sure to use the same currency as in your Apple Pay payment sheet |

| 2702 |

Failed to decrypt apple pay token |

Check whether your Payment Processing Certificate is valid and uploaded to our merchant backend |

| 2703 |

Certificate service declined request because of validation errors. |

|

| 2704 |

Required parameter in apple pay token is missing or empty |

Check if all required parameters for the Apple Pay token are set |

Integrations

The API request below describe only Apple Pay on the web without specific Payment requests.

Standard request such as Capture, Debit, Refund should be done as for creditcard with defining a clearingtype="wlt" and wallettype="APL"

POST Genericpayment

Account Parameters

|

request

required

|

Fixed Value: preauthorization

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

Techical DATA Parameters

|

mode required

|

Format CHAR(2..50)

Payment mode - can be test or live. Only live mode is supported at the moment. Test mode will be available later this year.

---end

|

|

clearingtype required

|

Should be set as wlt as for other walllet based payment methods |

|

wallettype required

|

Should be set as APL for Apple Pay |

|

Currency

required

|

Format ISO 4217 3-letter codes example: EUR |

add_paydata PARAMETERS

|

add_paydata[action]

required

|

Format STRING

init_applepay_session

|

|

add_paydata[display_name]

required

|

Format STRING Will be displayed to the Endconsumer in the Apple UI |

|

add_paydata[domain_name]

required

|

Format STRING

Your domain name that uses Apple Pay

|

|

status

|

Permitted Values

OK

ERROR

|

Response Parameter (Approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(9..12)

PAYONE User ID, defined by PAYONE |

Response Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

request="genericpayment"

mid="1234"

aid="1235"

portalid="2013224"

key="123456789abcdefghij"

mode="live"

clearingtype="wlt"

wallettype="APL"

currency: "EUR"

add_paydata[action]="init_applepay_session"

add_paydata[display_name]="testStore"

add_paydata[domain_name]="aTestDomain"

RESPONSE

"status": "OK",

"workorderid": "PP2AADH3T16XW53W",

"add_paydata[applepay_payment_session]": "BASE64_encoded_STRING"

POST Request Pre- /Authorization

Account Parameters

|

request

required

|

Fixed Value: preauthorization

|

|

mid

required

|

your merchant ID, 5-digit numeric

|

|

aid

required

|

your subaccount ID, 5-digit numeric

|

|

portalId

required

|

your Portal ID, 7-digit numeric

|

|

key

required

|

your key value, alpha-numeric

|

PERSONAL DATA Parameters

|

firstname

optional

|

Format CHAR(1..50)

First name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

lastname

required

|

Format CHAR(2..50)

Last name of customer; optional if company is used, i.e.: you may use "company" or "lastname" or "firstname" plus "lastname" |

|

company

optional

|

Format CHAR(2..50)

Company name, required for B2B transactions (if add_paydata[b2b] = “yes”) |

|

street

optional

|

Format CHAR(1..50)

Street number and name (required: at least one character) |

|

zip

optional

|

Format CHAR(2..50)

Permitted Symbols [0-9][A-Z][a-z][_.-/ ]

Postcode |

|

city

optional

|

Format CHAR(2..50)

City of customer |

|

country

required

|

Format LIST

Permitted values ISO 3166 2-letter-codes

Samples

DE GB US Specifies country of address for the customer. Some countries require additional information in parameter "state"

|

|

email

optional

|

Format CHAR(5..254)

Permitted Symbols RFC 5322 Special Remark email validation: Max. length for email is 254 characters. Validation is set up in the following way: Username = Max. 63 characters Domain Name = Max. 63 characters "@" and "." is counted as a character as well; in case of a total of three suffixes, this would allow a total of 254 characters. email-address of customer |

|

birthday

optional

|

Format DATE(8), YYYYMMDD

Samples 20190101 / 19991231 Date of birth of customer |

|

telephonenumber

optional

|

Telephone number |

add_paydata PARAMETERS

|

add_paydata[paymentdata_token_version]

required

|

Format STRING

Sample EC_v1 |

|

add_paydata[paymentdata_token_data]

required

|

Sample rhHAQUrR118u[...]cwDw== |

|

add_paydata[paymentdata_token_signature]

required

|

Format STRING

Sample MIAGCSqGSIb3DQEHAqCAMIACAQE[...] |

|

add_paydata[paymentdata_token_ephemeral_publickey]

required

|

Sample MFkwEwYHKoZIzj0[...]Y2A== |

|

add_paydata[paymentdata_token_publickey_hash]

required

|

Format STRING

Sample ilecVF58bpB8qio[...]l6eirw2Y1v1KU |

|

add_paydata[paymentdata_token_transaction_id]

|

Format STRING

Sample be2e745845b31dfac7778c6e29[...] |

Response Parameters

|

status

|

Permitted Values

APPROVED

ERROR

|

Response Parameter (Approved)

|

txid

|

Format NUMERIC(9..12)

The txid specifies the payment process within the PAYONE platform |

|

userid

|

Format NUMERIC(9..12)

PAYONE User ID, defined by PAYONE |

Response Parameter (Error)

|

errorcode

|

Format NUMERIC(1..6)

In case of error the PAYONE Platform returns an error code for your internal usage. |

|

errormessage

|

Format CHAR(1..1024)

In case of error the PAYONE Platform returns an error message for your internal usage. |

|

customermessage

|

Format CHAR(1..1024)

The customermessage is returned to your system in order to be displayed to the customer. (Language selection is based on the end customer's language, parameter "language") |

Host: api.pay1.de Content-Type: application/x-www-form-urlencoded

Payload

add_paydata[paymentdata_token_data]=FpFyA6zSGkZC[...]xi8xeXCNbpGBpvlNXfcang==

add_paydata[paymentdata_token_ephemeral_publickey]=MFkwEwYHKoZIzj0CA[...]iXv34cYJ4lxZsjVgnsE0i6RX+mg==

add_paydata[paymentdata_token_publickey_hash]=tWOdQ0ARSRiQNsrS4[...]7X6KBxLLAa8=

add_paydata[paymentdata_token_signature]=MIAGCSqGSIb3DQEHAq[...]s9oHcqWMnolhsgAAAAAAAA

add_paydata[paymentdata_token_transaction_id]=12d7[...]d4eebc2e54109386

add_paydata[paymentdata_token_version]=EC_v1

aid=12345

amount=1000

api_version=3.11

cardtype=V

clearingtype=wlt

country=DE

currency=EUR

encoding=UTF-8

firstname=Demo

key=123456789abcdefghij

lastname=Dude

mid=12345

mode=test

portalid=123456

reference=013265464564654

request=preauthorization

wallettype=APL

RESPONSE

status=APPROVED

txid=123456789

userid=987654321