Payments Assignment Introduction

With account-based payment methods such as advance payment, invoice and direct debit, the incoming payments have to be assigned to the appropriate payment processes on an account.

The assignment of the payment from the receipt of the payment to the payment process largely takes place automatically on the PAYONE platform on the basis of a calculated scoring which is, among others, based on the name of the account holder, the amount of the incoming payment, and the account data provided by the bank. If it is possible to clearly find a payment process with the data which is provided on the account statement, and if an incoming payment is still expected there, then an automatic assignment takes place.

If the payment process has already been settled and no further incoming payment is therefore expected, or if no data was found in the account statement which enable a clear allocation then a manual assignment of the incoming payment is required. This manual assignment is initially completed by specially trained PAYONE employees. If it is not possible to make a clear link between the incoming payment and the payment process here, then an email enquiry is sent to the merchant with the request to provide notification as to whether and/or how this incoming payment is to be entered.

With the assignment of the payment in the PMI, it is now possible for the merchant to assign an open payment process independently if a manual assignment by PAYONE itself is not possible. The payment process is set to "Clarification by the merchant" by PAYONE and is therefore visible in the payment assignment in the merchant's PMI. The merchant can now look for a suitable payment process in the PMI and assign the incoming payment themselves accordingly.

Overview of the Open Incoming Payments

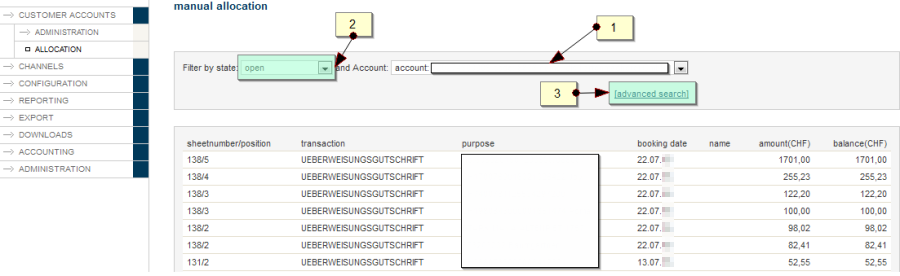

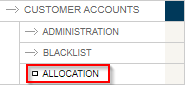

You can find the assignment of payments in the PMI in the main navigation menu:

---end

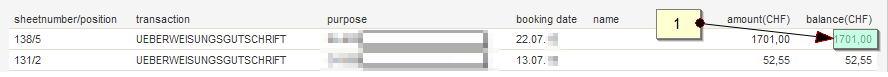

| field name | Beschreibung | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

sheetnumber/position |

number of the entry and its position |

||||||||||

|

Process |

Entry text from the account statement, here is a list of the most frequent entry texts The entry texts are not standardised and are determined individually by every bank. PAYONE shows the entry text from the account statement – such that it was made available. Should you have any questions, please contact your account-holding bank.:

---end |

||||||||||

|

purpose |

the first intended purpose field |

||||||||||

|

Entry date |

Entry date from the account statement |

||||||||||

|

Name |

Name of the account holder – if stated in the account statement |

||||||||||

|

Amount (currency) |

the original sum from the incoming payment

---end |

||||||||||

|

Remaining amount (currency) |

the original sum from the incoming payment |

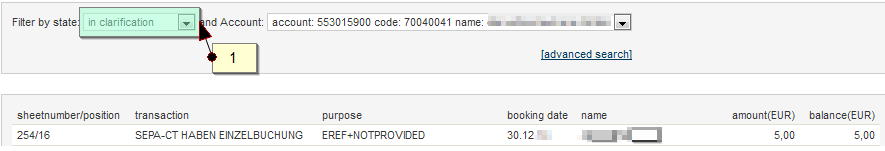

Advanced Search

The "not allocated" incoming payments from the last three months are shown as standard. With the advanced search feature, you can optionally show the as yet "not assigned" or "already assigned" incoming payments in a time frame that you have selected. The results can also be filtered with a text search via the intended purpose fields A search is supported on the intended purpose fields 1 to 6.

---end

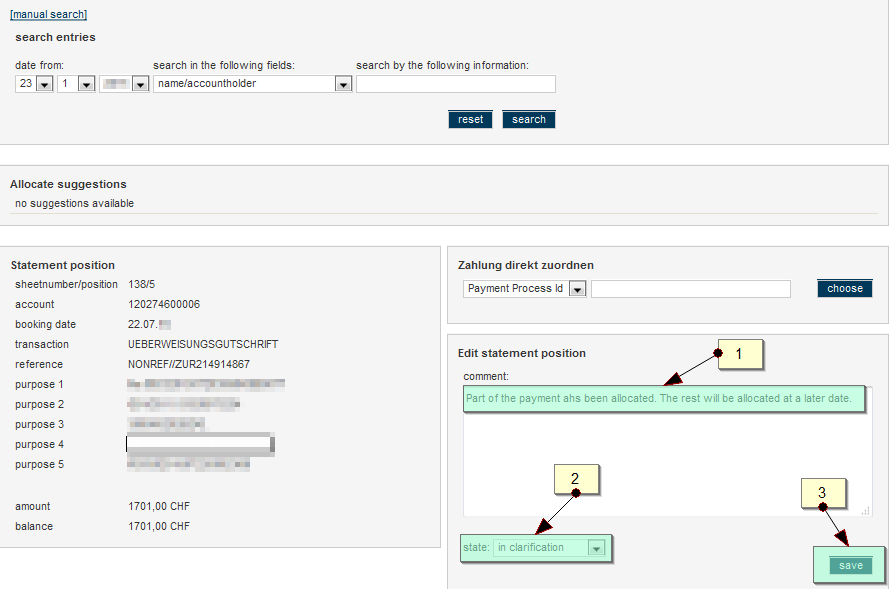

Assignments

Assignment via Name Search

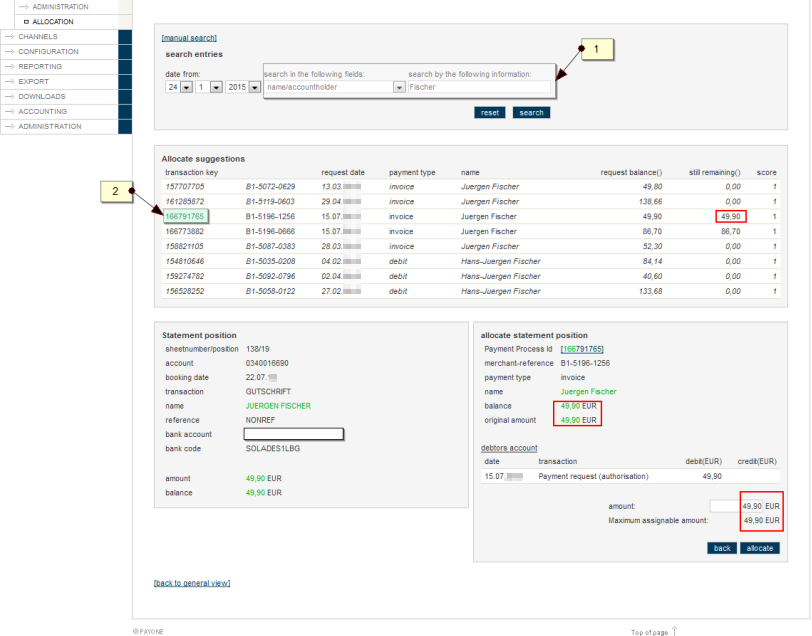

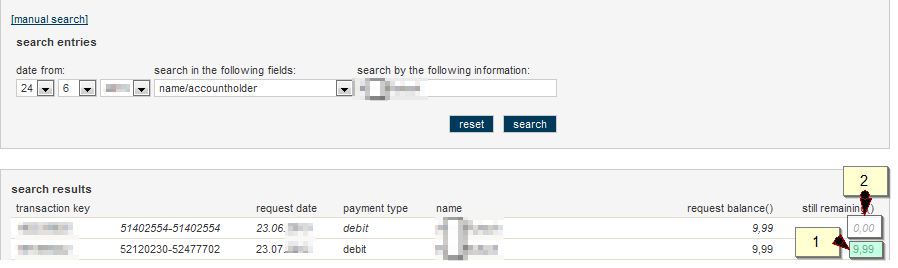

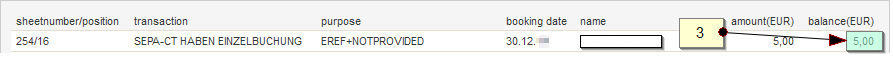

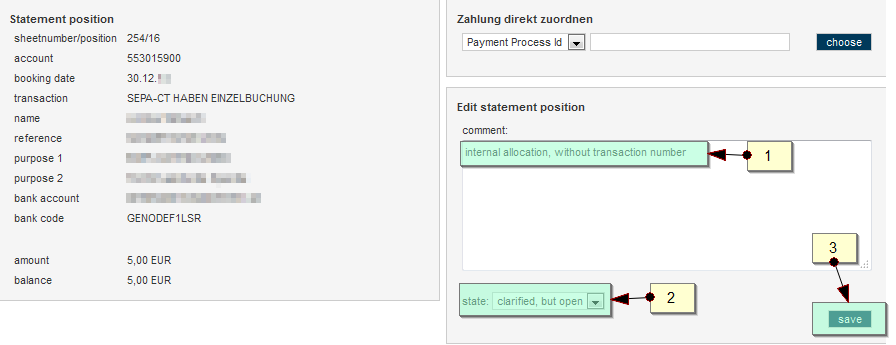

Once a line from the list of open incoming payments is selected, the details concerning the incoming payment are then shown. Above this display, in the search field (1) you now have the choice of searching for the name or a reference number (your order number).

The search results are then displayed underneath. In this example, there was only one match during the search for the name The search for the name is flexible with regard to upper and lower case lettering and converts umlauts automatically. A search for parts of a name is not supported. This means it is possible to search for "Schroeder", "Schröder" or "schröder" – but not for "schröd".. After selecting this match (2), the details on the incoming payment are shown and possible matches are highlighted in green. The remaining sum of the incoming payment and the open sum of the payment process match and the name is also of sufficient similarity (Maxime is also known as "Maxi"), which means an assignment of this incoming payment to the payment process that was found can be completed.

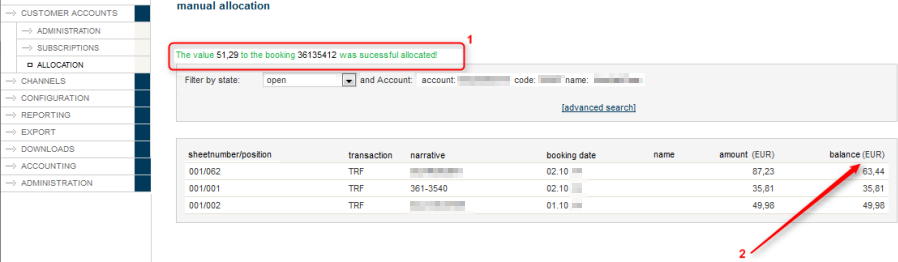

In the aforementioned example, the sum of the receivable from the payment process corresponds to the sum of the incoming payment, which means that the entire sum of the incoming payment has to be entered. Therefore, click on "assign" (3) in order to complete the action.

For this purpose, the sum which is to be assigned is entered in the input field on the bottom right. It is possible to choose between entering the total sum from the incoming payment or a partial sum on the selected payment process.

Only enter payment processes if these are clearly in the direct context of the incoming payment and a clear assignment is to be made.

This process cannot be reversed.

---end