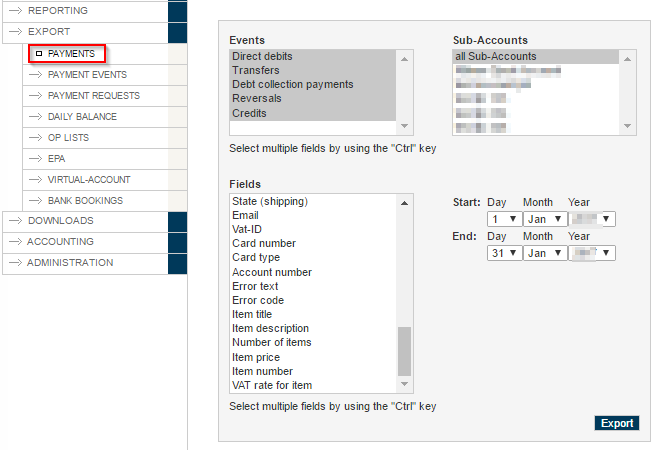

Payments

The payments export enables you to export your previous transaction data in the PAYONE Merchant Interface (PMI). In this context, differing criteria can be freely selected and are explained in further detail in the following parts of this document.

Different types of process can be exported: with the multiple selection feature, it is also possible for several or all of the types of process to be contained in a single export file.

| Parameter | Kommentar |

|---|---|

|

Direct debits Source |

collection in the direct debit process, debiting of credit cards, etc. |

|

Transfers Source |

advance payment, cash on delivery, invoice, online credit transfer |

|

Debt collection payments Source |

payments made via your debt collection service provider |

|

Reversals Source |

return payments with direct debit payments, charge backs with credit card payments |

|

Credits Source |

return credit transfers triggered by the merchant, e.g. on the purchaser's bank account, on their credit card account, or on their PayPal account. |

Please note:

With incoming credit transfers and chargebacks, the date of the account statement applies. With debit entries and credit entries, the date on which they were carried out applies, but not the date on which the debit entry and/or the credit transfer was entered on the account.

| Parameter | Kommentar |

|---|---|

|

Creation time |

date/time on which the payment was acquired by the system |

|

Booking date |

date under which the payment was acquired in the accounting Booking date (YYYYMMDD) |

|

Document date |

date of the business transaction in question (date of the receipt of payment) Document date (YYYYMMDD) |

|

Document reference |

external reference number of the payment, e.g. account statement number |

|

Process-Parameter |

individual parameter |

|

Event |

type of process |

|

Payment type |

category of payment method C.f. clearingtype |

|

Sub type (of payment) |

with which the transaction was completed (provider) C.f. subtype - export |

|

Amount |

amount of the transaction |

|

Currency |

currency in which the transaction was completed |

|

First name |

first name of the purchaser |

|

Surname |

surname of the purchaser |

|

Company |

company of the purchaser |

|

Address addition |

Additional information on the address of the purchaser |

|

Street |

street of the purchaser |

|

Town |

location of the purchaser |

|

Postcode |

postcode of the purchaser |

|

Country |

country of the purchaser |

|

State |

region of the purchaser |

|

First name (shipping) |

first name of the consignee |

|

Last name (shipping) |

surname of the consignee |

|

Company (shipping) |

company of the consignee |

|

Address addition (shipping) |

Additional information on the address of the consignee |

|

Street (shipping) |

street of the consignee |

|

Street number (shipping) |

street number of the consignee |

|

City (shipping) |

location of the consignee |

|

Zip (shipping) |

postcode of the consignee |

|

Country (shipping) |

Firma des Sendungsempfängers |

|

State (shipping) |

country of the consignee |

|

Straße (Versand) |

region of the consignee |

|

|

Hausnummer des Sendungsempfängers |

|

Ort (Versand) |

Ort des Sendungsempfängers |

|

PLZ (Versand) |

Postleitzahl des Sendungsempfängers |

|

Land (Versand) |

Land des Sendungsempfängers |

|

Region (Versand) |

Region des Sendungsempfängers |

|

|

email address of the consignee |

|

Vat-ID |

Vat-ID of the purchaser |

|

Card number |

with credit card payments: Card number in secure format |

|

Card type |

with credit card payments: Account number of the purchaser |

|

Account number |

bank account number of the purchaser |

|

Error text |

with chargebacks, refer to the "API documentation" |

|

Error code |

with chargebacks, refer to the "API documentation" |

|

Item title |

title of the item |

|

Item description |

description of the item |

|

Number of items |

quantity of the items |

|

Item price |

price of the item |

|

Item number |

number of the item |

|

VAT rate for item |

VAT rate of the item |

Examples

Here you can download an example export for Payment as CSV-file:

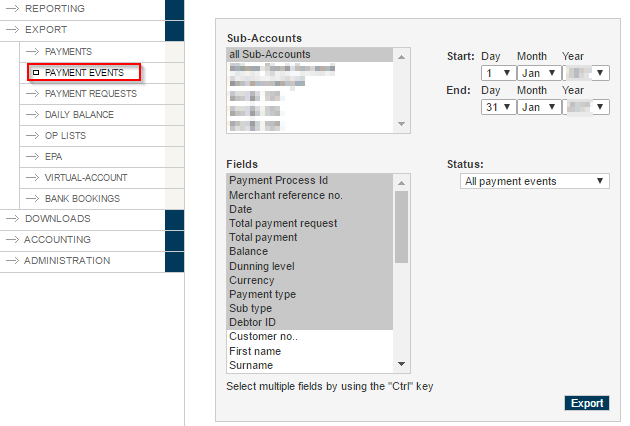

Payment Events

The payment processes export shows the status of the payment processes for either individual or all of the available sub-accounts available at the time of the export. It is possible to filter within the payment processes according to specific circumstances, such as all of the receivables which are currently at a certain dunning level. The different criteria can be freely selected and are explained in further detail in the following parts of this document.

- All payment events

- Outstanding payment events

- Dunning proposal list

- Dunning level 1

- Dunning level 2

- Dunning level 3

- Dunning level 4

- Debt collection proposal list

- With debt collection agency

- Settled payment events

Weitere Parameter:

|

Parameter |

Kommentar |

|---|---|

| Account-ID | ID of the Sub-Account within the PAYONE Plattform |

| Payment Process Id | process number of the PAYONE platform |

| Serial no. | sequence number of the step within the transaction |

| Merchant reference no. | reference number of the merchant which was handed over to the PAYONE platform with the booking |

| Date | initiation of the payment process (UNIX time stamp) |

| Total payment request | sum of all receivables (in the biggest currency unit! e.g. EURO) |

| Total payment | sum of all payments (in the biggest currency unit! e.g. EURO) |

| Balance | of the process account (in the biggest currency unit! e.g. Euro) |

| Dunning level | dunning status of the purchaser |

| Currency | pecifies currency for this transaction, Format: ISO 4217 (currencies) 3-letter-codes |

| Payment type | category of payment method C.f. clearingtype |

| Sub type (of payment) | with which the transaction was completed (provider) C.f. subtype - export |

| (PAYONE) Debtor ID | PAYONE debtor no. |

| (Merchant) Customer no. | customer number with merchant |

| First name | first name of the purchaser |

| Surname | surname of the purchaser |

| Company | possible company name of the purchaser |

| Address addition | Additional information on the address of the purchaser |

| Street | street name of the invoice address |

| Town | location of the invoice address |

| Postcode | postcode of the invoice address |

| Country | country of the invoice address (ISO - 3166) |

| State | region of the purchaser |

| First name (shipping) | first name of the consignee |

| Last name (shipping) | surname of the consignee |

| Company (shipping) | company of the consignee |

| Address addition (shipping) | Additional information on the address of the consignee |

| Street (shipping) | street of the consignee |

| Street number (shipping) | street number of the consignee |

|

City (shipping) |

location of the consignee |

|

Zip (shipping) |

postcode of the consignee |

|

Country (shipping) |

country of the consignee |

|

State (shipping) |

region of the consignee |

|

|

email address of the invoice recipient |

example

Here you can download an example export for Payment Events as CSV-file:

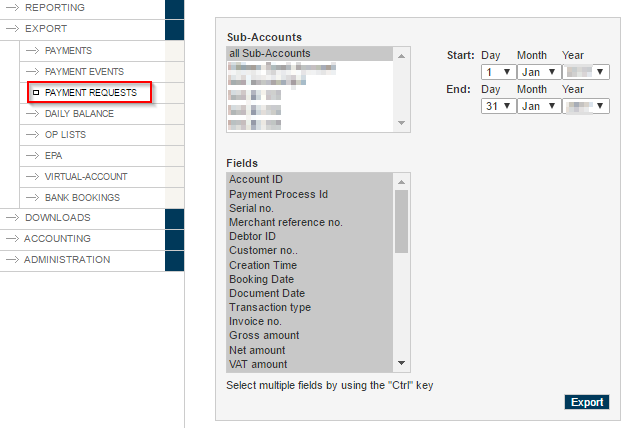

Payment Requests

The Receivables export shows all of the receivables to have been entered for either individual or all of the available sub-accounts, and can be downloaded by authorised users in the PAYONE Merchant Interface (PMI). In this context, the different criteria can be selected freely and are described in the following parts of this document.

further Parameter:

|

Parameter |

Kommentar |

|---|---|

|

Account-ID |

ID of the sub-account of the PAYONE platform |

|

PAYONE process Id |

process number of the PAYONE platform |

|

Serial no. |

sequence number of the step within the transaction |

|

Merchant reference no. |

reference number of the merchant which was handed over to the PAYONE platform with the booking |

|

(PAYONE) Debtor no. |

automatically assigned PAYONE platform internal customer number (return parameter user-ID) |

|

(Merchant) Customer no. |

customer number of the purchaser with the merchant which was handed over to the PAYONE platform with the booking (request parameter customer ID) |

|

Creation time |

date/time on which the payment was acquired by the system |

|

Booking date |

date under which the payment was acquired in the accounting |

|

Document date |

date of the business transaction in question (date of the receipt of payment) |

|

Transaction type |

receivable type C.f. 5.3 |

|

Invoice no. |

Fbill number with merchant |

|

Gross amount |

gross sum of the receivable |

|

Net amount |

net sum of the receivable |

|

VAT amount |

VAT sum of the receivable |

|

VAT rate |

rate of VAT in percent |

|

Currency |

Währung, in der die Transaktion abgewickelt wurde |

|

First name |

first name of the purchaser |

|

Surname |

surname of the purchaser |

|

Company |

company of the purchaser |

|

Address addition |

Additional information on the address of the purchaser |

|

Street |

street of the purchaser |

|

Town |

location of the purchaser |

|

Postcode |

postcode of the purchaser |

|

Country |

country of the purchaser |

|

State |

region of the purchaser |

|

First name (shipping) |

first name of the consignee |

|

Last name (shipping) |

surname of the consignee |

|

Company (shipping) |

company of the consignee |

|

Address addition (shipping) |

Additional information on the address of the consignee |

|

Street (shipping) |

street of the consignee |

|

Street number (shipping) |

street number of the consignee |

|

City (shipping) |

location of the consignee |

|

Zip (shipping) |

postcode of the consignee |

|

Country (shipping) |

country of the consignee |

|

State (shipping) |

region of the consignee |

|

|

email address of the consignee |

|

Vat-ID |

Vat-ID of the purchaser |

example

Here you can download an example export for Payment Requests as CSV-file:

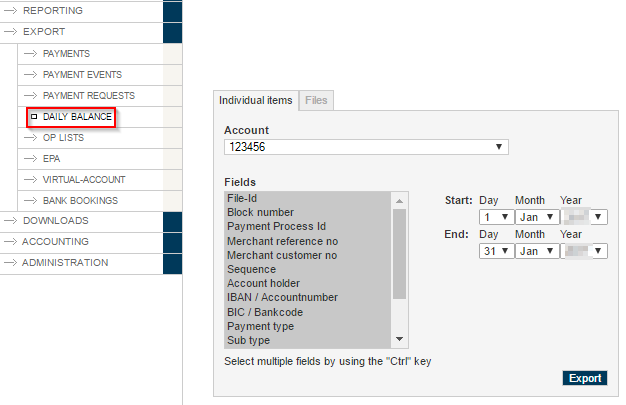

Daily Balance

The daily closing export offers the possibility of exporting individual items and files of the daily closings that have been completed. In these daily closings, the direct debits and credit transfers from one day or several days are summarised.

---end

| Parameter | Kommentar |

|---|---|

|

File ID |

File transfer exchange number (with the credit transfer of (collective-) direct debits, this number is shown in the intended purpose of the account statement). In the export it is possible to see which individual customer payments are located in a collector. |

|

Block number |

aggregation of SEPA direct debits depending on the due date |

|

Payment process Id |

PAYONE process ID |

|

Merchant reference no. |

merchant reference number |

|

Merchant customer no. |

customer number with merchant |

|

Sequence |

sequence number |

|

Account holder |

owner of the account |

|

IBAN / Account number |

IBAN/account number of the account |

|

BIC / Bankcode |

Sort code |

|

Payment type |

category of payment method C.f. clearingtype |

|

Sub type (of payment) |

with which the transaction was completed (provider) C.f. subtype - export |

|

Amount |

total price in the smallest currency unit |

|

Purpose |

dynamic text component |

|

Mandate reference |

SEPA credit transfer reference (can be generated by PAYONE or is given by the merchant as a parameter) |

|

Date of mandate |

the mandate was issued |

---end

Example

Here you can download an example export for Daily Balance as CSV-file:

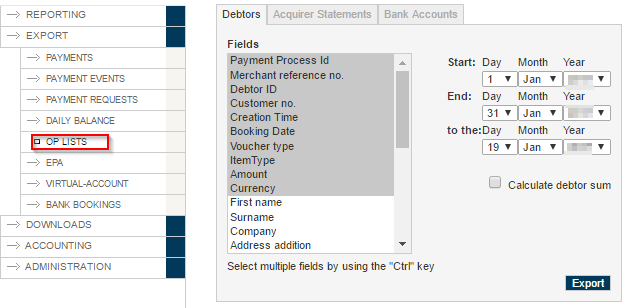

OP-Lists

The OP list (open items list) export can be downloaded by authorised users in the PAYONE Merchant Interface (PMI). In this context, all of the open items from a definable time frame are exported at a definable target date from the past. In this way, for example, it is possible for all of the open items to be viewed which occurred in January and were still open in March. In this context, an open item can also be an overpayment.

Open items can be displayed accordingly using the Acquirer Statements and Bank Accounts tabs. If several bank accounts are used, these can be selected separately.

---end

For Debtor and Acquirer Statements:

---end

|

Fieldname |

description |

|---|---|

|

PAYONE process Id |

PAYONE process ID |

|

Merchant reference no. |

merchant reference number, which was given with the transaction to PAYONE |

|

(PAYONE) Debtor no. |

automatically assigned PAYONE platform internal customer number (return parameter user-ID) |

|

(Merchant) Customer no. |

customer number with merchant, which was given with the transaction to PAYONE (Request Parameter customer-ID) |

|

Creation time |

date/time on which the payment was acquired by the system |

|

Booking date |

date under which the payment was acquired in the accounting |

|

Voucher type |

type of business transaction |

|

Item type |

type of entry |

|

Amount |

transaction sum |

|

Currency |

currency in which the transaction was completed |

|

First name |

first name of the purchaser |

|

Surname |

surname of the purchaser |

|

Company |

company of the purchaser |

|

Address addition |

Additional information on the address of the purchaser |

|

Street |

street of the purchaser |

|

Town |

location of the purchaser |

|

Postcode |

postcode of the purchaser |

|

Country |

country of the purchaser |

|

State |

region of the purchaser |

|

First name (shipping) |

first name of the consignee |

|

Last name (shipping) |

surname of the consignee |

|

Company (shipping) |

company of the consignee |

|

Address addition (shipping) |

Additional information on the address of the consignee |

|

Street (shipping) |

street of the consignee |

|

Street number (shipping) |

street number of the consignee |

|

City (shipping) |

location of the consignee |

|

Zip (shipping) |

postcode of the consignee |

|

Country (shipping) |

country of the consignee |

|

State (shipping) |

region of the consignee |

|

|

email address of the consignee |

---end

For bank accounts:

---end

| Field name | description |

|---|---|

|

Statement number |

number of the account statement |

|

Creation time |

date/time on which the payment was acquired by the system |

|

Booking date |

date under which the payment was acquired in the accounting |

|

Voucher type |

type of business transaction |

|

Item type |

type of entry |

|

Amount |

transaction sum |

|

Currency |

currency in which the transaction was completed |

|

Bookingtext |

text which is supplemented by the intended purpose (dynamic) |

|

Reason for payment 1-10 |

dynamic text component |

|

Account holder |

Owner of the account |

|

Bank account |

account number of the account |

|

Bank Code |

sort code |

Example

Here you can download an example export for OP-Lists as CSV-file:

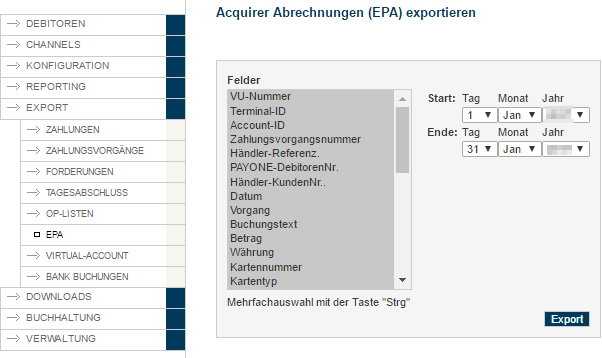

EPA

EPA files (Electronic Payment Advice) are Settlement files from Acquirers, and just like an account statement, they contain information about completed payments, chargebacks and credit entries. EPA files can be obtained from the PAYONE platform, and just like account statements, automatically processed and assigned to the processing account. Acquirers regularly pay the credit balance from completed credit card transactions into the contractual partner's bank account. In this context, the transactions from the accounting period in question are generally summarised in one invoice. At the same time, the individual transaction-related information from a settlement is generated as an EPA file and provided by the Acquirer.

|

Field name |

description |

|---|---|

|

VU-Nummer |

contractual company number |

|

Terminal-ID |

ID of the terminal used for the transaction |

|

Account-ID |

ID of the sub-account that was used |

|

Payment process Id |

process number of the PAYONE platform |

|

Merchant reference no. |

reference number of the merchant which was handed over to the PAYONE platform with the booking |

|

(PAYONE) debtor no. |

automatically assigned PAYONE platform internal customer number (return parameter user-ID) |

|

(Merchant) Customer no. |

customer number of the purchaser with the merchant which was handed over to the PAYONE platform with the booking (request parameter customer ID) |

|

Date |

customer number of the purchaser with the merchant which was handed over to the PAYONE platform with the booking (request parameter customer ID) |

|

Event |

type of process C.f. 5.2 |

|

Entry description |

text of the entry |

|

Amount |

transaction sum |

|

Currency |

currency in which the transaction was completed |

|

Card number |

credit card number (in brief) |

|

Card type |

brand of card (Visa, MasterCard, etc.) |

| First name | first name of the purchaser |

| Surname | surname of the purchaser |

| Company | possible company name of the purchaser |

| Address addition | Additional information on the address of the purchaser |

| Street | street name of the invoice address |

| Town | location of the invoice address |

| Postcode | postcode of the invoice address |

| Country | country of the invoice address (ISO - 3166) |

| State | region of the purchaser |

| First name (shipping) | first name of the consignee |

| Last name (shipping) | surname of the consignee |

| Company (shipping) | company of the consignee |

| Address addition (shipping) | Additional information on the address of the consignee |

| Street (shipping) | street of the consignee |

| Street number (shipping) | street number of the consignee |

|

City (shipping) |

location of the consignee |

|

Zip (shipping) |

postcode of the consignee |

|

Country (shipping) |

country of the consignee |

|

State (shipping) |

region of the consignee |

|

|

email address of the invoice recipient |

example

Here you can download an example export for EPA as CSV-file:

Virtual-Account

In the virtual account export, you are provided with the individual purchases and subscriptions which have been settled in the Billing module. With a start and end date, the evaluation time frame – for which the appropriate transaction data of the virtual account can be exported as a CSV file – can be freely selected. The generation of this file is also triggered by the Export button.

|

Feldname |

description |

|---|---|

|

Account-ID |

ID of the sub-account that was used |

|

Virtual-Account-ID |

ID of the virtual account in question |

|

Virtual-Account-Name |

name for the clear identification of the virtual account |

|

Process ID (VA) |

process number on the virtual account |

|

Process-Reference (VA) |

merchant reference in the virtual account |

|

Process-Parameter |

individual parameter |

|

Creation time |

date/time on which the payment was acquired by the system |

|

Amount |

transaction sum |

|

Currency |

currency in which the transaction was completed |

|

Payment Process ID |

process number of the PAYONE platform |

|

(PAYONE) Debtor no. |

automatically assigned PAYONE platform internal customer number (return parameter user-ID) |

|

(Merchant) Customer no. |

customer number of the purchaser with the merchant which was handed over to the PAYONE platform with the booking (request parameter customer ID) |

|

First name |

first name of the purchaser |

|

Surname |

surname of the purchaser |

|

Company |

company of the purchaser |

|

Address addition |

Additional information on the address of the purchaser |

|

Street |

street of the purchaser |

|

Town |

location of the purchaser |

|

Postcode |

postcode of the purchaser |

|

Country |

country of the purchaser |

|

State |

region of the purchaser |

|

First name (shipping) |

first name of the consignee |

|

Last name (shipping) |

surname of the consignee |

|

Company (shipping) |

company of the consignee |

|

Address addition (shipping) |

Additional information on the address of the consignee |

|

Street (shipping) |

street of the consignee |

|

Street number (shipping) |

street number of the consignee |

|

City (shipping) |

location of the consignee |

|

Zip (shipping) |

postcode of the consignee |

|

Country (shipping) |

country of the consignee |

|

State (shipping) |

region of the consignee |

|

|

email address of the consignee |

|

Vat-ID |

Vat-ID of the purchaser |

Example

Here you can download an example export for VA as CSV-file:

Here you can download all files packaged