Risk Check Processes / Risk Management

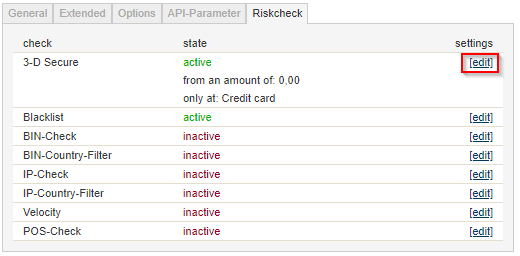

Via Configuration >> Payment Portals >> Edit the corresponding access or shop, you can find the various options, including as the last tab [Riskcheck]. Please inform yourself in detail about the different Riskcheck procedures and make sure that your configuration matches your requirements/desires.

3-D Secure

Procedure to make credit card transactions on the Internet even more secure. The 3-D Secure technology was developed by Visa and marketed under the brand name "Verified by Visa" in order to make online payment by credit card even more secure. Mastercard also offers this procedure under the name "Mastercard SecureCode". With American Express, the procedure is called "Safekey". 3-D Secure significantly reduces the risk of fraud and the loss of payments due to card misuse. Cardholders are protected against misuse of their credit card number because they have to confirm their identity prior to payment, e.g. by entering a code. The code is checked online by the cardholder's house bank (issuer).

Sperrliste

Entries for the revocation list can be managed in the PMI. The blacklist can be called up under the menu item Accounts Receivable/Blacklist. The revocation list displays automatic revocation list entries of the Velocity Check as well as manual revocation list entries. The following types are displayed in the revocation list:

- E-Mail Addresses

- Credit card numbers (no pseudo card number)

- Bank details (IBAN)

BIN-Check

The BIN (Bank Identification Number) denotes the first six digits of a credit card number and identifies the bank issuing the credit card. If BIN Check is activated, the PAYONE platform checks whether the country of the bill recipient and the country of the card-issuing bank match. It is not always possible to clearly identify the issuing country of a card via the BIN - in this case the transaction is permitted. In the event of a deviation, the transaction can be rejected or a follow-up check defined.

The BIN Check is available for all countries. It can only be carried out in the course of a transaction via the PAYONE platform (reservation and purchase).

BIN-Country-Filter

The BIN (Bank Identification Number) denotes the first six digits of a credit card number and identifies the bank issuing the credit card. As a rule, this enables the country of issue of the credit card to be determined. The BIN Country Filter, which can be activated, enables the definition of a negative list (blacklist) or a positive list (whitelist) of the issuing countries of the credit cards that are approved or rejected for making payments.

The BIN Country Filter can only be used in the course of a transaction via the PAYONE platform (reservation and purchase).

IP-Check

The IP Check verifies the country of origin of a buyer's IP address and compares it with the country of the buyer's billing address. The identification is carried out using external databases. No guarantee can be given for the accuracy and correctness of the country determined for an IP address. If the country of the IP address and the country of the invoice recipient do not match when IP Check is activated, the transaction is rejected.

The IP Check is available for all countries. It can only be carried out in the course of a transaction via the PAYONE platform (reservation and purchase).

IP-Country-Filter

The IP Country Filter checks the country of origin of a buyer's IP address and allows the definition of a negative list (blacklist) or positive list (whitelist) of countries from which a transaction is initiated. This allows payments to be approved or rejected from a list of countries. Identification is made using external databases. No guarantee can be given for the accuracy and correctness of the country determined for an IP address.

The IP Country Filter is available for all countries. It can only be performed in the course of a transaction via the PAYONE platform (reservation and purchase).

Velocity

The Velocity Check checks the repeated use of an e-mail address, an IP address, a credit card number or a bank account (so-called features) within a specified period of time. You can define how many purchase attempts can be made with one, several or all of these characteristics within a definable period of time. If more purchase attempts than allowed are made with one of these characteristics within the defined time span, the characteristic is locked for a configurable time. Further purchase attempts with data containing a locked characteristic can be rejected by PAYONE.

The Velocity Check is available for all countries. It can only be performed in the course of a transaction (reservation and purchase) via the PAYONE platform and also counts purchase attempts that have been rejected by the bank.

POS-Check

The POS Check verifies the specified bank details against a lock file. The blocking file contains account details with open return debit memos from stationary trading (point of sale). The blocking file is fed by numerous well-known retail companies.