Customer Account Administration

The debtors-overview is located in the main navigation menu.

One of the basic areas of the PMI is the Customer account administration, where all of the payment processes completed via the PAYONE platform are displayed centrally. The debtor overview offers numerous opportunities for the administration of payment processes and debtors:

- Search for debtors on the basis of differing parameters

- Display of debtor and process accounts

- Administration of debtors' master data and payment data

- Display and administration of contracts and subscriptions

- Search and display of dunning runs and reminders

- Search and download of invoices and credit entrie

- Completion of credit entries with individual credit entry items

- De-recognition of receivables

---end

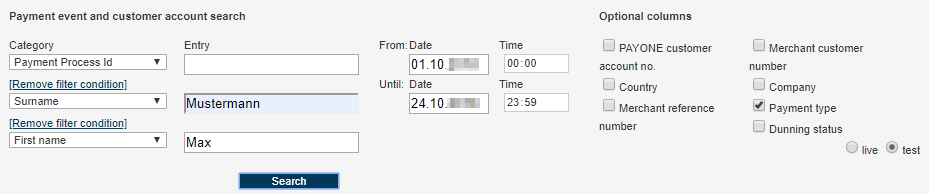

Payment Process and Debtor Search

The Customer account administration contains the master data for all of the purchasers of a merchant for which a receivable was created in the PAYONE platform, for instance, the name and address, email address, bank account details, closed subscriptions, etc.

The PAYONE platform runs a system-wide and successive PAYONE process number which is also referred to as the transaction-ID (TXID).

The PAYONE platform also runs an account for every purchaser which is identified by the PAYONE debtor number (user-ID). All of a purchaser's transactions are listed there. The purchaser is identified with the aforementioned PAYONE debtor or merchant customer number (customer-id). This customer number can be created by your shop system and transferred to PAYONE by interface. It serves the clear identification of the purchaser in your shop system.

Before starting the search it is necessary to select the Live or the Test mode, this is done using the radio button in the top right. The PAYONE Payment Platform can be used in two different modes: in the test mode and in the live mode. Both modes are controlled via special parameter transfers in order to be active. The platform (hardware and software) is the same in both modes. The key difference between the test mode and the live mode is that the transfer of data to external systems (e.g. banks, credit card institutes, credit agencies) only takes place in the live mode. In the test mode, all enquiries are simulated within the PAYONE payment platform or transferred to the appropriate external system in the test mode if it specifically supports a test mode. With this approach, it is possible for test scenarios to be completed with defined test data.

The search result is limited to 1,000 results. If the selected search criteria encompass over 1,000 results, an error message will appear with the request to limit the search.

- Category: a selection of a maximum of three combinable search criteria

- Input: input the search criteria

- From: time frame of search (start), on day-basis

- To: time frame of search (end), on day-basis

- Search: the search is initialised

| Parameter | Short explanation | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Date |

the time of the order (day and time of the entry of the order in the PAYONE platform) |

||||||||||||||||

|

Surname, first name |

the name of the purchaser |

||||||||||||||||

|

Process number |

unique number, as assigned by PAYONE (TX-ID) |

||||||||||||||||

|

Method of payment |

the payment method for the order (initial) |

||||||||||||||||

|

Status |

the status of the transaction

---end |

||||||||||||||||

|

Receivable |

the sum of the authorised or pre-authorised receivable. The sum before the brackets designates the current receivable, the sum in the brackets, the pre-authorised receivable. |

||||||||||||||||

|

Payment |

the received payment |

||||||||||||||||

|

Balance |

the balance of the receivable, meaning either a receivable that has been settled or a receivable that has been overpaid or underpaid. |

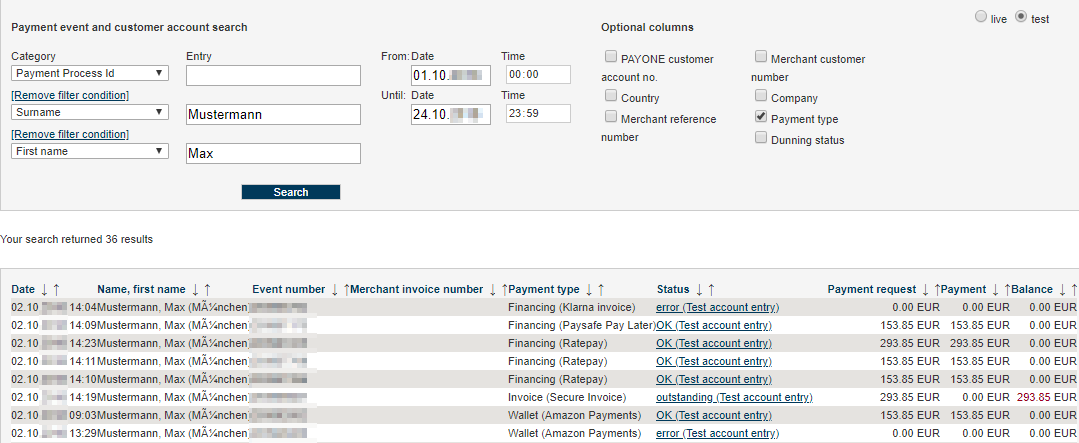

Click on name, process number or [details], in order to access the details on the payment process view.

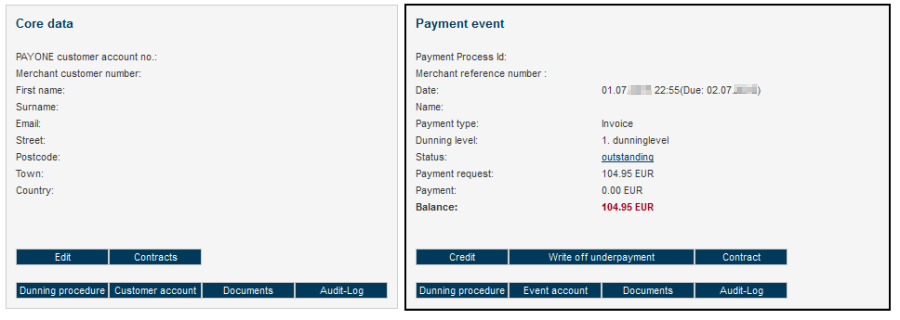

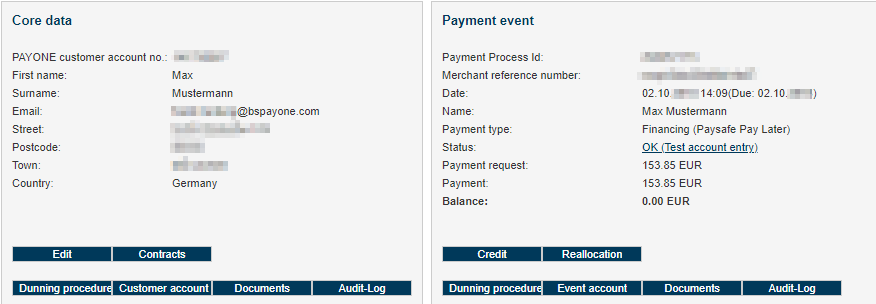

The detailed view of a search result occurs in two parts:

- The master data of the customer is located on the left hand side. The buttons which are situated below open up views in which all of the processes of the selected customer are listed and can be edited on a superordinate basis.

- On the right hand side you can find information regarding the currently selected payment process. You can carry out changes relating to this process here. These changes do not have any impact on the other payment processes of this customer.

edit Master data

You can view and amend the master data regarding your debtors. The most recently used invoice address and the data from the last credit card payment and bank account details are saved; neither an archiving nor versioning of the overwritten data takes place.

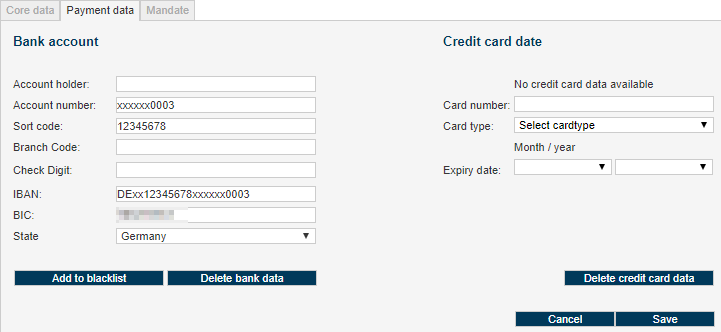

The master data and payment data of a debtor can be updated in different ways. In the PMI it is possible to edit or supplement the data on a manual basis Alternatively to the manual editing of the data, it is also possible to update purchaser information via an interface command (request via the API server). Since only the most recently used data are saved, in the event of a new order by the debtor with divergent information, the information available in the PMI is updated.. It is not possible to delete a debtor. To open the view with appropriate input fields in the form format, click on the edit button. The first tab contains the master data; the second tab contains the payment data.

Here, you are able to view, amend or delete the bank details and credit card details pertaining to a purchaser. The changes made here are carried out for all of the purchases of this customer on a process-spanning basis.

For bank accounts, the account holder, account number, bank sort code, branch number, check digit (if available) or the IBAN and BIC and the country are saved.

For credit card payments, the card holder, card type, credit card number and expiry data are all saved. Credit card numbers are only shown with the last 4 digits. This is specified by law on the grounds of PCI DSS conformity.

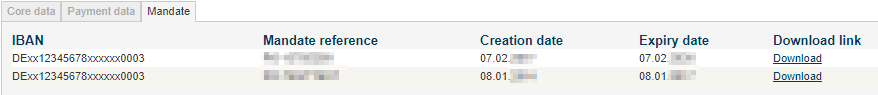

For the direct debit payment method, you can download the mandates here.

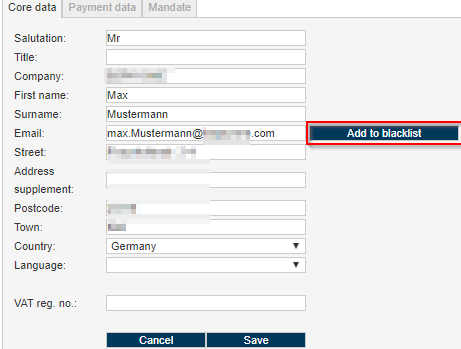

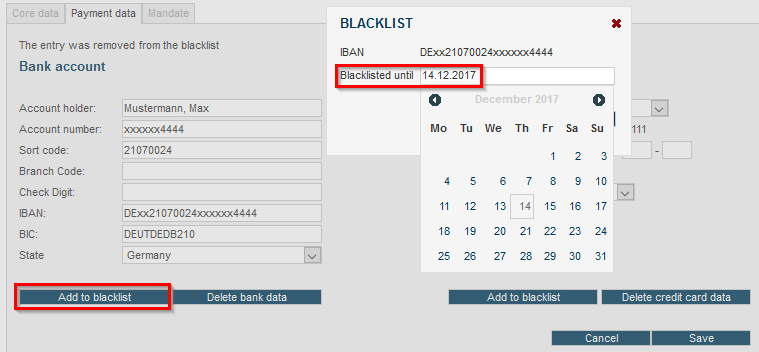

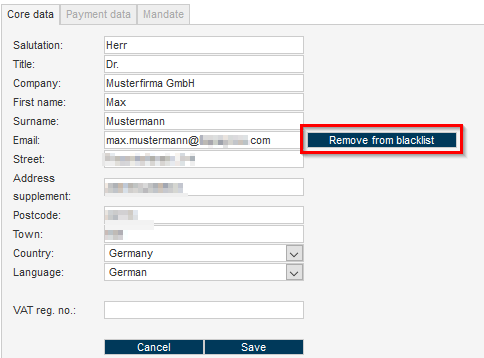

Integrated Blacklist

With the help of the Risk Management module specific master data can be set on blacklist to block payment transactions.

Therefore the values of- e-mail-address

- IBAN (International Bank Account Number)

- credit card number

can be set on or removed from the blacklist directly within the debtor administration.

Add to Blacklist

---end

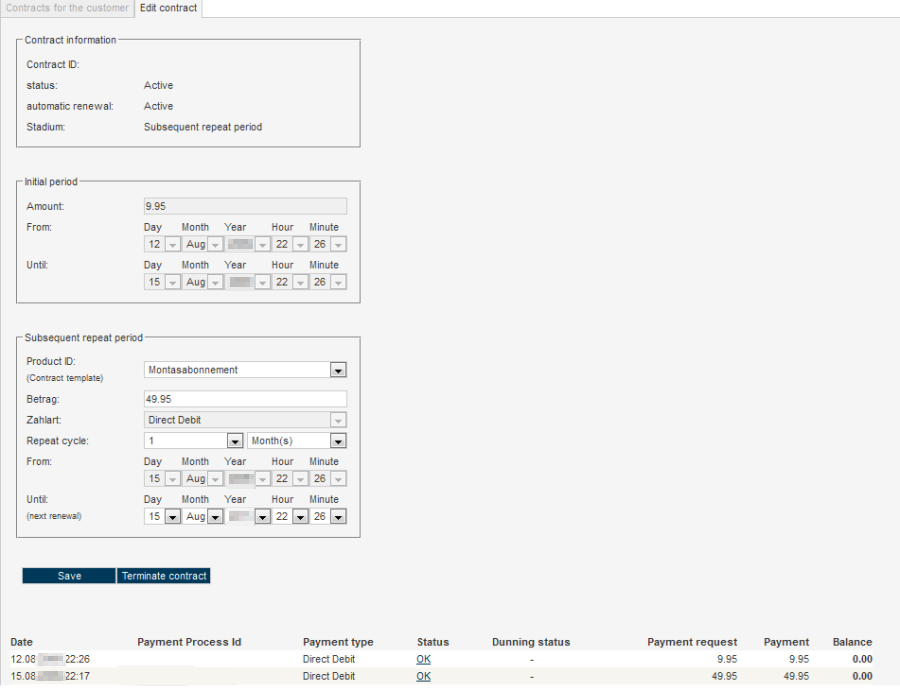

The Contracts of a Purchaser

With the help of the Subscription Handling module, the PAYONE platform administrates recurring payments and subscriptions (contracts). In this context, via the PMI, contract templates with configurable periods and prices are defined. The key features of the Subscription Handling module include A detailed description of the functional scope of the Subscription Handling module is available upon request.:

- The automated administration of recurring payments

- Differing settlement intervals (weeks, months)

- Periods and prices are individually configurable

- Integrated cancellation management (e.g. cancellation in the event of non-payment)

---end

Contracts for the Customer

In the master data view pertaining to a debtor, click on the contracts button in order to display all the existing subscriptions.

| Parameter | short description |

|---|---|

|

Contract ID |

this unique ID number is generated automatically when concluding the contract |

|

Product ID |

the designation of the offer that you can freely select |

|

Method of payment |

the method of payment which was used for the process (usually a credit card, invoice or direct debit) |

|

Sum |

the sum payable as a gross value |

|

Subscription value |

the purchase value of the subscription |

|

Start |

the start of the period of the subscription |

|

End |

the end of the period of the subscription |

|

Status |

the general status of the subscription: "active", "expired", "cancelled", "blocked" |

|

Subscription status |

the status of the period of the subscription: "active", "expired", "cancelled", "blocked". A subscription can have initial and follow-up periods. The subscription status refers to the status of these periods. Generally, both of the statuses are identical. |

---end

In the second tab, Edit contract, you can view, manage or cancel the purchaser's contracted subscriptions.

Customer Dunning Processes

The Receivables Management module displays the dunning process regarding a customer, and works closely together with the Payment module. It is responsible for the commercial dunning, and on request, the handing over of cases to external debt collection agencies in order to request overdue payments.

In the event of a chargeback or an invoice which is not settled on time, the PAYONE platform initiates the dunning process fully automatically upon request via the Receivables Management module A detailed description of the functional scope of the Receivables Management module is available upon request.

The dunning process can be configured individually and has the following functions:

- Initialisation of the commercial dunning process after due date or chargeback

- Automated commercial dunning process via email and/or post with up to 4 variable dunning levels

- Dunning levels, texts and corporate design of the dunning notices in different languages are individually configurable via the PAYONE Merchant Service

- Management of dunning periods, tolerance limits, dunning blocks as well as proposed dunning and debt collection lists

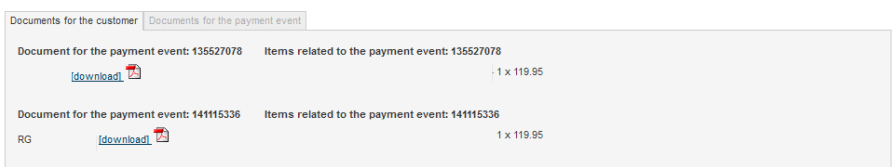

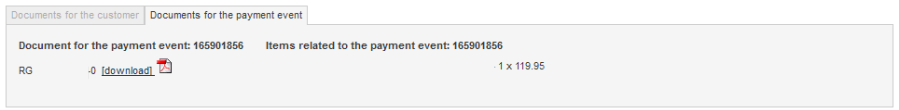

Click on the dunning button in the master data area (left) to access an overview of all the dunning processes which have so far been carried out for this customer data set. This is where you can find details on the individual dunning levels and documents (payment reminders and dunning) which have been so far sent to the purchaser.

The Dunning button in the right hand payment process area opens an overview of the dunning processes which belong to this individual process.

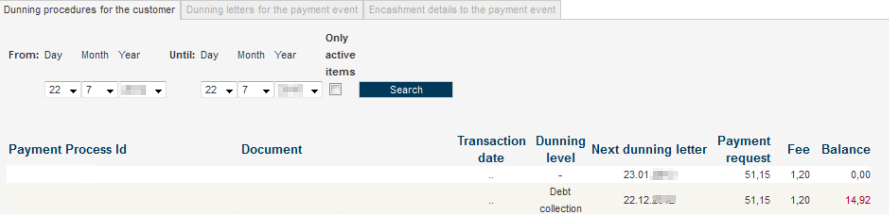

Dunning Procedures for the Customer

Under the customer dunning runs tab it is possible to filter entries according to the date. The Active only check-box filters the search results so that it is only the current dunning runs which are displayed.

The search result provides the following information:

| Parameter | Short description |

|---|---|

|

PAYONE process number |

a unique number which is assigned by PAYONE (TX-ID) |

|

Document |

the invoice number for the invoice on which the process is based (with the Invoice Issuing module ordered) |

|

Transaction date |

this field is not filled in for technical reasons |

|

Dunning level |

the dunning status (dunning level or debt collection) |

|

Next dunning notice |

the date on when the next dunning level is triggered |

|

Receivable |

the open sum of the receivable (gross value) |

|

Fee |

the dunning fee as predefined by the merchant |

|

Balance |

the overall open receivable |

---end

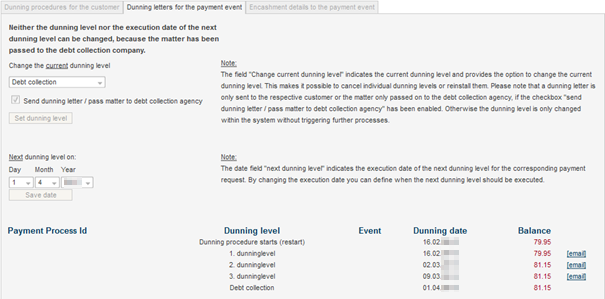

Dunning Letters for the Payment Event

You can configure dunning notices on the payment process in the second tab. Here, you are able to manually skip the dunning levels for individual customers or carry them out again. The send dunning notice/forward case to debt collection initialises the sending of documents and/or the transfer of data to the collection agency. If this box is not activated when clicking on set dunning level, then the setting is only changed at the internal system level, and no external processes are initiated. It is also possible to amend the entry into the next dunning level individually.

Clicking on the email link at the end of the line takes you to a copy of the email and/or of the dunning notice which was sent to the purchaser.

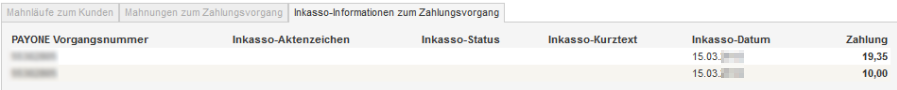

Dept Collection Information on the Payment

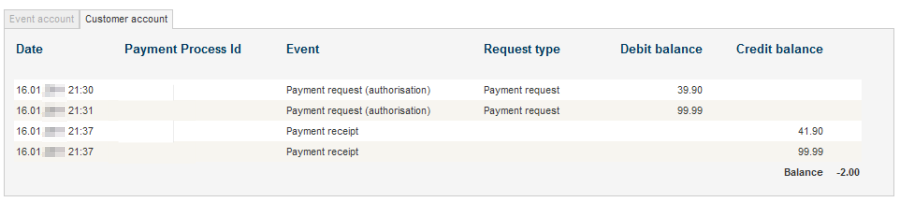

Display of the Debtor Account

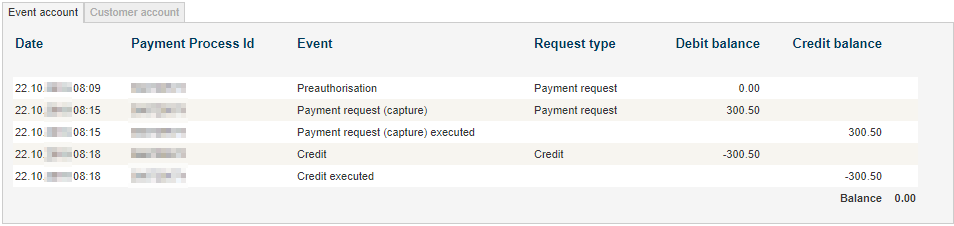

The PAYONE platform manages an individual process account for every payment process. The sum of all the process accounts of a purchaser/debtors results in the balance of this debtor. All of the receivables and payments are entered on the debit or credit side of a process account. In this way, every business transaction is reflected in an entry and is visible in the process account.

Event Account

| Parameter | Short description |

|---|---|

|

Date |

the time of the process |

|

PAYONE process number |

the unique number which is assigned by PAYONE (TX-ID) |

|

Process |

the type of the process (receivable, credit entry, chargeback, etc.) |

|

Type of receivable |

the type of receivable (chargeback fee, penalty interest, delivery costs, receivable, credit entry, returns) |

|

Debit |

(positive/negative) receivable |

|

Credit |

(positive/negative) payment |

---end

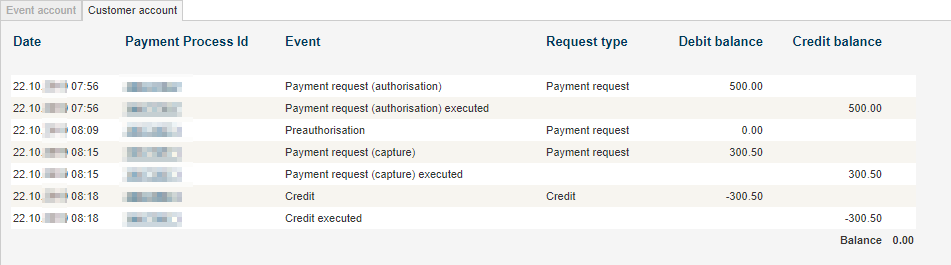

Customer Account

| Parameter | Short description |

|---|---|

|

Date |

the time of the order |

|

PAYONE process number |

the unique number which is assigned by PAYONE (TX-ID) |

|

Process |

the type of the process (receivable, credit entry, chargeback, etc.) |

|

Type of receivable |

the type of receivable (chargeback fee, penalty interest, delivery costs, receivable, credit entry, returns) |

|

Debit |

(positive/negative) receivable |

|

Credit |

(positive/negative) payment |

---end

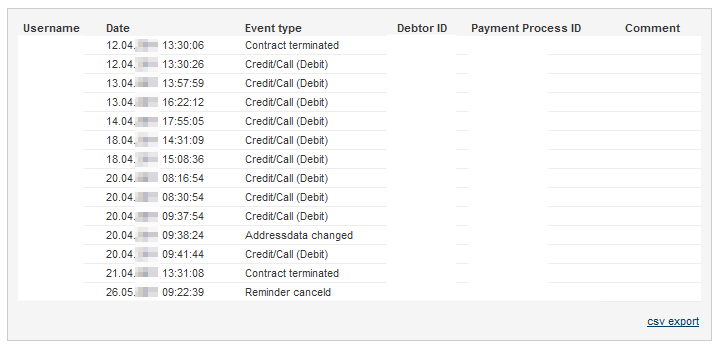

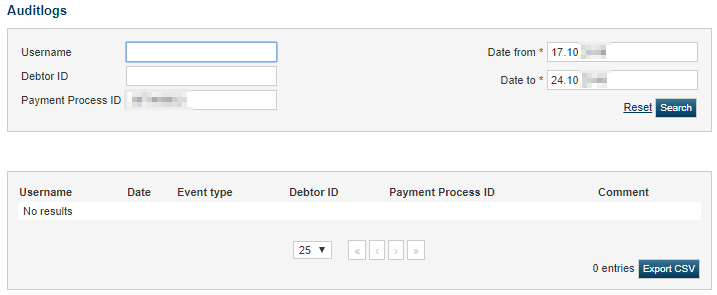

Audit-Log of a Debtor

All of the relevant data changes and actions as well as the logged in user of the PMI who triggered these actions are saved in the Audit-Log. All of the details can therefore be seamlessly traced.

---end

| Parameter | Kommentar |

|---|---|

|

User name |

the user who compiled the comment |

|

Date |

the date that the comment was saved |

|

Type of event |

the event on which the comment was compiled |

|

Debtor ID |

the Debtor ID |

|

Process number |

the process number |

|

Comment |

a comment |

---end

Editing a Payment Process

---end

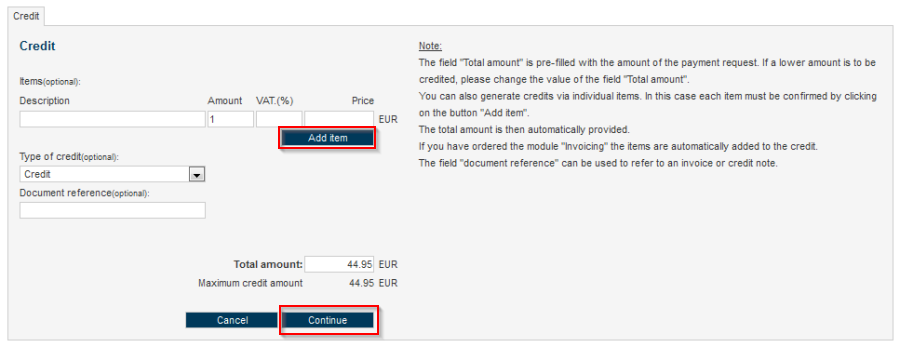

| Parameter | Short Explanation |

|---|---|

|

Description |

the article text which is to be shown on the invoice/credit entry voucher. |

|

Number |

the quantity of the credited article |

|

VAT (%) |

the rate of VAT |

|

Price |

the gross price |

|

Add position |

the type of receivable (chargeback fee, penalty interest, delivery costs, receivable, credit entry, returns) |

|

Type of credit entry (optional) |

credit entry, return of goods, chargeback fees (de-recognition), delivery costs (de-recognition), reminder fees (de-recognition), penalty interest (de-recognition) |

|

Total sum |

the sum of the credit entry (partial credit entry possible) |

|

Maximum sum of the credit entry |

the maximum sum that can be paid |

By clicking on Continue the credit entry is confirmed and carried out.

To create a receipt for the purchaser it is necessary for the Invoice Issuing module to be ordered. If this is not the case, the Items (optional) fields do not have any effect and can be ignored.

De-recognition of an open receivable

---end

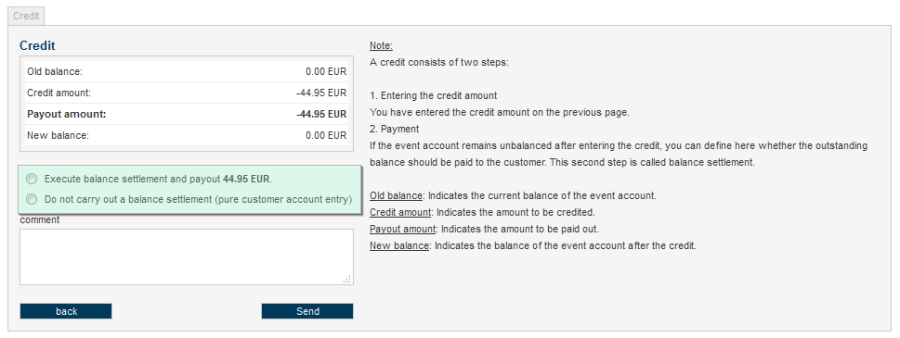

| Parameter | Kommentar |

|---|---|

|

Old balance |

the current balance of the transaction |

|

Sum of the credit note |

the sum which is credited (no flow of funds) |

|

Amount disbursed |

the sum which is to be paid to the purchaser (movement of funds takes place) |

|

New balance |

the balance that would exist after the de-recognition. |

|

Comment |

a comment regarding the de-recognition (is not displayed to the purchaser). If a note is added at this point, it can be viewed in the Audit Log overview. |

Transfer

It is possible for account-based payment types to be transferred with the transfer button (open invoice, direct debit, advance payment). If a purchaser pays a receivable by direct debit which has already been settled in full, for example, then this overpayment can be transferred to another receivable which is still open.

---end